|

|

Mortgage Rates Daily Commentary

Tuesday 7 May 2024

65% of mortgage customers more than 3 months ahead of repayments - Westpac Westpac New Zealand says about 65% of its mortgage customers were more than three months ahead on repayments at March 31, which helps to explain why fewer customers than it had expected are suffering hardship amid higher interest rates. [READ ON]

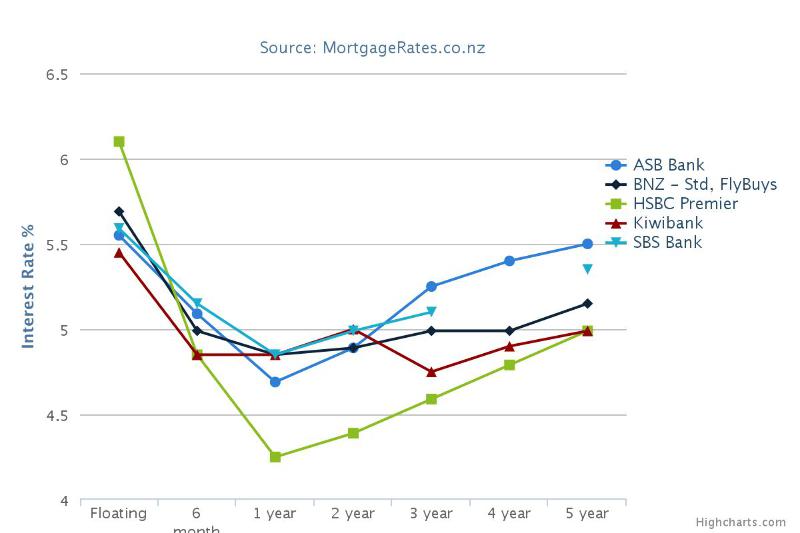

Comparing selected banks

Following a week of rate changes we have pulled together a graph comparing pricing strategies.

Friday, March 18th 2016, 10:04AM

Here we have compared just five lenders who have taken different strategies to pricing their home loans. Also note this is just for standard rates. There are a range of Specials in the market too.

- HSBC - clearly it commands a market leading position in fixed rates, especially when its Specials are considered. However it is the only bank not to move its floating rate.

- Pricing remains in a tight band up to two years, but for longer terms there is greater divergence in pricing.

- SBS - While it often is a market leader, it's current pricing is a tad ordinary.

- ASB - Sharp on the one-year term but starts to look pricey further out the curve.

- BNZ - Continues to be reasonably aggressive compared to its big bank peers.

- Kiwibank - Sharp as usual except for standard two-year rates.

Tags: Mortgage Rates

Comments from our readers

Sign In to add your comment

|

|

Mortgage Rates Table

Full Rates Table | Compare Rates

| Lender |

Flt |

1yr |

2yr |

3yr |

|---|

| AIA - Back My Build |

6.19 |

- |

- |

- |

| AIA - Go Home Loans |

8.74 |

7.24 |

6.75 |

6.65 |

| ANZ |

8.64 |

▼7.74 |

7.39 |

7.25 |

| ANZ Blueprint to Build |

7.39 |

- |

- |

- |

| ANZ Good Energy |

- |

- |

- |

1.00 |

| ANZ Special |

- |

▼7.14 |

6.79 |

6.65 |

| ASB Bank |

8.64 |

7.24 |

6.75 |

6.65 |

| ASB Better Homes Top Up |

- |

- |

- |

1.00 |

| Avanti Finance |

9.15 |

- |

- |

- |

| Basecorp Finance |

9.60 |

- |

- |

- |

| Bluestone |

9.24 |

- |

- |

- |

| Lender |

Flt |

1yr |

2yr |

3yr |

|---|

| BNZ - Classic |

- |

7.24 |

6.79 |

6.65 |

| BNZ - Green Home Loan top-ups |

- |

- |

- |

1.00 |

| BNZ - Mortgage One |

8.69 |

- |

- |

- |

| BNZ - Rapid Repay |

8.69 |

- |

- |

- |

| BNZ - Std, FlyBuys |

8.69 |

7.84 |

7.39 |

7.25 |

| BNZ - TotalMoney |

8.69 |

- |

- |

- |

| CFML Loans |

9.45 |

- |

- |

- |

| China Construction Bank |

- |

7.09 |

6.75 |

6.49 |

| China Construction Bank Special |

- |

- |

- |

- |

| Co-operative Bank - First Home Special |

- |

7.04 |

- |

- |

| Co-operative Bank - Owner Occ |

8.40 |

7.24 |

6.79 |

6.65 |

| Lender |

Flt |

1yr |

2yr |

3yr |

|---|

| Co-operative Bank - Standard |

8.40 |

7.74 |

7.29 |

7.15 |

| Credit Union Auckland |

7.70 |

- |

- |

- |

| First Credit Union Special |

- |

7.45 |

7.35 |

- |

| First Credit Union Standard |

8.50 |

7.99 |

7.85 |

- |

| Heartland Bank - Online |

7.99 |

6.89 |

6.55 |

6.35 |

| Heartland Bank - Reverse Mortgage |

- |

- |

- |

- |

| Heretaunga Building Society |

8.90 |

7.60 |

7.40 |

- |

| HSBC Premier |

8.59 |

- |

- |

- |

| HSBC Premier LVR > 80% |

- |

- |

- |

- |

| HSBC Special |

- |

- |

- |

- |

| ICBC |

7.85 |

7.05 |

6.75 |

6.59 |

| Lender |

Flt |

1yr |

2yr |

3yr |

|---|

| Kainga Ora |

8.64 |

7.79 |

7.39 |

7.25 |

| Kainga Ora - First Home Buyer Special |

- |

- |

- |

- |

| Kiwibank |

8.50 |

8.25 |

7.79 |

7.55 |

| Kiwibank - Offset |

8.50 |

- |

- |

- |

| Kiwibank Special |

- |

7.25 |

6.79 |

6.65 |

| Liberty |

8.59 |

8.69 |

8.79 |

8.94 |

| Nelson Building Society |

9.00 |

7.75 |

7.35 |

- |

| Pepper Money Advantage |

10.49 |

- |

- |

- |

| Pepper Money Easy |

8.69 |

- |

- |

- |

| Pepper Money Essential |

8.29 |

- |

- |

- |

| Resimac - LVR < 80% |

8.84 |

8.09 |

7.59 |

7.29 |

| Lender |

Flt |

1yr |

2yr |

3yr |

|---|

| Resimac - LVR < 90% |

9.84 |

9.09 |

8.59 |

8.29 |

| Resimac - Specialist Clear (Alt Doc) |

- |

- |

8.99 |

- |

| Resimac - Specialist Clear (Full Doc) |

- |

- |

9.49 |

- |

| SBS Bank |

8.74 |

7.84 |

7.29 |

6.59 |

| SBS Bank Special |

- |

7.24 |

6.69 |

5.99 |

| SBS Construction lending for FHB |

- |

- |

- |

- |

| SBS FirstHome Combo |

6.19 |

6.74 |

- |

- |

| SBS FirstHome Combo |

- |

- |

- |

- |

| SBS Unwind reverse equity |

9.95 |

- |

- |

- |

| Select Home Loans |

9.24 |

- |

- |

- |

| TSB Bank |

9.44 |

7.79 |

7.55 |

7.45 |

| Lender |

Flt |

1yr |

2yr |

3yr |

|---|

| TSB Special |

8.64 |

6.99 |

6.75 |

6.65 |

| Unity |

8.64 |

6.99 |

6.79 |

- |

| Unity First Home Buyer special |

- |

6.55 |

6.45 |

- |

| Wairarapa Building Society |

8.60 |

6.95 |

6.85 |

- |

| Westpac |

8.64 |

7.89 |

7.35 |

7.25 |

| Westpac Choices Everyday |

8.74 |

- |

- |

- |

| Westpac Offset |

8.64 |

- |

- |

- |

| Westpac Special |

- |

7.29 |

6.75 |

6.65 |

| Median |

8.64 |

7.27 |

7.29 |

6.65 |

Last updated: 3 May 2024 9:11am Previous News

-

Thursday, September 28th, 9:00AM

RBNZ announces OCR decision

-

Tuesday, August 1st, 11:19AM

SBS eyes partnership with mortgage advisers

-

Thursday, June 22nd, 9:00AM

OCR held again - here's what RBNZ had to say

-

Thursday, May 11th, 10:26AM

Surprise at RBNZ’s OCR outlook

-

Thursday, May 11th, 9:00AM

No change to OCR: What RB said today

-

Monday, May 8th, 6:00AM

Focus on tone, not content, of OCR call this week

-

Tuesday, May 2nd, 11:10AM

ANZ half-year profit jumps

-

Monday, April 24th, 10:23AM

Local flavour makes for bank winners

MORE NEWS»

News Bites

Compare Mortgage Rates

Find a Mortgage Broker

|

|

|

1 Comment

1 Comment