Market Review: December 2009 commentary

With the exception of Japan, most global sharemarkets had a good month in November. The Land of The Rising Sun, though, started to suffer deflation and a large number of capital raisings did not help investors' attitudes.

Friday, December 11th 2009, 9:19AM

Elsewhere, continued rapid growth in China and India, as well as continued central bank purchases of gold (as the US and other major currencies' outlook dimmed), resulted in materials being the best performing sector. Finally, progress was made in US healthcare reform, which helped pharmaceutical shares, while airlines and other transportation stocks benefited from merger activity.

The US Federal Reserve signaled it would maintain an accommodative monetary policy for an extended period, providing a boost to most financial assets. However, late in the month, Dubai World's attempted debt renegotiation saw equity markets reverse quicker than Tiger Woods, although with surprisingly less overall impact than the errant driver. Government and credit markets were up in the month.

In New Zealand shares, investors focused on result announcements and corporate transactions. DNZ Property, Kathmandu, PGG Wrightson and Synlait Milk all either raised equity or contemplated raising capital during November. Local insurer Tower Limited reported a solid result, as did Methven, although the Fletcher Building AGM comments placed a dampener on a belief that conditions were improving as rapidly as expected.

New Zealand interest rates with maturities from two years to 10 years moved approximately 0.20% lower over the month as Dubai's problems refocused the market's attention on the risks remaining to a global recovery. The RBNZ is maintaining that it will wait until the second half of 2010 before raising the OCR because the economy needs further stimulus as it recovers from recession.

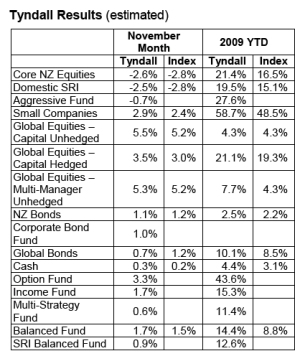

The Option Fund was again a star for the month, putting in another solid 3.30% return and seeing its return for the calendar year-to-date rise to nearly 45%. The strongest asset class during the month was unhedged global equities, helped by a NZD fall. The Tyndall Small Companies Fund has been the strongest for the year to date, although there have many double-digit returning asset classes.

The 2000s have been a rather tumultuous time for investment markets, with two of the largest drawdowns in global equity history at the start and end of the period, with a solid rally in the middle and a short and very sharp recovery right at the end. This has meant that it has been very trying for those invested in the markets and even worse for those who try to formulate investment policies for funds.

The key, as always, has been to embrace diversified policies throughout, with a strong long-term strategy designed to achieve the desired goals, although mindful of the occasions when particular asset classes have been very over- or under-valued.

On behalf of all Tyndall staff, I wish you and your families a safe and happy Christmas and New Year.

Peter Lynn, CFA, Head of Strategy

Tyndall

| « Market Review: December 2009 London commentary | Investment managers favour equities » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |