Market Review: London April 2009 Commentary

In this month’s Tyndall comment, Andrew Hunt discusses Tyndall's expectation that New Zealand’s recession will deepen further in coming months. And, the different paths emerging for both NZ and Australian economies.

Wednesday, April 8th 2009, 12:57PM

The Hare and the Tortoise?

Economic conditions in New Zealand and Australia are substantially ‘less bad’ than in much of the Northern Hemisphere currently.

There does not yet seem to be the acute level of financial and economic distress visible that we can see in the US and parts of Europe, despite the fact that both New Zealand and Australia were enthusiastic participants in the global credit boom and the fact that both countries relied to a very great extent on inflows of foreign funding to finance their respective domestic credit booms.

Given that many of the other countries which also employed high levels of foreign financing for their domestic credit booms have since fallen by the wayside in the current global slump (Iceland being the most extreme example), the resilience of the Antipodean economies is remarkable.

Intriguingly, we find that both countries have been able to continue to tap international credit markets remarkably successfully over recent months, although no one is quite sure why this has occurred.

Explanations for this relative success have ranged from the local institutions’ long term experience in managing their foreign funding requirements; the beneficial effects of the government guarantees; the countries’ assumed commodity exposures or even simple luck but, whatever the cause, the Australian and New Zealand banking systems have not suffered the funding pressures that have sunk Iceland, made life difficult for the UK banks and which now threaten to destabilize the Eastern European economies.

Certainly, the banks are finding it a little more expensive to raise money from abroad and the inflows have not been as plentiful as they once were (hence the sudden reversal in the local currencies) but it nevertheless seems that these Southern Hemisphere countries have been the exception to the global ‘rule’.

Of course, this situation could change in an instant but at this time we see little reason to expect such a shift and therefore we expect Australia and New Zealand to be spared the worst effects of the global banking crisis in the near term.

We also see the emergence of a marked difference between the two Southern countries’ respective economic trajectories, although we doubt that this is appreciated at this time by many foreign-based commentators.

In New Zealand, it is clear that despite the continued access to foreign funding, the credit boom that had previously propelled domestic growth (and domestic house prices) is now ending in much the same way as has occurred in much of the rest of the OECD. Indeed, domestic credit growth has been effectively zero since last Spring (the time of the Lehman Debacle) and this is clearly constraining what had become a credit addicted private sector.

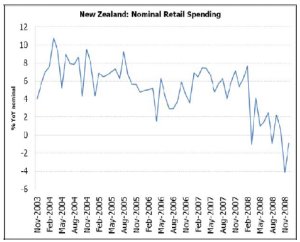

Indeed, we have estimated that New Zealand households possessed an annual borrowing requirement of around NZD24 billion in 2008 and the fact that this financial deficit can no longer be financed is forcing a change in people’s ability to spend. Hence, the housing market is beginning to weaken (particularly in the former ‘hotspots’ of Queenstown and Nelson) and the cash amount of retail spending is beginning to fall as people find they simply do not have the cash available to spend in the shops.

Admittedly, the recent fall in fuel prices and the RBNZ’s swift reduction in interest rates have helped to support household finances but, despite these moves, households in aggregate are having to tighten their belts and a domestic recession has resulted. Unfortunately, we suspect that this recession will deepen over coming months as the household savings rate continues to rise as people attempt to rebuild their finances.

This increase in saving / reduction in spending will certainly hurt corporate revenues and profits, with clear adverse implications for the labour market and household incomes as the year progresses. Moreover, given the levels of over indebtedness present in some houses and parts of the dairy sector, we can expect the economic slowdown to set in motion an escalation of the problems already beginning to appear in these areas of the economy.

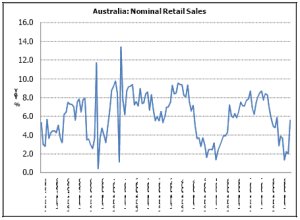

In Australia however, it is apparent that credit growth has not yet come to an end and, although the recent weakness in capital spending and exports has created a technical recession, it is clear that Australian households are still borrowing aggressively.

Hence, retail spending is continuing to expand (albeit at a slower pace) and the local property markets remain at extremely expensive levels in comparison to income levels. Anecdotally, we found that many Australians still expect property prices to rise from here, despite their already low level of affordability.

Therefore, it seems to us that the Australian credit boom may roll on a little while longer, quite possibly with some help from the Chinese economy’s surprisingly resilient demand for the country’s mineral exports.

Although China’s economy is in a deep recession, large state subsidies are allowing companies to continue to produce goods despite the weak demand for those goods and hence China is continuing to import raw materials, despite its slowdown. This clearly is not a sustainable situation in the long term but for now China is continuing to support Australia’s mining sector and by implication the whole economy.

Of course, ultimately Australia’s credit boom will end (at what by then will be even more stretched levels and debt ratios) and China’s current subsidy-driven production growth will have to subside or even unwind as inventories are reduced but until then, Australia’s economy may surprise people with its strength and resilience, if only in the near term.

Given this outlook, we would not expect further rate cuts from the Australian Central Bank (not least of all because domestic inflation remains stubbornly high) and we may even see a rebound in the Australian dollar.

In New Zealand, however, the weaker domestic environment and decline in inflationary pressures can be expected to lead to further rate cuts and quite possibly to a weaker NZD. Indeed, we gather that the authorities would quite welcome a weaker NZD and that they may even intervene to achieve such an aim.

Admittedly, in the short term, we would not expect these rate cuts to create a new leg to the credit boom, given the growing desire within the population to save, but the rate cuts will make servicing existing debts somewhat easier.

Therefore they will assist in the period of financial convalescence that New Zealand is now undergoing. Indeed, by 2012 or so, New Zealand’s private sector, by foregoing growth in the near term, may emerge with relatively strong balance sheets and, this event, coupled with what by then should be a highly competitive currency, should provide robust foundations for a new economic cycle.

Australia, in contrast, may at that point be entering its own period of financial consolidation. Despite their geographic proximity, it seems that Australia and New Zealand are now following fundamentally different paths.

Andrew Hunt, London

| « Market Review: March 2009 Commentary | Market Review: April 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |