Portfolio Talk: Ben Griffiths

BT Funds Management in Australia last year poached the management team from ING's small cap equity fund and is now setting up its own fund. The managers, Ben Griffiths and Brian Eley were in New Zealand recently to check out a number of companies and tell people about the fund. Good Returns editor Philip Macalister caught up with Griffiths during the visit.

Wednesday, May 29th 2002, 10:46PM

Why are small companies appealing at this stage in the economic cycle?

Why are small companies appealing at this stage in the economic cycle? Liquidity in stock markets is heavily dependent on volatility. When volatility rises, as it did in September, then liquidity narrows. When that happens the market targets the large cap stocks. Since September 11 volatility has reduced in global sharemarkets, including Australia, and liquidity has picked up small companies.

(Consequently) small companies are rerating globally.

What's happening with valuations?

Small companies for some time now have traded at a substantial discount to the large caps and the discount got up to around 25% at the end of the fourth quarter last year. It's drifted in slightly and is now closer to 17%.

At times they get to parity. The last time stocks hit parity was late 1999, early 2000 when you had the dot com blow up occurring and you had momentum, rather than valuation pushed small companies to giddy heights.

Small companies are a leveraged way of playing a recovering economy.

What state are small companies in?

Fortunately for us Australian companies have got very robust balance sheets at this point in the cycle. Their gearing levels are quite low so higher interest rates, which are starting to kick in globally, aren't going to have a damaging effect on them.

The other interesting aspect is that any stock market advance requires solid retail interest in the market. This has been blindly absent for two years until the December quarter last year. During that time the private client returned to the Australian market.

These investors don't want banks, and healthcare stocks, they want to buy true small caps and micro caps.

Any bull run has its beginnings in the smallest of the small caps. Investors then rotate their positions into medium size small caps then larger small caps and ultimately into the large caps. We've seen the beginnings of what we think will be a generous period for equities.

What sectors do you like at present?

We continue to be good supporters of small healthcare stocks in the Australian market. We continue to believe they will be well sought after.

We are also big believers in resource infrastructure companies as between A$10-12 billion worth of resource projects have been given formal go ahead in Australia. They will be direct beneficiaries of the capital expenditure required in the development and running of these operations.

There's one defensive media stock we like, that's Singleton Advertising Agency, and importantly several resource companies we like. They have good sustainable earnings streams, solid management, and are operating within growth markets. These include Portland Mine, MacArthur Coal and Jubilee Mine (a nickel miner in Western Australia).

Do you buy New Zealand stocks?

We will buy NZ stocks as long as they have an Australian exchange listing.

What's your definition of a small company?

A small cap company is one that lives outside the ASX100. Generally it will have a market capitalisation of less than $900 million. We will invest in small companies between A$75 million and A$900 million.

What's your outlook for the Australian market at present?

The Australian small cap market will remain a solid performer notwithstanding current volatility. There is some jitterishness around with company chief executive's jawboning down over zealous analysts who are probably assuming too much growth this year.

What do you expect the fund to do this year?

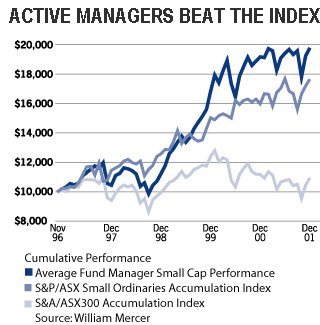

We are saying we would target outperformance of the Small Ordinaries Accumulation index of at least 8%

How many stocks in the portfolio?

Between 40 and 60. We never envisage going below 40 but at times it may drift above 60.

Is this a replica of the ING fund you managed or something new?

It's a new fund that BT decided they wanted to launch.

Fortunately BT's approach to investing equities is very similar to ING's approach. It is done on a growth at reasonable price (GARP) style and blends in some of the qualitative factors like industry growth rates and management.

We have improved the process a little bit and slightly changed the blend of qualitative and quantitative to 50:50 and we have introduced a strong bias in our qualitative assessment to management.

| « Budget: Cullen outlines super changes | King builds an empire » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |