Look at what's in front of you

While looking for fancy new products to provide extra return, investors and advisers may be missing out on a reliable performer right under their noses.

Wednesday, April 16th 2003, 2:41PM

Global bonds or international fixed interest investments are not the most talked about or well understood assets which people can put into their portfolios, yet there is a strong case for using them.

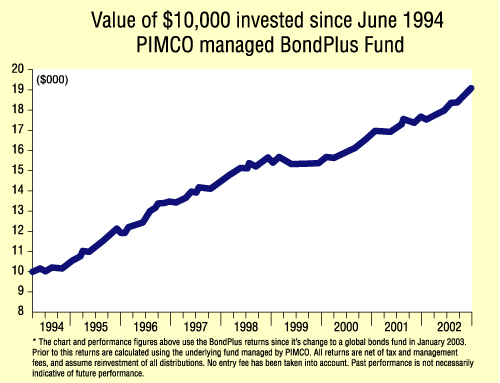

The first thing people look at is performance. On this count global bonds have performed well, outpacing the local bond market most years. For instance the Salomon Hedged world bond index returned 8.7%, 10.3% and 11.3% over five, 10 and 14 year periods.

So the performance has been good and consistent.

While on a straight return basis international bonds look good, they also stack up on the risk/return front providing enhanced returns without increased volatility.

This "bull market" period in bonds has been largely due to moves by central banks around the world to cut interest rates. In this situation, fixed interest investors can make significant capital gains.

However, with official cash rates around the world at historically low levels and unlikely to fall further, investors are wondering if it is a good time to have money in this sector.

Basic logic would suggest that rates are likely to start rising, therefore capital will be lost in fixed interest investments.

One person with a different perspective is PIMCO executive vice-president John Wilson who manages Tower's international bond portfolio.

He points out that over recent years most fund managers have changed their mandates so that they can invest in corporate debt as well as sovereign (or government) debt. This change has been brought about because managers need new opportunities to add value. Also, there have been some concerns that a number of countries were looking to pay off their debt, while at the same time there has been a massive explosion in the number of corporate debt issues released.

Wilson says that although rates are low in the United States and are likely to start drifting higher (thus making them unattractive), there are significant opportunities to add value in the corporate sector in the US.

He says the rates on many issues are far too high because of blanket concerns about corporate scandals, governance and accounting practices. Once these pass, rates will come down.

One area PIMCO is overweight in is BBB rated stock.

"While rates on government debt may be at cyclical lows, yields on corporate debt are high," he says.

"To us this looks like an outstanding opportunity to add some selected corporate names to the portfolio and earn some very attractive rates of return."

Wilson points out that US government debt is unattractive but because corporate Europe is a mess ("frankly on the point of tipping into recession"), rates there have room to keep falling.

Wilson says although the bull market in bonds is ending, returns are still looking good.

He is predicting that over the next year international shares are likely to return about 7% with 16% volatility, while bonds will do about 6% with just 3% volatility.

That is a pretty attractive proposition to an investor who has taken a hammering on the downward roller coaster ride of the sharemarket.

Wilson isn't the only one who thinks bonds are not widely enough used in portfolios at present.

"In spite of the compelling returns this asset class is typically under-represented in portfolios," Bank of New Zealand Insurance and Investments chief executive officer, Anthony Thyne told the recent FundSource conference.

As Thyne says: "You often have to look at what's in front of you."

Special Offers

« Global Bonds – a rising star? Alternative funds available in NZ » Commenting is closed

Printable version

Email to a friend