Market Review: London March 2009 Commentary

Andrew Hunt, international economist for Tyndall takes an in-depth look at the issues around global unemployment.

Friday, March 13th 2009, 9:46AM

The Next Shoe To Drop: Global Unemployment

Over recent weeks, as we have visited and reviewed a number of seemingly quite disparate economies around the globe, one of the features that has stood out most clearly has been the extent to which implied labour productivity rates have tumbled of late in many countries around the world.

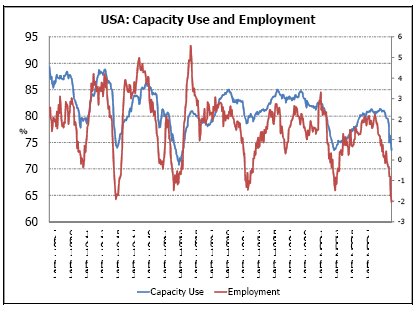

Although in the US companies in the manufacturing sector have been relatively swift in attempting to protect productivity rates by adjusting their payrolls rapidly to the change in the production environment (hence the Atlanta Fed has reported that job losses are occurring at a proportionately faster rate than in previous recessions), companies in many other countries have not been so ‘cost conscious’ and aggressive in their labour shedding.

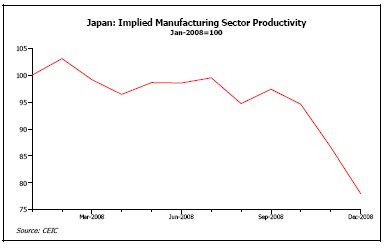

For example, in Brazil, we find that implied labour productivity had declined by a distressing 10% compared to a year ago and in Japan we can estimate that implied labour productivity has fallen by a massive 20% in the last six months alone.

In Europe, companies also appear to have hoarded labour even as production rates have declined, with the result that notional German manufact-uring sector productivity has probably declined by 5-6% over the last six months. In the Southern European economies – the PIGS - the data appears to be even worse.

The implied hoarding of labour by European companies, which of course will have been at the acute expense of their profits, is perhaps not overly surprising given the region’s legendary ‘social’ and legal environment but we are intrigued to find that many Asian countries - not only Japan – have also decided to retain staff even as production has fallen away.

It seems that despite their much lauded entrepreneurism and despite their recent awful production trends and the still high level of inventories, Asian companies have so far been relatively slow to adjust their labour costs to the new demand environment.

For example, although the majority of Korean companies are reporting the existence of substantial levels of excess capacity according to the Bank of Korea’s monthly surveys, employment levels were essentially stable in the year to December.

Consequently, we find that the bulk of the financial burden of Asia’s economic slowdown is falling primarily on private sector’s rates of profit at present; the corporate sector’s reluctance to lay off staff and close factories has implied that corporate profits have declined rather than household incomes.

Presumably, the rationale for Asian companies’ failure to lay off staff is some form of ‘long termism’. Companies are evidently expecting a recovery in either world trade or domestic demand and therefore they are attempting to maintain their current levels of capacity in anticipation of this event.

However, we must wonder just how ‘long term’ a view companies will want to take – and more importantly will be able to take.

In reality, we suspect that if there are not clear signs of either a global or domestic improvement within the next few months, thoughts of long termism will have to come a distant second best to the concept of corporate survival.

Indeed, although we do not yet have the complete fourth quarter flow of funds data for Japan, we believe that it is highly probable that Japan’s companies will have become significantly cash flow negative over the quarter as a result of the collapse in sales receipts and the companies’ failure to reduce labour costs.

This situation will of course not have been new to Japan; during the ‘phoney’ part of the early 1990s recession companies were also prepared to sacrifice their own financials rather than lay off staff.

However, we must note that the extent of the slowdown in Japan’s economy at that time was very much less than that which exists today; companies probably had no inkling at that stage just how long the recession would ultimately last; and bank credit, even then, was probably more readily available than it is today.

Therefore, rather than waiting years to adjust their labour force as they did in the early 1990s, we suspect Japan’s companies may feel obliged to act earlier with regard to their potential surplus labour positions. Similarly, given their experiences in the Asian Crisis of 1997 and the subsequent Y2K bust, other Asian companies may also not feel inclined – or even be able - to take a long term view.

Returning to Europe, we are not surprised that companies have ‘felt obliged’ to retain staff and indeed the institutional / legal framework of the Continent can make labour shedding difficult and costly.

However, at the same time, we must note that Europe’s corporate sector entered the current recession profoundly cash flow negative and with even ECB Governor Trichet now finally admitting that the financial crisis in the Euro Zone is deepening, it may be that cash flow concerns will cause European companies to act rather faster than they might have done in the past with regard to cost reductions.

It therefore seems to us that given the poor quarter that we are currently enduring and the low probability of a meaningful improvement in production trends in 2009Q2 given current inventory levels, we may be on the cusp of a major and profound shift in global labour market conditions, with all that this will entail for both politics and economics.

We like many have been working on the assumption that the global economy will look better in 2009 and even we share Fed Chairman Bernanke’s view that the technical recession may indeed end in the US and elsewhere in 2009H2.

By the second half of the year, it is true that savings rates will in all probability have moved back towards their historical norms (thereby implying that expenditure levels will no longer have to fall relative to incomes), household cash flow may have been improved by effective mortgage rate cuts and various government’s fiscal initiatives and, in the corporate sector, inventory positions will presumably have been brought down.

We have even gone so far as to suggest that consumers, who will presumably have been conditioned to expect a better second half by recent government prognostications, may even begin to ‘borrow’ some growth from the second half over the next few months (i.e. by spending some of their anticipated tax rebates even before they arrive).

However, what concerns us with this now relatively consensus view of a better second half is that, given the declines in productivity noted above and the now increasingly widespread view that the global economy could suffer a relapse in 2010 as the various government fiscal policy ‘life support’ effort is scaled back, companies may not be prepared to run with surplus labour in anticipation of this expected second half ‘recovery’.

As we have noted, with corporate cash flow remaining under intense pressure and the global banking system still profoundly compromised, companies may simply not be allowed to hoard labour in anticipation of this event and so there is therefore a risk that, in many countries, the hypothesised improvement may either come too late to save domestic employment trends.

Indeed, there is even a risk that the now widely expected second half recovery is somehow thwarted by a sharp rise in unemployment in the near term, and consequent drop in wage incomes, that overwhelms the effects of the fiscal response.

In fact, we increasingly see the probability of a second half recovery becoming the product of a race between rising unemployment rates and government spending and we must admit that with corporate cash flow deteriorating and governments still evidently thrashing around in search of a concrete policy framework, the middle part of the now widely expected ‘w’ slump-recovery-slump scenario is beginning to look under threat.

The second half global recovery story is now beginning to look rather shaky and thus we see the way clear for further rate cuts by central banks – and further currency weakness in cyclically sensitive currencies such as the NZD.

Andrew Hunt, London

| « Fund manager of the year nominees announced | Market Review: March 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |