Market Review: Crisis – what crisis?

In this month's commentary Tyndall Investment Management managing director Anthony Quirk comments on whether we are entering crisis mode.

Wednesday, February 7th 2007, 4:08PM

by Anthony Quirk

|

This market summary is provided by Tyndall Investment Management. To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here |

It has been a positive start to the year with stronger than expected US growth (lower unemployment claims, better housing starts and robust consumer sentiment and real income expectations) plus a significant decline in the oil price. There was also a sign of wider economic strength with the OECD leading indicator moving upwards after falling through the second of 2006.

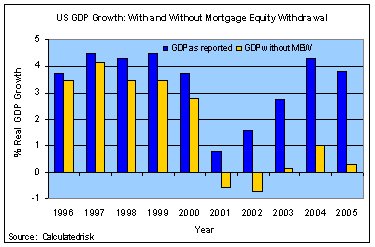

Just as has been the case for the New Zealand economy, low unemployment appears to be under pinning the US economy at present and keeping consumer spending going. A key factor fuelling consumer spending is Mortgage Equity Withdrawals (MEWs) – see the chart below.

AQ Comment: A Mortgage Equity Withdrawal (MEW) is basically borrowing against the residential home. This in turn is used to fund consumer spending, which helps boost US GDP as shown in the chart. The issue becomes what happens to GDP when higher interest rates and/or lower house prices decreases future MEW levels.

Economists generally seem to be upgrading their US economic forecasts for Q1 ’07. But this may be due to mainly temporary factors such as the unseasonably warm weather over the start of winter there. Given this there now seems more chance of a Fed rate rise than a cut through 2007. We are still seeing the impacts of previously loose US monetary policy and resultant global excess liquidity, which is helping to keep markets buoyant.

A soft global landing for 2007 is still the most likely scenario. However, this is probably already impounded in prices with analyst earnings consensus still seeming to have a positive bias. Global sharemarket valuations are not overly extended, if earnings come through as expected.

US corporate earnings growth will probably slow to single digit levels through 2007 but as long as earnings do not decline then decreasing interest rates may mean share prices could still rise. However, equity markets would then become more reliant on monetary policy settings rather than earnings. This can be dangerous if rates stay higher for longer than expected, or indeed rise. Moreover, profit margins may fall from their current high levels.

A QUICK TRIP AROUND THE WORLD

By its standards Europe is booming with strong consumer spending and corporate sector capital contributing to the health of the economy. There is increasing analyst confidence in Europe’s growth outlook, as shown in the latest ZEW Indicator of Economic Sentiment (which covers investor and analyst economic expectations). The economic waters have been muddied by a recent German VAT hike, which brought forward some consumer purchasing into late 2006 and means 2007 will have a slow start in that country. But this is expected to be transitory and growth should pick up later in the year. However, Europe’s Central Bank (the ECB) may seek to continue to be (overly?) vigilant and hike rates. On the plus side European equities still look cheap.

Unfortunately the recovery in the Japanese economy appears to have been cut off in the short-term by an overly sensitive central bank. This, combined with muted employee earnings and total employment growth has meant households have pulled their (spending) horns in again. However, corporate profitability is holding up well and the long-term positive reflationary and corporate restructuring outlook for Japan remains intact. After a relatively poor 2006 year the Japanese sharemarket is now at six year highs.

TWO POTENTIAL CATALYSTS TO STOP BULL MARKETS

China is still growing more strongly than the authorities would like with 2006 GDP likely to have been double-digit rather than the 8% target set by the Chinese Premier. This confirms the inherent underlying strength of this emerging global power house and that it will continue to play an increasing role in global growth.

Bull market returns for five straight years seems hard to fathom and two major threats I see that may bring this to an end are set out below. They both have as their source the massive liquidity injection into global markets through the slashing of interest rates to 46 year-lows by the US Federal Reserve earlier this decade.

- extended and comprehensive interest rate rises around the world

With global growth at such sustained high levels, normally a key risk would be an inflationary spike that Central Banks would have to snuff out. The good news is that this doesn’t seem to be happening (yet). However, there are some hawkish Central Bankers out there! Unexpected monetary tightenings would have a significant impact on corporate profits and market valuations. The impacts could go further with private equity and structured product markets negatively affected, with the worst case being some sort of market collapse or dislocation. We are probably over due for one of those! - a US housing slump

It is easy to create a negative scenario for the US residential housing market. Since 2001 this sector has clearly been a major driver of US economic growth, through fuelling enormous consumer spending and creating many new jobs in the sector. According to a study by Northern Trust, 43% of private sector jobs created from 2001-2005 were housing related! On the consumer side some studies have shown that the rise in US house prices has provided at least 2/3rds of the increase in household net worth since 2001. However, the greatest impact on the economy has probably been the Mortgage Equity Withdrawal (MEW) and the consumer spending it prompted. MEW was over 10% of disposable income in 2004, with Alan Greenspan himself estimating that 50% of MEW flows through to consumption, which in turns under pins GDP growth. This is great when house prices are going up but might turn ugly if the current bloated US housing inventory situation leads to a sustained fall in house prices. A rise in rates would also impact negatively on MEWs as well.

WHAT ABOUT HERE?

In New Zealand, while the economy may have bottomed around the middle of last year we are probably heading for our 3rd year of sub-normal growth. Central bank policy still remains the key. With only modest economic growth and a highly valued equity market it is hard to get too excited. I think it will become harder and harder for companies to keep meeting earnings expectations and so more profit downgrade warnings may become the norm. Any significant turn downwards in the Kiwi dollar could accentuate equity market weakness as foreign investors seek to liquidate their (generally unhedged) kiwi share market holdings.

So I am cautious about the outlook for the 2007 year for equities, particularly in New Zealand. This might just be the year where we see some correction in markets. As always the way to approach this for most investors is to take a balanced and not extreme approach and to be very wary of trying to time entry and exits into investment sectors, given it is so difficult to pick market peaks and troughs.

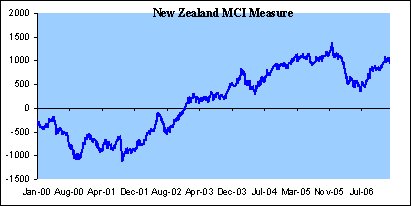

AQ Comment: The MCI for NZ (combination of interest and exchange rates) has been consistently climbing over the past 6 months. It is now close to its all time high. This is a prime reason why economic growth will continue to be relatively low in NZ this year.

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

Anthony Quirk is the managing director of Guardian Trust Funds Management.

| « Key Macro Themes for 2007 | Managers cautions on NZ shares » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |