Last orders at the liquidity bar?

It has been our firm contention that financial market liquidity has been booming over the nine months or so, albeit for what might be described as technical rather than strictly official policy reasons.

Tuesday, July 4th 2017, 11:13AM

by Andrew Hunt

Furthermore, we would fully attribute the recent gravity-defying – and bad news-defying – behaviour of financial markets to these strong liquidity trends. In fact, we would go so far as to suggest that global financial market liquidity conditions have been as lax as at any time since the mid-2000s over recent months.

Some of the recent growth in global liquidity can be attributed to China’s still immense capital outflows. These have clearly made their presence felt in many of the world’s asset markets, such as the property markets of the US Bay Area, London, Sydney or Auckland, collectible watches, aging footballers, and of course the various cryptocurrencies. Indeed, we calculate that last year Chinese credit growth was in excess of US$3.5 trillion and we estimate that, at least prior to the recent introduction of more stringent capital controls, roughly a third of the funds that were being directly created by this credit boom were finding their way abroad. Moreover, at the same time we must note that domestic demand in China was rising in response to the (over) easy monetary conditions and this in turn resulted in a $150 billion increase in China’s demand for imports. This was not an insignificant amount even within the context of the global economy and it certainly provided a lift to the revenues of many of the world’s exporters.

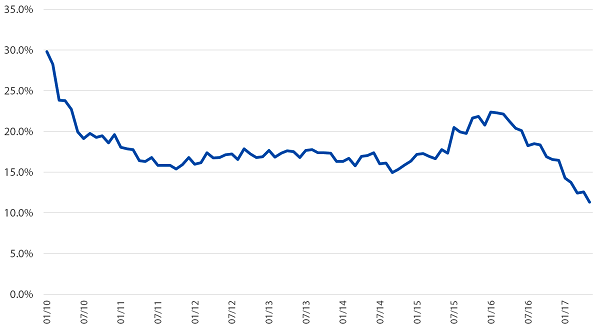

Consequently, China was providing a great deal of ‘liquidity’ to the rest of the world via its capital account leakages in foreign property and financial markets and at the same time its revival in import demand was the primary catalyst for the global reflation story that so occupied the financial markets as 2016 drew to a close. However, we must now recognize that China is now in the midst of a credit crunch the like of which we have not witnessed since the GFC and which bears comparison to the UK in 1989 (ahead of the ERM Debacle) or Japan in 1991 (ahead of the ‘lost decades’).

China: Bank Lending to Private Sector

Interestingly, we find that the UK household sector was initially quite slow to react to the shift that occurred within credit conditions at the end of the 1980s Boom (in fact, consumer spending did not truly weaken until later in 1989) but the reaction within the corporate sector to the deterioration in credit conditions was much swifter. Similarly, in Japan, although the BoJ orchestrated a severe credit tightening during early 1991 and the corporate sector recession unfolded almost immediately, the consumer ‘clung on’ into late 1992 before finally succumbing to what amounted to a near recession. It would seem that China is experiencing similar lags on this occasion in that although the corporate sector may already have succumbed to the tighter credit regime (and with it, so too has China’s demand for commodities and capital goods), we find that China’s consumers still possess some residual momentum.

In time, the latter will no doubt fade as conditions in the labour market weaken and we fully expect that China’s economy will finish 2017 in a notably weak state in terms of not only the health of its financial system, but also its true rates of achieved economic growth. This China-slowdown will, of course, have implications for global financial markets.

Indeed, given that we have suggested that the primary catalysts for the global recovery story / trade in late 2016 was China’s surging import demand and large capital outflows, the forthcoming reversal in the Mainland economy, as well as the on-going and increasingly draconian tightening of its capital controls can be expected to not only lead to some sharp downward revisions in the markets’ expectations for global economic growth but also to a direct reduction in the outflow of liquidity from China.

Another important source of global liquidity growth - and perhaps even confidence within the global recovery story – has come from the Euro Zone. However, despite the rumours of a renaissance, we find that Europe’s commercial banks, which had previously been quite heavy sellers of European government bonds during much of 2016, have recently reduced their rate of disposal of these instruments and this action has resulted in a marked improvement in financial market liquidity trends over recent months.

During much of 2016, and as a result of their sales of bonds, it had been the commercial banks that had provided one of the main counterparties for the European Central Bank’s own policy-driven bond purchase programme. Unfortunately, this situation had tended to blunt the effectiveness of the ECB’s Quantitative Easing Efforts since when the ECB purchased bonds from a commercial bank, all that was occurring in reality was a shift in the ownership of the bonds in question from one bank to another, a situation which implied that there was virtually no effect or impact on any other components of the economic system.

Moreover, since the banks were selling bonds that yielded ‘something’ but acquiring excess reserves on which they had to pay a charge (i.e. negative interest rates), the transactions were actually damaging the profitability and capital and hence underlying health of the European banks. Consequently, it was not surprising to find that the ECB was failing to gain ‘traction’ with its policies throughout much of 2016. However, now that the European banks have slowed their rate of bond sales, the ECB has instead been obliged to source its bonds from non-bank investors such as pension funds with the result that as these entities have sold their bonds, they have been able – and often required - to acquire other financial assets. This has naturally improved the efficacy of the ECB’s QE strategy very significantly.

Some have suggested that this ‘improvement in traction’ by the ECB has helped to spur an economic recovery in Europe but we would tend to demur from this conclusion. In reality, much of the reported revival in nominal growth in Europe over the winter months was simply the effect of the then higher oil prices on the export and sales data. It should be remembered that when oil is landed in Rotterdam or elsewhere, it is often shipped across several borders (thereby being recorded as an export on each occasion) before it is consumed. Hence, the higher oil price in late 2016 resulted in a surge in reported export revenue growth, even though the net quantities of goods (even including oil) being shipped were not in fact improving. Unfortunately, with oil prices now declining once again, this recovery ’illusion’ in the trade data will be lost.

In fact, we estimate that there were only two areas of genuine strength within the European export complex during the first half of this year. The first was a sharp (circa 20%) increase in shipments to China which we very doubt will be sustained as the PRC economy slows. The second source of improved trade trends within Europe earlier this year was a revival in import demand in France.

As a result of a ‘pre-election’ fiscal boost and faster credit trends, France’s rate of domestic demand growth has improved but, unfortunately for France, it seems that much of the extra demand that has been created has found its way into higher imports. While this situation may have benefitted German and Spanish exporters, it has led to a notable weakening in France’s trade accounts that seems inconsistent with its continued participation in the Euro Zone’s fixed exchange rate regime. Consequently, we expect the French import boom to also prove to be temporary as the market system acts to once again cool French domestic demand trends.

Crucially, and despite the narrowness and even fragility within the European recovery, the ECB is clearly contemplating a long-overdue move away from its ill-stared negative interest rate regime. Indeed, one does not have to spend long within even the ECB to know just how keen policymakers have become to end this monetary experiment (which seems to have done more harm to the savings and banking sectors than it has done to help the real economies) but, if the ECB does vote to exit its negative rate regime, it will both encourage and perhaps even allow Europe’s banks to once again start selling their bonds. Unfortunately, if this occurs, it will once again degrade the effectiveness of the ECB’s current regime in generating higher liquidity growth.

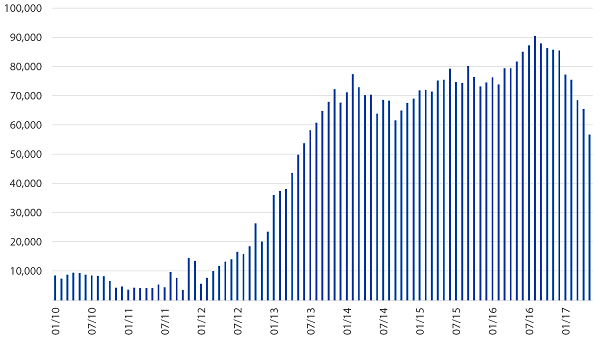

In some respects, we have witnessed an analogous situation unfold in Japan over the last year. Around six to nine months ago, Japan’s commercial banks also began to slow their rate of bond disposals, presumably because they had begun to run out of bonds that they could sell. Initially, this reduced rate of bond selling by the banks helped to buoy liquidity growth in Japan but it seems that once the BoJ became aware of the situation, it took the opportunity to reduce its own rate of bond acquisitions. Elsewhere, such an action would have been described as a tapering and we suspect that it may yet reduce liquidity growth within Japan’s financial system.

Japan: BoJ Bond Purchases JPY billion over 12 months

Fortunately, we suspect that Japan’s domestic economy still possesses enough intrinsic momentum to ‘survive’ this tapering and also - we suspect - any headwinds that might emanate from a slower Chinese economy. Although Japan’s export sector will certainly experience a downturn if China’s economy slows as expected, we believe that the resurgent domestic credit cycle and improved rate of household income growth should allow Japan’s service sector to continue to produce a reasonable rate of growth – particularly in per capita terms. Indeed, it is the strength in the service sectors that has led the BoJ to believe that it is in fact safe to begin tapering its bond purchase programme.

Important although each of the factors noted above will have been – and will be – we suspect that the primary influence on global liquidity trends over recent months has been the actions of not only the Federal Reserve (which seems intent on continuing to raise policy rates) but also the US Treasury Department.

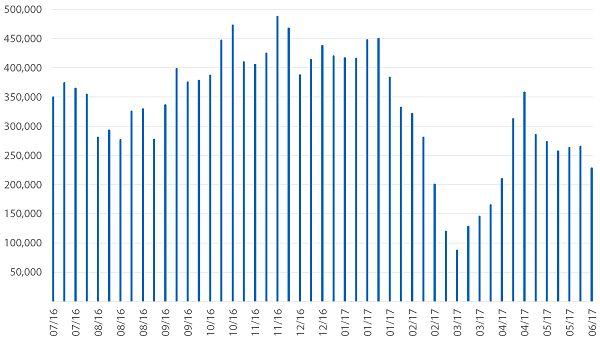

In late November last year, the US government was holding around $430 billion of cash at the Federal Reserve. However, throughout December and over much of the first quarter of this year, the Treasury took the highly unusual step pf suspending its issuance of deficit-funding T bonds and instead it funded the expanded budget deficit primarily from its cash reserves. However, by the middle of March, the government’s reserves were all but exhausted and the Treasury was once again obliged to begin issuing bonds during April; but then since May, the Treasury has returned to its practice of running down its cash reserves.

All of this may at first sight seem to be relatively esoteric but from a practical point of view the actions of the Treasury have been even more effective in generating liquidity than was the Federal Reserve’s QE Policies.

USA: Treasury Cash Reserves

Ordinarily, when a government spends more than it receives in taxes and other revenues, it finds itself adding ‘money’ to the private sector and implicitly also to the banking system as it transfers money to the recipients (and their bankers) of its spending programmes. However, in the usual course of events, it then will tend to take much of this money back out of the economy by selling the deficit–financing bonds to the investment community. Indeed, if all of the bonds that are sold in order to finance the government’s deficit are sold to domestic non-bank residents, the process will not affect the aggregate amount of liquidity in the entire economy (although it could be argued that it will tend to boost liquidity in the real economy at the expense of financial market liquidity).

Conversely, when the government holds cash at the Federal reserve, the money is essentially sterile and in a virtual sense locked away in the Federal Reserve’s vaults (think Die Hard 3...) but if the government decides to use the funds to finance its deficit rather than selling bonds, then the money will be released into the private sector but not subsequently reclaimed through the debt issuance programme.

In fact, it seems that on this occasion when the government has released its funds it has achieved a double whammy effect on the financial markets. Firstly, the recipients of the government expenditure will have witnessed an increase in their monetary wealth and they seem to have used this as a reason to acquire more equity holdings. Secondly, as the funds enter the recipients’ bank accounts, the banks then found themselves notionally short of assets, with the result that they were (quasi) obliged to expand their own holdings of trading assets and repo-market lending to other financial institutions. These flows will also have helped to buoy financial market liquidity trends. Indeed, over recent weeks we suspect that the Treasury’s actions may have generated $30-$50 billion of net inflows into financial markets per week – an amount that will have dwarfed anything that the Fed achieved during its QEPs.

As to exactly why the Treasury has been conducting these types of operations is not clear at this time. Some have suggested that it is a by-product of the Debt Ceiling Rules, others have suggested that it has been caused by an administrative logjam in Washington, and others have opined more conspiratorial theories. However, regardless of the cause, the impact has been massive but we must also acknowledge that such actions can only be finite.

Indeed, by the end of July, it is likely that not only will the Treasury have notionally run out of money, but it will need to rebuild its reserves by issuing even more bonds than are required to fund the deficit. Add to this the fact that the seasonal peak in the US budget deficit tends to occur during the third quarter, and we could easily foresee a situation in which Treasury bond issue accelerates from essentially zero to almost a trillion-dollar rate in the second half of the year. Naturally, if the government attempts to sell so many bonds, it will exert a very depressing influence on liquidity trends within financial markets.

As a result, we fear that the US financial system will find itself contending not just with a Federal Reserve that seemingly come-what-may still wishes to continue raising interest rates (another hike this year seems likely) but also with a very heavy overhang of Treasury Bond issuance that will likely draw liquidity out of the system. At the same time, it is clear that the Trump economic stimulus is unlikely to materialize this year and we strongly suspect that overall GDP growth in the USA over 2017 will not be materially different to that which occurred in either 2015 or 2016. This too is likely to come as a disappointment to the financial markets.

Consequently, it seems to us that the global liquidity boom and global economic recovery stories that have so buoyed asset markets (both bonds and equities) over recent months are likely to at best fade and more likely reverse over the course of the third quarter. This situation can be expected to provide a headwind to the risk asset markets and even bond markets may struggle given not only the supply overhang in the USA but also signs that despite the economic slowdown in China, the Asian Region seems to have become a structural exporter of inflation rather than deflation over the last few quarters. After six months of buoyant asset markets and low volatility, the second half of 2017 may prove somewhat more challenging for investors.

Disclaimer: Please note that much of the content which appears on this page is intended for the use of professional investors only.

Andrew Hunt International Economist London

| « Harbour re-launches income fund | Can experts predict market turning points? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |