WATER - Blue Gold

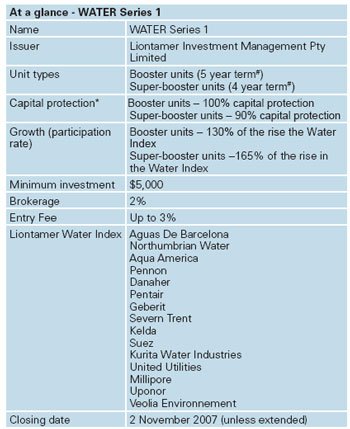

Liontamer have launched a new capital protected water fund, WATER Series 1, to access the growth potential of the global water industry. This article takes a look at the key drivers of this exciting investment theme.

Monday, July 9th 2007, 6:00AM

Liontamer have launched a new capital protected water fund, WATER Series 1, to access the growth potential of the global water industry. This article takes a look at the key drivers of this exciting investment theme.Pipes, pumps and valves deliver water, but infrastructure is only part of the growing water story. Filtration and treatment of waste water, metering, quality testing and new technology (such as 'Reverse Osmosis' in taking salt from sea water) add to the depth of the water industry. The investment spectrum in this sector is made up of defensive utility companies through to waste management and those dealing in new technology for desalination or providing ultra-purified water to the bio tech or engineering industries. Companies involved across all aspects of the water sector could be the winners in this compelling investment story.

Our liquid economy

Water – the blue blood running through the veins of every industry. It's taking its place as a powerful commodity story; scarce, essential and there is no substitute for it. To top it off, supply and demand are moving in opposite directions. Access to clean water comes at a price and that price is expected to keep rising.

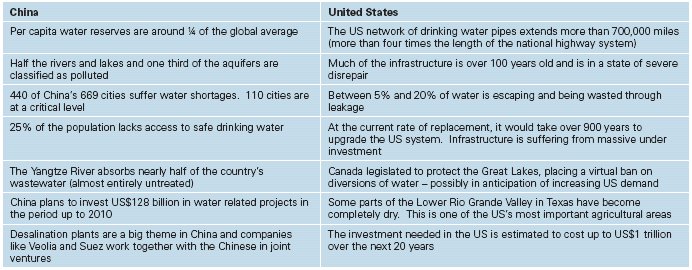

The success of every industry depends on secure water supplies and without access to clean unpolluted water, world economic growth could be in crisis. This is especially true when you look at one of the world's current economic powerhouses; China. With 21% of the world's population and only 7% of the world's water resources, water scarcity has become a major political issue.

1.1 billion people lack access to clean water

Our oceans are full of it and at the flick of a tap there is the illusion of unlimited access. On closer inspection, how much is really available for human consumption? In short, only 1%. A staggering 97% of the worlds water resources lie in our oceans (requiring highly expensive desalination technology and a large drain on energy to become useable) and 2% of the remaining 3% is frozen.

Phrases bandied about in the press such as "Blue-gold", "blue-oil", or "liquid gold" are now becoming highly appropriate labels. When you consider that it takes 11,000 litres of water to make one semi conductor wafer and 300 litres to produce a kilo of paper, the importance of the water story is bought to life.

Supply and demand – large fundamental changes

Climate change, pollution and poor resource management are driving down our supplies of water. On the demand side, growing populations mean our water usage has increased by six times in the past 100 years and is expected to double again by 2050. Demand for food makes the irrigation needs of agriculture a major force – 70% of all fresh water is channelled to agricultural use. Urbanisation and industrial growth continue to add to the rampant demand growth.

One key issue is that supply and demand issues transverse both developed and emerging markets. Water scarcity is certainly not limited to the developing nations. Currently 25% of the world's population are experiencing 'water stress' including key economies like the US, Southern Europe and Australia. Meanwhile in the emerging markets of Latin America, China and India, water stress could threaten growth and hinder development. Regional collaboration will be essential with 260 rivers in the world shared by two or more countries. Governments and local bodies across the world have made water a top policy issue and the companies who supply water infrastructure, services and technology should benefit strongly from the increased political focus and legislation.

East vs West – both China and the US dig deep

Stop talking about the problem, what's the solution?

Enhance supply: this means getting water from the area it's located in, to the area it's needed, and at the time it's needed. A huge investment in infrastructure will be needed to deliver water and store it. Utility companies, such as Aqua America, are expected to benefit from this enormous need. In addition supply can increase by using sea water and developing new desalination technology, recycling waste water, using waste water for irrigation, using new treatment methods involving microbiology, membrane, crystallisation and nanotechnology. The Japanese company Kurita Water is a good example of a company whose revenues are derived from water treatment. Kurita Water began as a manufacturer of water treatment chemicals, before turning to water treatment equipment.

Reduce demand: more efficient water use in agriculture and industry will have massive benefits. Companies involved in irrigation technology, recycling, leak detection, improved pipes, pumps and valves, and using salt water based technology will help reduce the intense demand on water supplies. One business strong in this segment is Swiss firm Geberit, a leader in the area of sanitary systems and piping in Europe.

Manage our water better: this can be done by increasing the price of water and regulating the use of water in industry. Managing the quality of water is also essential. Water metering and water testing companies are well positioned to benefit as legislation increases. US company Danaher is an example of one company operating at the leading edge of ultra-violet treatment systems which disinfect billions of litres of water every day in over 35 countries.

Sources: KBC Asset Management, UBS Q-Series Water, Summit Global Management.

Full details are contained in the Investment Statement and registered Prospectus, provided by Liontamer Investment Management Pty Ltd (ABN 23 104 174 325). # Liontamer has the discretion to reduce or increase the maturity date by six months, depending on market movements during the offer period. *Capital protection at maturity, means you will receive back 100% for booster units, or 90% for super-booster units, of the combined amount invested and early bird interest (earned during the offer period) less any entry fee charged (up to 3%). There is a more detailed description of capital protection in the Investment Statement and the limited circumstances when capital protection may not be available.

| « Kauri Notes - High targeted returns | Accessing the Water H2Opportunity » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |