Mortgage lending grows but other lending grows faster

While mortgage lending grew in 2001 and still dominates New Zealand bank’s loan books, it declined as a proportion of total lending assets, according to KPMG’s latest annual survey of financial institutions.

Tuesday, May 14th 2002, 7:17PM

by Jenny Ruth

Mortgage lending grew $4.3 billion in the year but fell from 47% of total lending to 44%.

The reason for that is that other lending grew even faster. Commercial and financial lending rose from 32% of total lending to 35%.

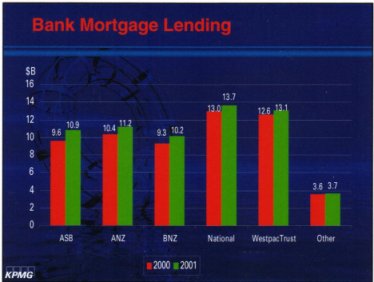

National Bank dominates the mortgage market with a book totalling $13.7 billion, which was up $700 million on 2000, while ASB Bank enjoyed the biggest increase in its mortgage portfolio, up 14%, or $1.3 billion to $10.9 billion.

Bank of New Zealand is the smallest of the big five mortgage lenders with an $11.2 billion book, up $900 million from 2000, followed by ASB and then ANZ Bank at $11.2 billion, up $800 million from 2000, and WestpacTrust with $13.1 billion, up $500 million on 2000.

KPMG says the split between fixed and floating rate mortgages hasn’t changed significantly over the past three years, currently at 60% fixed and 40% floating.

Between the banks there are significant differences. BNZ and National Bank closely replicate the national average while ASB Bank has only 57% fixed. ANZ Bank has consistently had more fixed rate mortgage customers than the average. While the proportion fell in 2001, it still has 67% in fixed rate loans. WestpacTrust has only 54% of its customers in fixed rate loans.

"The mortgage lending market is arguably the most competitive market in the New Zealand financial services industry, given the number of participants involved," KPMG says.

The survey also found New Zealand banks had yet another year of record profitability in 2001 as they managed to increase average interest margins slightly after declines in each of the previous eight years.

New Zealand registered banks recorded a 17.9% improvement in underlying performance during the year while net profit rose 18.4% from $1.7 billion to $2 billion.

Their weighted average interest margin, the difference between what banks pay for deposits and what they collect from loans, climbed 2 basis points to 2.31%.

All the major banks increased net interest income with Bank of New Zealand’s up 13% to $88 million and National Bank’s up 11% to $81 million.

WestpacTrust was the only major bank to show a continued fall in margins, down 22 basis points, but a $4.3 billion rise in lending assets still saw it lift net interest income $21 million.

For the third year running, National Bank improved its interest margin from 2.59% to 2.63% while ANZ Bank’s rose 8 basis points to 2.67%

Andrew

Dinsdale, chairman of KPMG’s banking group, says bank margins

are likely to improve further in the short term, given the rising

interest rate environment.

Andrew

Dinsdale, chairman of KPMG’s banking group, says bank margins

are likely to improve further in the short term, given the rising

interest rate environment.

Improved consumer confidence is driving

mortgage lending growth particularly in Auckland. "All the

evidence we’ve had is that it’s a pretty spectacular

story in Auckland," Dinsdale says.

| « Question marks over size of rates rise | OCR Increases to 5.5 per cent » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |