Market Review: February 2008 commentary

This month's Tyndall Commentary features comment from Peter Lynn, Tyndall's Head of Strategy.

Monday, February 11th 2008, 1:41PM

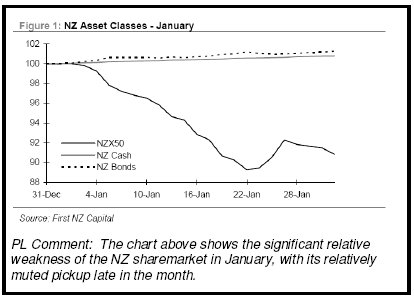

It was not a pleasant way to start a new year. For the first three weeks of 2008, stock exchanges around the world suffered consecutive negative trading days as the world factored into share prices an impending US recession. New Zealand was certainly in on the game, with the first 14 trading days of the month (out of a total 21) all being negative for the NZX 50 Index. This was a record run of consecutive down-market days, not only for the start of a year but at any stage of any year. At its nadir, the NZX 50 Index was down 10.7%.A similar thing had been happening on other bourses as well, although there had been a few up days and some bigger down days incurred rather than the New Zealand market's steady track downwards. The S&P 500 Index in the US was, after its first 14 trading days, also down 10.7%.

However, the mighty US Fed then came to the rescue, first with a surprise 0.75% cut to the Fed Funds rate, taking it to 3.5% and then, at their regularly scheduled meeting at the end of the month, by another 0.5% to 3.0%. This is one of the most aggressive cuts by the Fed for many years and led US stock markets to recover very strongly from what would otherwise have been a very poor monthly result. It certainly had more impact than George Bush's USD150b fiscal stimulus, which was widely regarded as not being large enough to offset a potential recession.

The S&P 500 ended up returning -6.1% for January, while the Dow Jones was down "only" 4.6%. The New Zealand market also recovered, although not strongly, ending the month down 9.2%. However, European markets did not fare so well – the German DAX was down 15.1%, for example, for the whole month.

January does tend to be a somewhat volatile month for investment markets. In fact, in many years it has been either the best or worst months in that calendar year. There is, of course, the well-chronicled "January effect" in the US, where small company stocks are often sold off in late December for (usually) taxation reasons and then repurchased in early January. This effect seems to have diminished markedly over recent years (and clearly was not evident in 2008).

January does, though, tend to set the course for the first half of each calendar year, at least in the US. Of the 58 years from 1951 to 2007, the month of January was either the best or the worst performance month out of the first six for the S&P 500 Index in 29 of them, a statistically significant number. In nearly all of these it charted the direction for the whole calendar year.

My simple (and unproven) theory on this is that, during the first month of each year, there are many commentators speculating and estimating as to what the market holds for the whole year ahead. This "information" then gets fed through to investors who use it to place a value on stocks and to trade appropriately as soon as they can to take advantage of the likely scenarios that will develop over the course of the year. One could argue that this was occurring again in 2008, with the word "recession" (as measured by the Economist magazine's word count of the NY Times and Washington Post) reaching its highest level since about 2003. The huge write-downs (of many billions of dollars) by large financial institutions as a result of the 2007 credit crisis has not helped sentiment or expectation for 2008's prospects either.

Investors have already begun to price in a substantial downturn (if not a full-blooded recession) in the US economy, with the continued impact of the falling away of the US housing market and the rather sorry state of credit markets. Of course, economists are never great at predicting recessions in advance. If they do manage to predict one, it is usually when the recession is already underway. This is one of the problems with a recession. Technically, it is two consecutive quarters of negative GDP growth, but the statistics to confirm this do not arrive until well after that six month period has ended.

If this "new January effect" theory has any basis in reality, then things do not look good for 2008 as a whole. It was the worst January return for the S&P 500 index since 1990. However, it would be a brave person to predict weaker returns in any month this year than what occurred in January. There is also the possibility that several stocks were actually oversold in the downturn.

The last week of January saw a very solid rally in performance. On 23 January, the Dow rose over 630 points, with a record volume of over $7 billion. There are probably lots of opportunities still out there that can be exploited by smart investors.

However, there will certainly be a substantial amount of volatility apparent in the markets over the next five months or so. The key is the amount of uncertainty, particularly in regard to the full extent of the credit crisis. While this remains relatively uncertain, markets will continue to exhibit large up days and large down days.

One interesting aspect is that this effect of January setting the tone for the year ahead is not apparent in New Zealand. Of the 76 years from 1932 to 2007, January was either the best or worst performing month in the first half of the year in only 19 of these years – again statistically significant, but on the low side. In particular, it was only apparent once in the last decade (the year 2000).

The years in which January months exhibited outsized returns also correlates quite highly with those years in which markets exhibited extreme returns overall, including 1975, 1986, 1987, 1989, 1993 and 1994. Interestingly, in many of these years, the January month produced a return completely at odds with the course the year took. For example, January was the strongest month in 1994 and the weakest month in 1986.

Of course, it is not that surprising that the New Zealand market suffers such little impact from the month of January. Most New Zealanders (and, it seems, many working in the investment industry) spend a good portion of the month on holiday. This does lead to very light volumes on the market, which can result in some abnormal returns from reactionary investment decisions by small investors, but rational processing of investment information probably happens a lot less than during less holiday-filled months.

The New Zealand sharemarket will likely see a lot of volatility over the next three or four months as well. The economy is clearly slowing down; for example, November's retail sales numbers were relatively strong, but they were all concentrated into fuel and food prices, which have been rising strongly. The rest of the sector showed fairly weak spending. Corporate profits are likely to have cautionary forecasts. The big question is how much of this has already been priced in to the current market?

New Zealand companies have a tendency of being oversold, partly as a result of the impact of large amounts of foreign ownership, which can quickly leave the country whenever they feel that NZ risk levels get too high. Hence, there may possibly be bargains being created if stocks are being oversold. In addition, there are some positives to the local economy, with expected tax cuts and the dairy payouts providing some stimulatory effect.

To complete what has been a predominantly equity based commentary, we should put in a word for fixed interest investments. What is bad for equities is often good for bonds. The NZX Government Stock index rose 1.3% in January, which, excepting the extraordinary 3% return in August last year, was the highest monthly return since December 2003. Global bonds returned 2.0% for the month. There are always opportunities around somewhere. Thankfully, a diversified portfolio can cover a lot of them.

Tyndall's Comment on the Month's Numbers

Many of the numbers have been captured in the text above, but to summarise and complete: the NZX 50 index was down 9.2%, while the MSCI World Index returned -8.4%. NZ Govt bonds were up 1.3%, while the LBGAI (hedged) returned 2.0%. Despite all of the carnage on the sharemarkets, the NZD rose a small amount, up 2.4% against the USD and a similar amount against Sterling.

| « ASSET - Festive Talkfest | ASSET - See-through advice » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |