Market Review: The past 7 years - A roller coaster ride

In this month's commentary Tyndall Investment Management managing director Anthony Quirk reviews investment trends of the past seven years.

Friday, March 2nd 2007, 3:18PM

by Anthony Quirk

|

This market summary is provided by Tyndall Investment Management. To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here |

My role has been both interesting and exciting and one that I have enjoyed immensely over a period that has seen a roller coaster ride for global share markets. I arrived in mid-2000 just as the tech bubble was showing signs of strain. The bursting of that and the trauma of 9/11, combined to provide a turbulent time for the markets, for fund managers and investors. On the morning of 9/11 I remember vividly the awful feeling in the pit of my stomach knowing that the world had changed forever and that we still had to stay calm and professional given we manage the savings and retirement funds for so many investors.

Thankfully that seems a lifetime away now with an extended bull market run in local and global sharemarkets for the past four years. It seems hard to believe how much markets have rallied since the darkness of the early 2000s. However, it does show the resilience of man, coupled with the short-term benefits of loose monetary policy! While Alan Greenspan has his detractors I think he rightly saw the need to act decisively to ensure no repeat of the 1930s depression scenario. Back then Government and monetary policy exacerbated the 1929 crash.

AQ Comment:

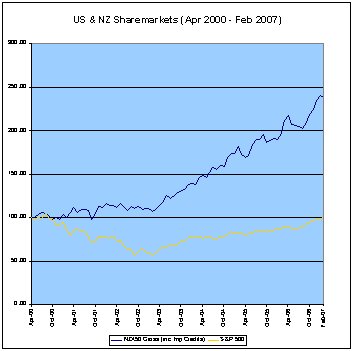

My tenure at Tyndall has coincided with the S&P actually going nowhere! The chart above reinforces the severe sell-off in the US market in the early 2000s and the steady recovery thereafter. In contrast the NZ market did not suffer as much in the global sell-off and has had stellar returns since. But that may be about to end as corporate earnings struggle here.

Greenspan took the pragmatic approach of re-stimulating the US economy because at that time there was no other part of the world that was going to make the running. Europe was struggling, Japan was still in the mire and China was still more potential than reality. The US Federal Reserve took rates down to 1%, a 46 year low and then left them there for a whole year. This degree of stimulus and for such an extended period was unprecedented.

The non-US regions have all strengthened since, helped by demand from a strong US economy (and consumer). We now have a much more balanced global economy that can better weather a US economic downturn. And with higher US interest rates and a housing bubble that looks vulnerable, that may be what we are about to see.

The downside of the loose monetary policy is that it has accentuated some global imbalances (the US current account deficit does not seem to be improving) and helped fuel a boom in US residential housing and mortgage equity withdrawals. It is now also helping to boost the number of private equity transactions, which now have elements of a bubble about them. A saving grace has been inflation remaining reasonably low, helped by low cost Asian based producers (particularly China) keeping prices down.

What about investment management trends?

Another interesting aspect of my role has been seeing some developing investment management trends. Seven years ago most investment managers were locked into traditional benchmark related products. However, the significant sharemarket downturn in the early 2000s provoked some investors and asset consultants into asking why the index had to be followed so closely, particularly when it goes down. The issue was while an index is a reasonable basis of comparison to establish how an investment manager is performing, it isn’t always the best way to construct an investment portfolio.

So there has been a movement to separating the market risk in portfolios (beta) and the true value added by the investment manager (alpha). The excellent work undertaken by the NZ Super fund since its establishment has reinforced this approach. The search for alpha by fund managers and investors is sensible – but not always successful! It does expose any investment manager that doesn’t have a sustainable advantage in adding value but also means those that do will be able to generate good returns for investors and themselves.

Another trend has been the rise in structured products. Some investors have said they would prefer a more certain positive return to be produced on their investments. That’s fine but some investors have demanded a little bit extra and this has resulted in product providers sometimes including significant leverage within some structured products. It is important in such cases that investors or their advisers understand whether the source of added value in the product (and any associated leverage) can cope with increased volatility levels.

The rise and rise in private equity in the past few years has been another investment trend. I still have a problem with this given many acquisitions are made at prices that industry players cannot make work (even with synergy benefits). The leverage involved is usually high and dependant on low interest rates. There also needs to be an exit to allow the private equity firm to realize its investment, which is dependant on strong sharemarkets continuing.

All of the above seems to be based on the current low risk environment remaining in place. Simple mean reversion suggests at some stage risk levels (and therefore the required return and interest rate levels) will rise. The extent of the rise will dictate whether some of the issues mentioned above turn into a market dislocation (or even a crash) of some sort. Of course increased volatility is not all bad as it does provide opportunities for skilled fund managers and traders to take advantage of over-sold situations.

AQ Comment:

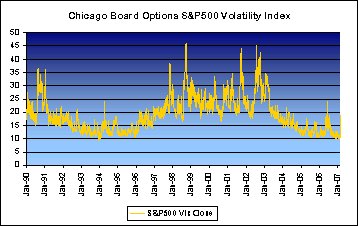

After the turmoil of the early 2000’s, risk levels have progressively decreased to their lowest in a decade. However, the China sell-off reminds us that this can change quickly. A prolonged rise to higher levels would not surprise. This could cause some problems for markets used to low risk levels.

Government Savings Policy

Over the seven year period there has been a definite shift in Governmental savings policy in this country. It has moved from a hands-off to a more proactive and involved approach. This has happened at all levels ranging from the establishment of NZ Super (which has been a real success story), to KiwiSaver and more attractive tax policy changes. There also seems to be some momentum to a compulsory savings model. This is the most positive environment in my 22 years in the industry.

The Government savings policy initiatives should also help to re-balance the current unbalanced mix of assets in the average New Zealander’s balance sheet, with housing currently dominating and all the risks this entails. I believe the key to investment success for the average investor is sound diversification. This ensures that you can still do well, even if one particular sector has a significant down turn. My fear is the reliance on residential property means many New Zealanders would face financial hardship if that market had a material correction from its current over-extended valuations.

It’s time for me to finish up (in more ways than one!). I’d like to thank our Tyndall clients for their loyalty and support over the years, any other readers for taking time to read my monthly commentaries. I’d also like to thank the Tyndall staff for their help in putting these commentaries together and of course their contribution to making Tyndall so successful over the years. I wish all of you the very best for the future.

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

Anthony Quirk is the managing director of Guardian Trust Funds Management.

| « Hands off CFP! | Levelling The Tax Playing Field » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |