Market Review: August 2009 London Commentary

Much has been written about the global "credit crunch" and the flow-on economic effects. This month, Andrew Hunt describes the credit boom well underway in China. This is much hyped and causing China's economy to pickup. Sound familiar? A time for caution.

Tuesday, August 11th 2009, 2:29PM

Chasing the China Story

Economists in Central Banks are generally charged with identifying potentially excessive credit expansions and attempting to forestall them. Since, if they don't succeed in controlling the credit system effectively, then situations such as that which emerged during 2007-8 are highly probable outcomes.

Indeed, history is littered with credit booms that turned to destructive busts and therefore it is the consensus view that they should generally be avoided by the authorities. However, many economists and other analysts within the portfolio management industry also frequently attempt to identify nascent credit booms - not so they can be avoided, but so they can be exploited - initially by being "long" as the boom inflates and then by being "short" as the boom deflates.

In theory, identifying a credit boom should be relatively easy. Naturally, the rate of credit expansion will tend to be high and economic growth often rapid but there will also tend to be a great deal of optimism and ‘sales hype' around that will at least seem to offer an alternative ‘fundamental view' of why economy "X" might suddenly be the new hot long term destination for investment funds.

Consequently, there is often pressure on the more cynical credit boom follower to modify their stance as to the likely longevity of the credit-induced boom. Indeed, our second assignment when we joined the economics profession (the first having been to look at China's price volatility-inducing behaviour in the natural rubber markets in the mid 1980s) was to look at the Lawson Economic Boom in the UK in the mid-late 1980s.

The press were running stories over the UK's economic renaissance and ‘structural advantages' that would somehow make the economy impregnable and immune to future cyclicality but in reality the economy's growth was simply the function of a household sector borrowing binge that was to subsequently end very badly in 1990-1992. Our third assignment was to cover Japan's ‘Heisei Boom' in the late 1980s and this subsequently proved to be one of the more destructive credit cycles in economic history.

Quite simply, the Japanese authorities' response to the economic implications of the rapidly appreciating Yen in 1986-7, and also to the threat potentially posed by the global equity market instability of late 1987, was to allow a dramatic expansion of domestic credit and to allow the creation of substantial ‘excess liquidity' (particularly in the financial system).

Unsurprisingly, this excess liquidity then gave rise to a boom in asset prices and a surge in foreign investor interest as foreigners began to notice the strong returns being produced by the Nikkei Equity Index. In time, the credit boom also gave rise to stronger household consumption; moreover investment in the property sector (this was the period in which Japanese property prices soared to completely irrational levels); excessive investment by companies in plant and equipment; and to a weakening in the trade accounts. Unfortunately, what the excess liquidity did not do was to foster a restructuring of Japan's economy and in fact it, in many ways, encouraged the continuation of the old immobile economic model by hiding its short-comings behind a veil of asset price inflation, at least until 1990.

However, many investors and commentators associated the positive short term effects of the credit boom on Japan's supposed ‘cultural advantages'. Despite the structural flaws that were already becoming apparent in the Japanese economy, this was the era in which we were all supposed to adopt Japanese business practices, eat sushi and to prepare for the Yen taking over as the global reserve currency. As a result of the investor hype, hubris and optimism generated by the boom (anybody wanting to remind or acquaint themselves with this feature of the boom should perhaps read the contemporary book ‘The House of Nomura' for a succinct if unintended summary of how intense the pro-Japan marketing machine became), buying into the Japanese economic story became de riguer.

Of course, when the Bank of Japan finally changed its monetary course in late 1989 and began raising interest rates, not only did the excess liquidity disappear quite rapidly but so too did the optimism generated by the marketing hyperbole about Japan's potential to become the new economic super power, its inbuilt economic superiority, its better working practices and long term ‘structural advantages'. In 1988, the world wanted to buy Japanese equities and emulate its business model but within a decade many of its former fans had become its biggest detractors as they switched from irrational exuberance to irrational pessimism, with a catastrophic impact on equity prices.

We recount this experience simply because we see many parallels between Western investors' views of Japan in 1989 and their current feelings towards China. Currently, the Chinese equity market is booming, the domestic economy at least appears to be bucking the global trend and there is already much talk of a shift in the balance of global economic power as a result of China's rising economy and expanding financial presence. Indeed, once again, the talk is of the US dollar losing its global reserve currency status as a new challenger arrives in the global economy.

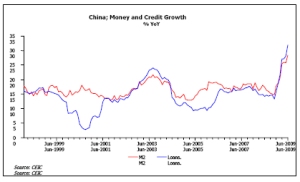

However, a closer look at China's available economic data casts some doubt on the true strength of China's economy and it also reveals the presence of an all too familiar domestic credit boom. By any standards, China's current 32% YoY rate of credit growth and its 28% rate of money growth appear not just excessive in an absolute sense but even more extreme when they are viewed in the context of China's still soft 4% rate of nominal GDP growth. China's credit system is clearly in full and hectic expansion mode at present and this credit boom is having its usual effects not just on domestic asset prices but also international investor sentiment it seems.

While we have no doubt that the credit boom has caused China's economy to pick up, we would also note that the hype regarding China's economic boom has become so intense that even the glaring inconsistencies in the China economic story seem to be being ignored. China is reporting a strong rise in the output of its energy intensive industries but no increase in energy consumption. Meanwhile, China's retail data is generally soft and the available inventory data suggests that whatever rise in production there is occurring, at least some of it is feeding not end user demand but inventories, which China's statisticians then classify not as ‘stocks' but as ‘investment'.

Finally, even China's trade figures and its foreign exchange reserve figures seem open to question - they are certainly unlikely to be as strong as many are portraying. China's economy probably has picked up as a result of a modest (by Chinese standards) pick up in infrastructure spending and the current huge domestic credit boom but the extent of the recovery is probably very limited and its longevity open to question given the probable weakening state of China's external accounts.

In practice, we suspect that the People's Bank of China will continue to allow the credit boom to run for another six to 12 months. Therefore, China's economy will continue to appear strong, its appetite for imports will continue to rise and this will provide some form of global economic stimulus, although we are not sure that even this second part of the story is as positive as some make out.

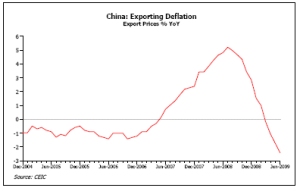

It is true that China is importing more and particularly in the commodity markets, this has led to some increase in prices within the relevant markets. However, China's own export prices are continuing to fall rapidly and since China is a price-setter in many global consumer goods prices, the fact that China is simultaneously raising commodity prices, while depressing finished goods prices should be bad news for global profits, despite their (China's) bigger appetite for imports. The China story is not as positive and transparent as many suggest.

Moreover, once the Chinese central bank does tighten its monetary stance, as we believe that it will have to in 2010 as its own trade accounts weaken and the RMB comes under pressure, Chinese companies will find it increasingly hard to finance their by then extremely bloated inventory positions.

At this point, we would not only expect a sharp slowdown in Chinese production trends but an overwhelmingly deflationary stock liquidation cycle is likely to unfold, to the discomfort of both Chinese companies and their overseas competitors (who will have to match China's falling export prices). Like all credit booms, China's will one day end with negative consequences for them, its overseas suppliers and its competitors.

Consequently, our strategy with regard to China (and indeed the other BRIC credit booms of Brazil and India) will be to ‘own them' or more precisely to speculate in them until we see signs that either domestic credit conditions are changing as a result of policy decisions or balance of payments constraints.

Admittedly, we will have a bias towards being cautious - many people who have played the greater fool theory in markets (there will be a greater fool to buy our exposure at the top...) in the past have ended up ‘going over the cliff' with the ‘long term bulls' and previous credit booms have occasionally proved susceptible to adverse news items and other unforeseen developments but, for now, we will chase the ever expanding supply of money in China.

We are prepared to back the Chinese ‘Gift Horse' for a while longer but we do recommend frequent looks in its mouth and we believe that these checks should centre on the inventory data and the external payments situation, although as we noted neither are well served by the available data.

There will be a time to sell the China theme, although it may not be quite yet

Andrew Hunt,

International Economist

London

| « A guide to UK pension transfers | Market Review: August 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |