COMBI Series6 Unlocking the potential of the world’s commodity market

Commodity prices came under pressure throughout 2008 as the world fell into recession and global demand dried up; however, commodities are now regaining value again - what's behind this recent bounce and is it sustainable?

Tuesday, September 15th 2009, 11:36AM

At Liontamer we see several fundamental drivers of commodity prices – some are already present while others will come into effect over the next few years:

• The global recession has deflated prices which has in turn led to production cuts and a reduction in supply

• The industrialisation of developing economies, especially China and India, continues more or less unabated

• There is a wall of infrastructure and energy spending as economic stimulus packages start to take effect and global demand rebuilds

• Growing wealth in the emerging markets means there are an increasing number of middle class consumers eating meat, grains and dairy products

• The bio-fuel industry and extreme weather events are adding pressure to key agricultural commodity prices

• There is a long-term trend of relentless population growth.

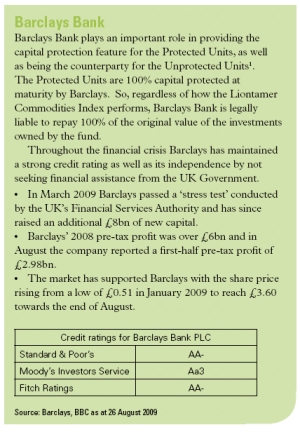

Oil demand forecast to rise

There seem to be two leading actors in every commodity story and it's clear the key players here are China and India. These two emerging super-economies remain on track to grow by more than 8.5% and 7.5% per annum respectively over the next ten years. In particular, all eyes seem to be on the Chinese economy, whose continued growth seems critical to this nascent global recovery. And if growth is fuelled by oil, then China's production engine must be revving. Chinese crude oil imports for July were over 42% higher than for the same month last year and have surpassed the last peak in demand back in March 2008, when China was stockpiling oil in preparation for the Olympic Games. Barclays are picking that oil demand in general will skyrocket. Barclays Capital recently announced that they are "forecasting an upswing in global oil demand from Q2 into Q4 that is seven times larger than the forecast of the International Energy Agency, and we still see upside risk in our forecast." This is a significantly bullish view from Barclays and, if correct, further strengthens a view that NZ investors should have an exposure to a range of commodities, not just oil, as China ramps up production again.

China: restocking not stockpiling

It appears that China is not just buying petroleum products; demand from China (and India) has been instrumental in driving a variety of commodity prices up. China, as the world's fastest-growing major economy, consumes more than a third of the world's aluminium output, a quarter of its copper production, almost a tenth of its oil and accounts for more than half of trading in iron ore. The price of copper, traditionally a barometer for economic activity because of its use in housing and construction, has doubled this year. Aluminium, used in cars, planes and construction, is at nine-month highs while nickel, a key ingredient in stainless steel, is at one-year highs. Clearly a bounce has already occurred, albeit from low bases, but is it a blip in a prolonged bear market or the start of a longer-term recovery in commodity prices?

At Liontamer, we subscribe to the view put forward by Barclays Capital that surging Chinese demand for commodities is not a case of stockpiling but instead reflects a major move to restock following declining inventories in 2007 and 2008. We believe both China and India will continue to be major commodity importers as their respective economic stimulus packages, announced in late 2008, start to take effect throughout the second half of 2009 and beyond, and deliver large infrastructure and public works programmes.

In addition, as more developed nations come out of recession and confidence grows that the Asia-led recovery has some momentum, increased production combined with low inventories, especially in the US, should start to have a flow-on effect on demand for commodities. Global production already appears to be starting to return to growth. The US has reported a lift in industrial production of 0.5%, the first rise in nine months and even Japan's economy is showing signs of improvement, recording GDP growth of 0.9% in Q2 this year.

Sweet taste of 28 year highs

Importantly, some important societal trends, such as population growth, urbanisation and shifting appetites from grain to meat in developing countries, show no sign of abating. Like most goods, commodity prices are affected by the pressures of supply and demand. Currently there are two main factors affecting global demand for staple foods like sugar, wheat, coffee and corn. First, people in developing nations are becoming wealthier as their economies thrive relative to their more developed counterparts, resulting in a growing influx of middle-class consumers demanding access to quality foodstuffs, including grains and meat products. Secondly, the burgeoning bio-fuel industry still has a significant appetite for corn, wheat and sugar; three of the main options from which to create ethanol. This demand needs to be met or prices will naturally inflate. A recent case in point; the severe drought in India, in conjunction with too much rain in Brazil has created a global shortage of sugar, sending prices to 28 year highs.

Developed economies appear to have started their economic recovery, meanwhile populations will inexorably continue to increase and geopolitical factors will inevitably continue to affect supply. At Liontamer, we believe this competing demand for commodities will in turn continue to place upward pressure on prices for many years to come.

Two commodity investment strategies

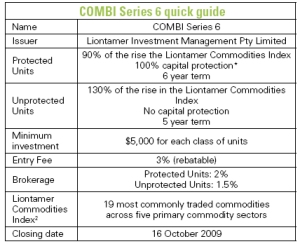

Liontamer has launched its sixth commodities fund, COMBI Series 6, which provides investors with an exposure to the 19 most commonly traded commodities across all five primary commodity sectors - energy, agriculture, precious metals, industrial metals and livestock. The Liontamer Commodities Index measures the performance of exchange-traded commodity futures and is designed to minimise concentration in any single commodity or sector.

COMBI Series 6 provides investors with the choice of two different investment strategies to benefit from the growth in the Liontamer Commodities Index. The first, Protected Units, offer 100% capital protection at maturity and 90% exposure to any gains in the Index*.

The second option, Unprotected Units, has no capital protection (so investors are exposed one-for-one to any decrease in the Index) but rewards investors with boosted exposure to any rise in the Index at maturity. This means that investors have two simple choices of how to access a long-term commodities growth story; boosted exposure for those who have a positive medium-term outlook for commodities and are comfortable with the potential for capital loss, or capital protection for those that place a high value on wealth preservation.

Full details are contained in the Investment Statement and registered Prospectus, provided by Liontamer Investment Management Pty Ltd (ABN 23 104 174 325). Copies are available upon request from Liontamer by calling 0800 210 450.

*Capital protection at maturity only applies to the Protected Units and means you will receive back 100% of the combined amount invested and early bird interest (earned during the offer period) less any entry fee charged (up to 3%) and any exit fee. Capital protection only applies at maturity. There is a more detailed description of capital protection in the Investment Statement and the limited circumstances when capital protection may not be available. Capital protection does not apply to the Unprotected Units. 1. Barclays Bank PLC does not guarantee repayment of the investment amount or any returns on the investment nor do they accept any liability to investors. However, as the Fund Asset Provider, Barclays Bank PLC is legally liable to pay to Liontamer as trustee of the fund, the investment amount plus any returns for the Protected Units and the formula of returns for the Unprotected Units. 2. Liontamer Commodities Index: Final Index levels are averaged monthly in the last year for both unit types. Averaging will protect you from any sharp falls in the Index; however in a rising market averaging lessens returns.

| « SPI Capital: Syndication domination | The rational bubble » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |