Market Review: Can the good times roll for yet another year?

In this month's commentary Tyndall Investment Management managing director Anthony Quirk comments on whether the good times will continue.

Tuesday, December 5th 2006, 9:57AM

by Anthony Quirk

|

This market summary is provided by Tyndall Investment Management. To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here |

Returns for the Year to Date

As the year draws to a close it is time to reflect on the performance of the various markets through 2006 and to preview next year. The year to date index performance figures (before tax and fees) for the key investment sectors that we invest in (and for the three previous calendar years) are shown in the table below.

Returns in 2006 have played out in relatively orthodox fashion with global property the "star" sector although all sectors, except bonds, outperformed the high cash rates available in New Zealand. So yet again a balanced approach paid dividends, reinforcing the difficulty of trying to “time” markets and switch optimally between them.

Tyndall's multi-strategy hedge fund return was again respectable. In a turn around from last year a slightly weaker kiwi dollar contributed to a slight difference in favour of unhedged over a fully hedged approach to global equities.

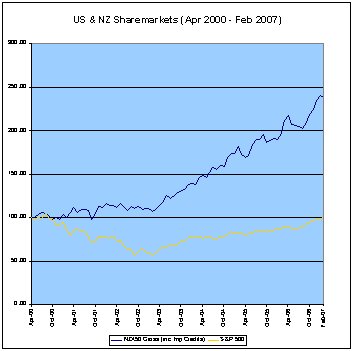

A surprise in 2006 has been the continued strong run from the global property sector (up 34%), after rising by over 30% in each of 2003 and 2004 and 15% in 2005. NZ shares struggled through the middle of 2006, but seems to be finishing strongly on the back of merger and acquisition activity.

So what is the outlook for 2007? I must start by emphasising how difficult it is to pick investment market turning points. Rather, this outlook is more about how long-term trends might unfold in 2007, rather than providing a short-term market timing strategy.

Global Outlook

Some key global themes for next year are:

- Global growth slowdown (but off a high base). Economic growth rates are expected to fall slightly in all the major economies (Europe, Japan, China and the US) in 2007. However, global economy activity is expected to still be robust and well balanced.

- China. China is trying to slow its economy as it grapples with various growing pains. However, its GDP is still expected to be up almost 10% in 2007 - that’s a slow down!? Thus, it is expected to still be a significant positive influence on the global economy next year.

- Slowing corporate earnings growth. Like the global economy, corporate growth rates are expected to ease in 2007, but off very high levels. For example, for the September quarter in the US the result was a 19% growth out-turn! To date the earnings risk has been on the upside, which has helped keep US sharemarket P/E multiples respectably in the mid-teens. However, the risks may now be moving to the downside with single digit earnings rather than double digit growth likely to be the norm in 2007.

- Inflation looking under control. Central bankers have been paranoid about second round impacts from oil prices. However, this doesn’t seem to have happened with productivity gains in the US continuing and export goods from Asia to the rest of the world remaining a deflationary force. Falling oil prices have helped further and inflation forecasts for all the major regions for 2007 are below 3% - hardly suggesting a resurgence in global inflation.

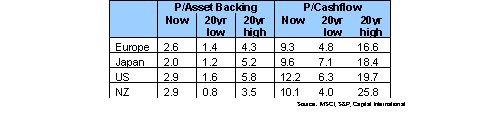

- Market valuations not overly stretched. As shown below, even with the healthy gains in global sharemarkets strong earnings growth has helped keep market valuations well below over priced levels. Price to cashflow multiples for the major markets are all in the middle of their 20-year ranges. The key will be whether earnings get crunched in 2007, thus lifting valuations to upper quartile levels. At this stage that seems unlikely.

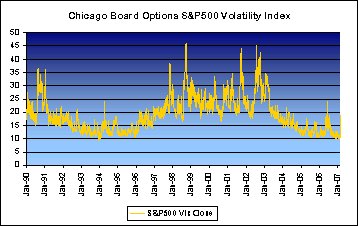

So what are the potential banana skins that could cause the markets to trip up in 2007? We are probably over due for a market shock of some sort, which seems to come along every few years (Asian crisis, Russian bond crisis, tech bubble, 9/11, etc, etc,).

A list of potential shocks which would see the current low risk environment change (as per the graph below) to more “normal” volatility levels includes:

- A slump in commodities prices

- The US housing collapse deepening

- Global imbalances finally leading to big shifts in interest rates and currencies (e.g. USD weakness)

- Over-zealous central bankers over-tightening monetary conditions

- Oil price going through the roof

- A one-off shock (SARS, Iran, Iraq, North Korea, terrorist attacks).

While these are all potentially significant, some are probably mutually exclusive and the likelihood of these factors derailing markets in 2007 appears relatively low – at least I hope so! However, I am mindful we have had a very calm past 3-4 years in terms of any financial crisis and such a situation will not carry on forever.

Finally, I'd like to wish all our readers a very happy Christmas. This year has turned out to be an excellent year in terms of returns and may 2007 be a prosperous year for all investors.

Anthony Quirk - Managing Director of Tyndall Investment Management

Ph: (09) 377 7262 or 0274 895 568

Email:anthony_quirk@tyndall.co.nz

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

Anthony Quirk is the managing director of Guardian Trust Funds Management.

| « Market Review | Key Macro Themes for 2007 » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |