Big rate falls forecast

Good Returns' survey of economists paints some positive light on the future direction of home loan rates.

Thursday, June 12th 2008, 5:39AM

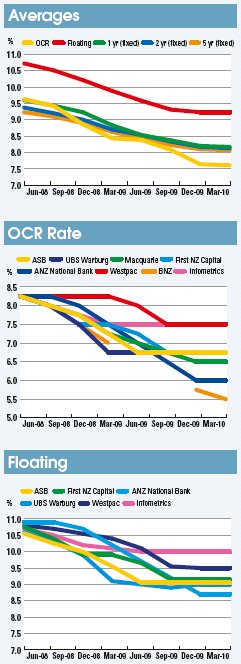

In our latest survey there are clear, and strong, predictions that rates are headed downwards.

In our latest survey there are clear, and strong, predictions that rates are headed downwards.

While there is a wide variance on when and how far and fast the Reserve Bank will cut its official rate, it is clear cuts are on their way.

As our graph (right) shows there is some consistency in how rates for various terms will fall.

ASB Bank forecasts fixed home loan rates to be around 0.50% and 1% lower across the board in 12 months and around 1.5% lower in 24 months.

Borrowers have a number of choices. The short term on is to pick a six-month rate now in with the expectation that rates will be lower by year's end.

The risk here is that if the forecasts don't pan out as predicted then you maybe paying a rate above 10% in six month's time.

While there are risks the probability of this happening is on the low side.

A more conservative approach is to pick a one-year rate, allowing more time for the interest rate peak to pass. The risk here is that you fix at higher rates longer than necessary.

Five-year rates are the lowest in the market and going for these is seen as taking on no-risk. However, the downside is that these rates are at historical highs and the probability is that rates will come back. Therefore it is not recommended people fix home loans for this length of time at present.

| « Finally some good news for borrowers | Mexican stand-off in housing market » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |