Market Review: London December 2008 Commentary

There can be no doubting the gravity and profoundness of recent events within the global economy, Andrew Hunt reports.

Monday, December 15th 2008, 12:39PM

Testing Economic Times

Even those such as ourselves that feared for the global economy’s outlook in 2008-9 have perhaps been surprised by the severity of the current economic downturn.

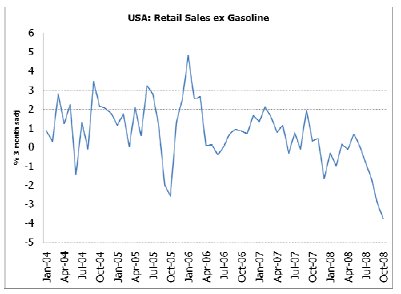

We were aware that US consumers were not only notionally ‘addicted’ to credit, but fundamentally cash flow negative. And therefore horribly exposed to any deterioration in the health of the credit system. Yet, even we have been surprised that US retail sales declined by nearly 5% in dollar terms in the three months to October.

An annualised rate of decline of more than 19% in nominal terms (let alone adjusted for inflation) in retail spending in the world’s largest economy is simply unprecedented in the modern era and certainly bears comparison to the Great Depression of the 1930s.

Unfortunately, the economic malaise has not been limited to the USA. Japan’s economy is also now firmly back in a recession and experiencing sharp falls in industrial output and even labour market conditions – despite the economy’s weak demographic situation.

In Germany, a recession has also emerged as export growth and capital spending trends have softened against a background of an already soft consumer spending environment. In the UK, output growth has also succumbed despite the household sector’s apparent determination to keep spending.

UK households were, it seems, prepared to forgo pension contributions, to cut back on insurance premiums and to aggressively sell down their stocks of investment assets, during the first half of the year in a ‘valiant’ attempt to keep spending. But even here, growth trends are now weakening and store closures have become an everyday feature of the economy; such stalwarts as Woolworths and MFI having collapsed.

Elsewhere in Europe, France’s economy is softening and the recession in the PIGS (the former Bubble-driven periphery countries of Iberia, Italy, Greece and Ireland) are building in intensity. Indeed, a recent trip to Ireland confirmed that the economy may be sliding into a full-blown depression.

The economic slowdown has not been confined to the developed world. The newly emerged economies of Eastern Europe have already succumbed to a financial crisis that has resulted in calls for assistance from the IMF. Unfortunately, we expect this crisis to deepen in 2009.

Growth is also slowing in Latin America and financial stresses are beginning to become apparent in these economies – most notably in Argentina. Even the countries of Asia have not been immune. High levels of inventories of unsold goods are causing a region-wide slowdown in production growth that will, in time, feed through into weaker household income and consumption growth. Even India’s substantially domestically driven economy has begun to decelerate, although given its recent inflation performance we suspect that the authorities may be welcoming this event, at least to a degree.

Perhaps surprisingly to some, nowhere has the Asian economic slowdown been more visible than in China. Over the last five or ten years, China’s weak agricultural sector has struggled to produce sufficient output to supply the growing urban populations and this has resulted in endemic food price inflation within the country.

Moreover, faced with rising subsistence costs, China’s government has been obliged to allow this food price inflation to result in higher levels of general wage inflation in the economy; to have done otherwise might have courted political unrest.

Unfortunately for China, this rise in wage inflation has occurred at a time during which speculative pressure has been pushing the local currency upwards, with the result that China’s international unit labour cost competitiveness has suffered severe deterioration since the early 2000s.

However, as the global slowdown has arrived and Wal-Mart’s customers in the US, The Range’s customers in the UK and The Warehouse’s customers in New Zealand have become both more thrifty and price sensitive, China has not been able to pass its higher costs on to its customers. Consequently, China’s exporters have recently suffered a major profit squeeze, as well as a build up in inventories of unsold goods. These events are already leading to a sharp slowdown in the PRC economy.

On a positive note, China’s authorities evidently realise that the economy is facing difficulties and they have announced not only an increase in government spending (of an unknown size as yet – the much heralded numbers being reported in the press contain little or no detail) but also a rise in production subsidies and a reform of the agricultural sector.

In time, these measures, combined with a liberalisation of food imports that could provide a useful long term boost to countries such as New Zealand, may help to revitalise China’s economy but, in the near term, we expect China’s economy to experience either a recession or a ‘near miss’ as a result of its weak competitiveness and high inventory ratios.

Clearly, this rather depressing tale of economic woe implies that the next six months are likely to be an extremely ugly period for the global economy. The G20 governments had an opportunity to improve the situation during their recent meeting but little concrete emerged, aside from an agreement to meet again for lunch in April 2009.

Some governments have of course announced policies of their own; Japan’s government may be about to spend more and the early signs are reasonably encouraging. The UK government has also announced a large expansion in its budget deficit, although the details of the plan looked more electorally-driven rather than economically optimal.

In the US, there are rumours of a large tax rebate once President Obama takes office and this would certainly be useful but, once again, this is an event for next year. Consequently, we see little to soothe the real economies’ plight in the near term.

Where we do see a chink of positive light is in the financial sector. The Federal Reserve’s recent spate of acronym-laden policy initiatives are now likely to be of sufficient aggregate size to prevent the credit crisis becoming any worse in the real economy and at the same time it may finally have provided enough liquidity to the financial system in order to prevent the process of forced de-leveraging in the hedge fund and investment banking sectors.

Indeed, with equity and credit market valuations now looking notably more attractive, the removal of the spectre of forced selling by leveraged investors may allow markets (including some of the high yielding currency markets such as the NZD) to rally in the near term, although as the New Year dawns and the depth of the current recession becomes more apparent, financial markets may yet face another testing period before the G20 meets again. And hopefully produces something more constructive.

Andrew Hunt, London

| « What finance company investors need to consider | Market Review: December 2008 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |