Market Review: June 2008 London commentary

In previous commentaries, Tyndall have pointed to the likelihood of the rocky road of 2008 including some shorter bursts of relative optimism and market recoveries. We experienced this in May. This month Tyndall comment on why this recovery is unsustainable.

Monday, June 9th 2008, 11:49AM

The global credit crisis is spreadingAlthough many global equity markets have regained their poise over recent weeks, we remain concerned that the global credit crisis is intensifying and that the global slowdown to which we have referred in previous reviews is spreading.

Indeed, away from the equity markets' apparent optimism, we find that financial sector share prices have begun to under perform their peers in other industries and that the credit growth numbers, in countries as disparate as the US, UK, Spain, Ireland, Germany, Eastern Europe, South Africa and New Zealand have each begun to slow, in some cases to levels which we regard as critical.

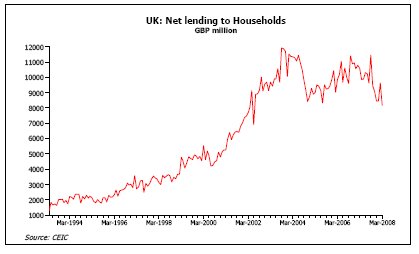

For example, in the UK, the monthly lending figures to the household sector have now dropped to below the £8.5 billion per calendar month that we regard as necessary simply to allow the UK consumer sector to 'stand still' with regard to its level of spending. UK consumers, like their US and other counterparts, had until recently been supplementing what had proved to be remarkably pedestrian rates of real disposable income growth during the 2000s by borrowing heavily so that they could spend much more than they were earning on a cash flow basis.

Indeed, we find that in both the UK and the US, the total level of household spending during 2007 was around 106% of their incomes - an unprecedented level in the available histories of these economies, although some countries (most notably Spain, New Zealand and Australia) have been even more aggressive in their 'over spending' behaviour of late.

However, this situation implies that in the absence of strong real wage growth, households in these countries can only spend as much this year as they spent last year if they continue to borrow heavily – since last year's spending was 106% of incomes, if this year's level of spending is not to fall, then more funds must be borrowed in order to again 'top up' disposable incomes.

Through the use of such cash flow statements and a little mathematics, we can calculate that US consumers need to borrow more than $600 billion this year and UK consumers more than £110 billion. In Australia and New Zealand, the numbers are smaller in absolute terms, but larger relative to income levels.

However, we are increasingly finding that in each case, the current level of credit growth in the economies is dropping below these (pro-rated) rates with the result that consumers may be facing very real cash flow binding constraints on their ability to spend as much money this year as they did last year. Moreover, with food and fuel prices now notably higher, the amount of 'spare money' that they have available for discretionary spending is very much reduced.

Therefore, we are not surprised to be witnessing an avalanche of weaker consumer data in the global economy at present. Households simply do not have spare money at present and many may be struggling to finance even last year's level of spending in nominal terms, let alone find sufficient money to increase real (inflation-adjusted) spending totals.

Hence, we believe that we have entered what may prove to be a sharp slowdown in Western and (some) Emerging Market consumer trends that will persist for some time to come – and at least until 2009.

In fact, we wonder whether the situation with regard to 'real' levels of Western consumer spending may be becoming even more acute at present as result of events not only in the energy markets but in China as well.

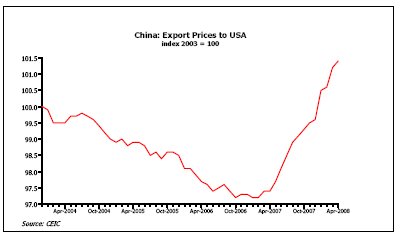

Following the outbreak of a wage-price spiral in China over the last 18 months (although the higher rate of Chinese inflation was initially caused by higher food costs, rising prices have now become endemic in the economy), China has become obliged to raise the prices of many of the consumer goods that it exports around the world. This is, of course, a very significant event for the global economy.

For the last 15 years, we in the Western economies have benefited from falling Chinese export prices that allowed (or in some cases forced) the prices of the clothes, consumer electronics, toys and other goods to decline in the shops that we used. Wal-Mart in the US, the Range in the UK, the Warehouse in New Zealand and a host of similar shops in Europe and elsewhere were able to offer their customers seemingly ever cheaper goods while China continued to cut its export prices.

But, as China's economy has overheated over the last year, and food shortages have pushed up not only living costs but wages as well, China has begun to raise its export prices and to export inflation to the West at a time during which Western consumers may be cash flow constrained. Hence, we are seeing not only signs of a global slowdown in nominal (i.e. cash value) consumer activity but higher inflation rates in many countries as well that could serve to further undermine real growth rates.

This situation does not only bode ill for the fortunes of the household sector. As consumer spending slows, corporate receipts will tend to suffer at a time in which input prices have been rising and this clearly will impact corporate profitability. In fact, if we take a more 'general' view of the situation for companies, we might suggest that in the middle of the 2000s at a time during which consumers were spending very much more on companies' products than they were earning from the wages that companies gave them, it would have been almost absurdly easy for companies to make large profits.

But, as consumers now save by spending less of the wages they are given, it will become notably harder for companies to produce profits. It is with this in mind that we remain cautious over the outlook for global equities, despite their recent rallies.

The outlook for bond markets remains mixed. Higher inflation is clearly an unattractive proposition for bonds but we suspect that the direction of these markets will ultimately be determined by the direction of official interest rates. Following our extensive travels of recent weeks, we remain convinced that official interest rates will continue to fall around the globe this year.

Although most central banks remain wary of the threat from higher inflation, most recognize that events in China and even in the energy markets are effectively beyond their control, and thus we continue to expect the major central banks to reduce interest rates further this year, providing of course that their domestic wage inflation indicators remain benign. Since we expect such an outcome, we therefore remain positively disposed towards fixed income investments.

Currency markets have of course been volatile over recent months. However, we do wonder whether we are now due a change in sentiment towards the US dollar. Clearly, the US is either in, or close to, a credit-crisis-driven recession but this may now be old news.

The fact that Japan may too have fallen into a near recession and that parts of Southern and Eastern Europe now appear beset by financial crisis of their own may soon force a change in expectations not just over regional growth rates but relative interest rate moves as well, which could prove beneficial to the USD. Even the emerging market and Australasian currencies could soon prove vulnerable to a correction as the extent of the global slowdown becomes more apparent.

Overall, despite the optimism suggested by the recent behaviour of global equity markets, we remain cautious over the outlook for global economic growth over the next 12-18 months with an added concern that inflation rates may also prove to be a source of further bad news for markets, at least until China's economy joins the slowdown later this year or early next year. We do, however, continue to expect further substantial interest rate cuts in the OECD area this year.

Andrew Hunt, London

| « ASSET - Government lightens the load | Market Review: June 2008 commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |