Market Review: London November 2008 Commentary

We are experiencing dramatic times in World economics. It is too early to foresee an end to the economic adjustments – let alone a ‘bottom’ in our markets.

Tuesday, November 11th 2008, 9:38AM

-Greg Campbell, Tyndall

Paradox of thrift

Over recent days, global equity markets have rallied strongly as central banks have reduced interest rates, in some cases quite aggressively. That equity markets have reacted so positively to this event is not surprising given the severity of the falls in markets that had occurred in the previous few weeks but, unfortunately, we doubt that the rate cuts, though clearly useful, will solve the current problem that besets the global economy. Thus, although the recent equity market rallies have appeared robust, we doubt that their foundations are particularly solid.

Around 18 months ago, a crisis broke out in the arcane mathematical world of the credit derivatives markets. By August 2007, the crisis had infected the global mortgage and banking sectors in general and by March this year the ‘disease’ had spread to encompass virtually the entire credit system around the world and, by August of this year – and particularly following a rather mis-timed rate hike in Europe – the global credit system had essentially become dysfunctional. This situation was, of course, not only a problem for the ‘fat cat bankers’ so beloved by the Press.

As we have noted many times before in these commentaries, large tracts of the global economy have come to increasingly rely on a consistent flow of new credit to cover their now large financial deficits over recent years and thus, when the supply of credit was compromised earlier this year, these cash flow negative entities began to face severe financial constraints that in turn limited their ability to spend.

For example, within this group of “cash flow negative entities” are the New Zealand and Australian household sectors, together with the household sectors of the US, UK, Spain, Denmark, Ireland, Eastern Europe and Iceland, as well as many corporate sectors in Europe and the Americas.

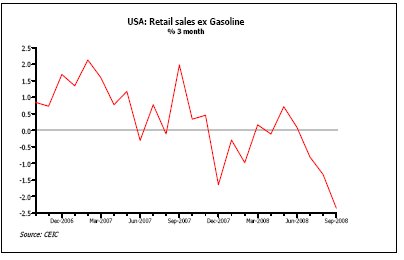

In each case, the interruption in the supply of credit to these various sectors has forced a dramatic change in spending behaviour as people have been obliged to bring their expenditure levels back in line with their incomes and cash receipts. Hence, we have seen weak consumer and corporate spending trends in all of these economies and in some cases – most notably Ireland and Iceland – the results have been depression-like rather than merely recessionary.

Given this collapse in the credit system and the economic weakness that it implied, we are not surprised to find that governments have reacted aggressively by pouring hundreds of billions of dollars into the financial system in order to keep it both sufficiently capitalised and notionally capable of functioning. Indeed, some may now believe that with official interest rates now lower and the banking system recapitalised, a new credit boom could be expected – although why the world would want such an event given the damage that the last boom has created is a moot point.

In fact, we believe that the chances of a new credit boom are relatively slim. The damage done to both sentiment within the banks’ loan departments and to potential borrowers’ psyche by not only the interruption in credit supply but also the recent declines in house prices and employment conditions makes it most unlikely that either lenders will wish to lend or borrowers will wish to borrow in the new world in which we find ourselves. Indeed, far from borrowing and ‘dis-saving’, we envisage that many people may now wish to save more and attempt to rebuild their balance sheets by either paying off debt or accumulating ‘reserves’ in case unemployment happens to them.

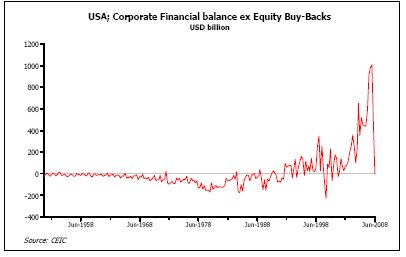

Unfortunately, it is an economic fact that if too many people begin to save simultaneously, this virtue can become a vice. If too many people save rather than spend, then the level of aggregate consumer expenditure must fall relative to wages and while this might appear ‘good news’ for household finances, it implies the reverse for the corporate sector which will find itself paying out more in wages than it receives in sales revenues, with the result that their cash flow situations will come under intense pressure at a time during which the financial and credit markets have become relatively inhospitable places from the point of view of fund raising.

In this situation, companies will have no option but to cut back on CAPEX, reduce their inventory levels by reducing production and, most importantly of all, they will also tend to retrench labour. Of course, the latter will in turn cause unemployment to rise and wage incomes to decline, thereby ratcheting up the pressure on the household sector’s finances and potentially initiating an even greater saving effort by the consumer. This potentially vicious cycle of ever increasing saving became known in the 1930s as the Paradox of Thrift and it was also a process that has affected Japan over recent years. Unfortunately we see clear evidence that not only are such cycles beginning to establish themselves in the Western economies, they are beginning to gain momentum.

Moreover, as the Paradox of Thrift has gained traction in the West, it has implied that international trade flows have softened, with an obvious and unwelcome impact on the still trade dependent economies of Japan and Asia. Even China, through the medium of its still de facto fixed exchange rate regime has found itself drawn into the slowdown, along with its other ‘BRIC’ partners and much of the remainder of the Emerging Market world. Moreover, as global industrial production has softened, so too has the demand for commodities, a situation that has of course brought yet more countries into the slowdown process. Therefore, we have no hesitation in referring to the current situation as representing a very real and uncomfortable global recession that will leave few countries unaffected.

Most seriously affected will be those countries in which the private sectors have weak cash flow and, unfortunately, this includes the Australasian countries, as well as the USA and much of Europe. However, unlike the Continental Europeans, New Zealand, Australia and for that matter the US and UK have the advantage of the economic policy flexibility implied by floating exchange rates and authorities that seem prepared to act reasonably aggressively. Hence, while we expect sterling as well as the New Zealand and Australian dollars to be weak currencies, this currency weakness should perhaps be viewed as a defence mechanism that should prevent the countries suffering the extremely deep recessions – or worse – that are now afflicting some countries within the Euro Bloc.

Unsurprisingly, given such an apparently bleak economic outlook, we suspect that it may be too early to ‘call a bottom’ in equity markets – or a top in bond markets. In order for us to become satisfied that equities represented a ‘buying opportunity’, we would need to see evidence that governments had moved on to tackle not only the financial systems’ problems but also those of the real economies. To our mind, the only way in which the Paradox of Thrift driven cycle can be broken is if governments radically improve the cash flow situations of their private sectors by not only reducing interest rates yet further but also by providing very substantial tax cuts (perhaps equivalent to two or three percent of national incomes) so that people will have the after tax cash flow available that allows them to pay down their debts without first having to cut their expenditure.

If governments fail in this easing task, we would envisage that the global recession will continue to intensify and that ultimately so many bankruptcies will occur in both the household and corporate sectors that the world’s banks will again suffer capital-threatening loan losses that will require yet more public funds to rectify. Therefore, we would argue that although many in government may not wish to spend yet more money fighting the recession, in reality they have no choice if they are to avoid even larger ‘bills’ at a later date but, until the authorities realise this and enact easier fiscal policies, we will remain cautious over the global outlook.

Andrew Hunt, London

| « Market Review: London October 2008 Commentary | Market Review: November 2008 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |