EquityPlus Fund

When talking about managed funds, who says ‘aggressive-balanced’ has to be an oxymoron?

Thursday, June 29th 2006, 10:03AM

When talking about managed funds, who says ‘aggressive-balanced’ has to be an oxymoron?

Most financial advisers would agree, when it comes to finding a balanced fund which is truly aggressive, pickings are slim. Many do not meet the needs of either individual investors or trustees. Achieving cost effective diversification combined with good prospects for growth can prove to be a real headache for both investors and advisers.

That’s where Guardian Trust’s EquityPlus Fund comes in.

In 2002 we looked at ways to improve the efficiency of investment management for modest size portfolios. It was essential that we created a fund that was cost efficient, easy to understand and provided a real “growth” focus. What was needed was an aggressive but balanced fund.

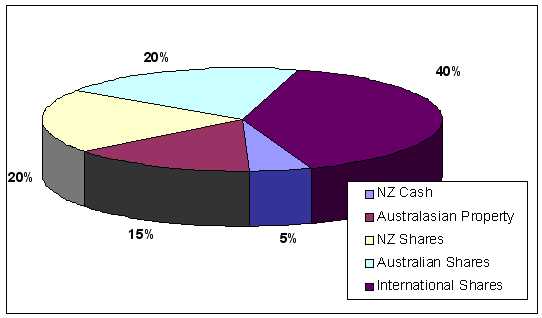

We designed the Guardian EquityPlus Fund specifically to meet these requirements. Opened in July 2003 for Guardian Trust’s own private clients, Guardian Trust has now launched this fund to the wider market. The Guardian EquityPlus Fund provides wide diversification of growth assets including property and shares in New Zealand, Australia and internationally. A small amount of cash is maintained within the portfolio but no fixed interest is held. This makes it easy for an adviser to match a corresponding amount of fixed interest with the fund to match specific client risk profiles.

More and more investors, while not willing to compromise on diversification, are prepared to accept a higher level of risk in return for increased potential for gain.

The EquityPlus Fund is managed by Ian Arkle, supported by a team, who between them, have more than 60 years experience within the investment industry. The team use a buy and hold approach, thereby giving investments time to prove their worth. That said, the team continue to regularly review all investments and do move funds as and when required. The EquityPlus team also ensure they rebalance the Fund as necessary so that asset allocations remain within set parameters ensuring the Fund’s diversity is maintained.

The Guardian EquityPlus Fund is suitable for investors with a medium to high appetite to risk and those looking for a longer term investment (at least five years) which has the potential to provide both capital gains and income. The Fund distributes income every six months (in March and September). Investors can choose to have income paid out or, if preferring to maximise capital growth, can opt to have income payments reinvested.

While the Fund is particularly useful for those with only limited capital to invest, it may also be attractive for larger investors who are seeking a simplistically run diversified growth portfolio.

EquityPlus Fund Manager, Ian Arkle, explains that when making investment decisions for the Fund the investment team are able to select from both direct holdings as well as other collective investment vehicles, including managed funds and listed investment trusts. This flexibility enables them to take advantage of the expertise in specific funds as well gain valuable cost efficiencies.

EquityPlus is a medium to high risk fund and in line with this, provides potential for high returns. For this reason, investors should be in a position which allows them to invest their money for at least five years in order to ride out any short term fluctuations. Ian believes that the EquityPlus Fund is an excellent choice for anyone wanting an aggressive growth investment with a proven track record.

Investment Returns for the last two years

|

Gross Income Return |

Net Income Return |

Capital Return |

Total Net Return |

|

|

1 Month (%) |

0.00 |

0.00 |

1.11 |

1.11 |

|

3 Months (%) |

2.36 |

1.58 |

8.41 |

10.15 |

|

6 Months (%) |

2.45 |

1.64 |

17.59 |

19.48 |

|

1 Year (%) |

4.49 |

3.01 |

24.71 |

28.41 |

|

2 Years (% pa) |

3.90 |

2.61 |

12.87 |

15.77 |

|

Inception (% pa) |

3.39 |

2.29 |

10.97 |

13.44 |

So, for those looking for a long-term savings vehicle, perhaps for education or a retirement fund, or for trustees requiring an efficient way to gain exposure to growth assets, the EquityPlus Fund provides an excellent option. If you would like to find out more about the Guardian EquityPlus Fund, or obtain a copy of the Fund fact sheet or an Investment Statement, simply visit our website; www.guardiantrust.co.nz or phone us on 0800 346 752.

| « Paperless papers | Liontamer goes shopping for quality » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |