Market Review: January 2010 London Commentary

For those hoping for a quiet 2010 following the dramas of the last few years, we must unfortunately confess to not having much good news for them.

Tuesday, January 5th 2010, 8:45AM

Although it is now a rapidly forming consensus within the investment community that 2010 will see economic growth start strong before fading into 2011 as tax rates move up and interest rates rise gently (along with inflation rates) in order to provide an essentially flat or mildly positive year for most asset markets, this is certainly not our central forecast. Moreover, we suspect that this simple economic scenario, even if it were to come to pass, would have much bearing on actual asset market returns.

Instead, it is our firm assumption that events in 2010 will shape the investment outlook for perhaps half a generation if not longer as governments finally come to terms with the aftermath of the 2007-8 credit boom. Naturally, many analysts and investors are optimistic over the early prospects for 2010 given the rapid recovery in many asset classes this year but it is our view that the asset price boom of the last nine months was merely a period of relative calm in the centre of the storm caused by the adoption of Quantitative Easing Policies (QEP) by many central banks.

Quite simply, a QEP works by flooding the asset markets with (leveraged) cash in the hope that the resulting increase in financial sector activity and profits will spill over into the real economies and thereby generate a stimulative impact on real world variables, such as employment and consumer spending.

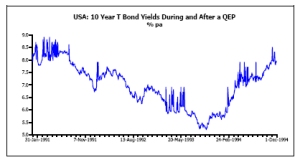

History relates that we have already experienced two distinct previous episodes of Quantitative Easing in the last 20 years, the first occurring in the early 1990s in the US in the wake of the Savings and Loans Banking Crisis of 1990-1993 and the second occurred in Japan soon after the 9-11 terrorist attacks.

Both episodes were accompanied by a great deal of investor optimism at the time and by sharply rising asset prices against a background of extraordinarily low yields in fixed income markets. However, when these policies were reversed in early 1994 and early 2006 respectively, global equity prices came under strong downward pressure (particularly emerging market equities), bond yields increased around the globe and economic growth faltered once again.

This ‘round-trip' characteristic of QEPs - namely an asset price boom and temporary economic recovery that is then followed by a sell-off in asset prices and renewed slowdown once the QEP is removed - led one of our more senior central bank contacts to describe a QEP as being the economic equivalent of attempting to forget a bad week at work with the help of Friday night drinks; it feels good at the time but on Saturday morning one wakes to find that one still has the same problems and an even bigger headache!

Admittedly, the QEP regimes adopted in 2009 have provided much needed liquidity to what were fundamentally illiquid parts of the financial system and therefore they did play a clear role in avoiding a systemic collapse of the financial system but, as most staffers in the majority of central banks with whom we meet over recent months have suggested, this particular danger has now passed and the excesses that are being bred by the QEPs themselves (in the form of rampant and potentially systemically dangerous speculation in some asset classes including commodities) would lead many in central banking land to immediately suspend their QEP regimes, despite the short term damage that this might inflict on asset markets and global growth.

In short, many of the technocrats within central bank policymaking fear that the current QEP regimes have become a breeding ground for the next AIG / Lehman crises. In practice, they feel that now is the moment to take the punchbowl away from the party, even though this may trigger an early - but limited - hangover and back up in yields. The alternative is of course to leave the party in full swing and to accept the likelihood of a much larger eventual hangover.

Another factor that is worrying central bankers at present is the recent resurgence of inflation. Although unemployment remains high and capacity utilisation low in much of the developed world, there are parts of the emerging market world in which the reverse is true and the most prominent of these is the Chinese agricultural sector.

For decades China has systematically underinvested in its food production with the result that, whenever the economy revives and employment in the cities picks up, the agricultural sector becomes starved of resources and its output declines. From this point, it is usually only a short step to higher food price inflation and from there to higher wage inflation rates as employees seek to maintain their living standards. Over recent months, this food prices / wages spiral has appeared in China and one of the primary implications of this inflation of China's cost base has been a rise in its export prices.

Unfortunately for countries in the West, which have spent the last decade or so moving to a position in which they increasingly rely on Chinese goods to meet many of their consumers' needs, this rise in Chinese inflation has implied an increase in the prices of electronics and other goods in the shops, with an obvious impact on their own underlying inflation rates. Hence, we are seeing inflation rates beginning to move up in the West to the discomfort of the central banks.

As if these two factors were not enough to provide central bankers with sleepless nights, we also have the rise of fiscal profligacy in the West. In the USA, the Obama Administration has recently shied away from an opportunity to reduce the budget deficit by using some of the returned banking rescue funds to pay down debt and instead it has elected to use the returned funds to raise social security and small business programmes.

In the UK, the Brown government is delaying any fiscal consolidation process and in Europe successive governments have eased their fiscal regimes over recent weeks rather than tightened them, with Ireland being the only exception. In Greece and Spain, the level of fiscal ill-discipline has reached new heights as the governments have expanded their budget deficits via the granting of high pay awards and overly generous social security arrangements that will hurt rather than improve their long term competitive positions (which are already very weak). Clearly, the central banks find these trends abhorrent and some privately have suggested that they need to weaken bond markets in order to force fiscal discipline on their wayward political masters.

Given the level of fiscal ill-discipline, the rising inflation trend and an obvious desire amongst central banks to tighten, one would think that bond markets can only deteriorate from here and, in so doing, ultimately undermine equity markets, almost regardless of economic growth trends. It is not clear however, whether the central bankers will have their way in the near term, since it increasingly appears that politicians may yet attempt to force a continuation of the QEP party.

One of the less obvious but important components of the QEP regime is that the process effectively compels the banking systems - including the central banks - of the various countries involved to become significant buyers of government bonds. Indeed, we estimate that almost the entire budget deficit of the OECD area this year has been financed by leveraged institutions such as banks who have used, either explicitly or implicitly, the QEPs as their rationale for these transactions.

However, if the central banks were to exit these regimes, as they did in 1994 and 2006, then we could expect a sharp rise in bond yields as households, pension funds and mutual fund investors were called upon to fund the government's huge deficits.

Such a back up in yields would not only force an increase in the governments' day-to-day funding costs (and therefore impose a discipline on them) but it would also likely abort whatever nascent economic recovery we have at present. We have no doubt that history would repeat itself in this respect if central banks attempted to exit their QEP regimes and clearly the politicians have an incentive to avoid this outcome, particularly in light of recent trends within the real economies.

Although there is much talk of a global economic recovery at present, we find that although many economies did succeed in rebounding from their crisis-affected lows in the middle of the year, the growth momentum has not been sustained into Q4. Particularly in Europe and Asia (outside China, which is overheating), growth momentum appears to be being lost at present and we even have our suspicions that the US recovery is running out of steam as consumer spending fails to live up to expectations.

In this complex environment, we believe that there will be one of a binary set of outcomes for markets and currencies in 2010. If the politicians prevail and force a continuation of the central banks' QEP party, we would expect bond markets to only sell off slightly and equities to perform modestly well in the near term. Credit spreads might also behave well as any potential default candidates, such as Greece, are ‘bailed out' by the governments and their access to cheap funding.

This ‘nationalised' or ‘socialised' outcome might have severe negative long term consequences for inflation, profits and efficiency (and hence all asset classes, a la the 1970s) but in the near term it would presumably support risk appetite amongst investors, possibly at some cost to the US dollar which presumably remains a funding currency for investors and therefore subject to periods of flow of funds driven weakness.

Alternatively, if the central banks hold sway and force a tightening of policy late in 2010Q1, then we would expect to see a back up in bond yields that would be followed after a short lag by weakness in equities, commodity plays and credit spreads.

There would presumably be more defaults amongst debtors at this point but the US currency might rise as a safe haven. The nascent recovery that may or may not be present in the global economy - and we doubt that it is present - would presumably falter at this point as yields rose, thereby increasing the pressure on equities but also setting the scene for a eventual recovery in bond markets towards year end as the inflation threat receded along with growth.

For our money, we would suggest that the central banks will ultimately triumph in the policy debate but in the near term the politicians may attempt to keep the party going a few months longer. 2010 promises to be anything other than a quiet year - there will be buying and selling opportunities in all asset classes we fear.

Andrew Hunt

International Economist

London

| « Investment managers favour equities | Mercer's top 10 investment trends for 2010 » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |