Big questions for 2018

Tuesday, January 23rd 2018, 9:00AM

by Andrew Hunt

We suspect that the most popular ‘questions’ that people have with regard to the outlook for 2018 revolve around the extent to which the global real economic recovery will continue, and just how many rate hikes the ‘new’ Federal Open Market Committee will need to enact in the USA over the course of 2018. However, and to misquote Donald Rumsfeld, we would suggest that there are always a number of relatively ”known unknowns”, and the outlook for the FOMC surely falls into this category; as such, it is unlikely to trip markets on its own. Instead, we would argue that it is usually the “unknown unknowns that get you”, and we would offer two alternative questions for markets in this respect.

For us, the primary questions for 2018 will be whether global nominal GDP growth will continue to accelerate, and whether this will cause the world’s major central banks to change their policy framework in a relatively fundamental way, away from targeting from asset prices to general (real world) prices. This may seem to represent a technical or even somewhat pedantic point, but we would suggest that two – or even three – modest rate hikes by the Fed, that were still within the context of the current policy regime, would probably not unduly trouble markets, but we suspect that a genuine regime change within central banking would have profound implications for markets, not least since any commitment to raise rates would, in effect, become ‘open-ended’.

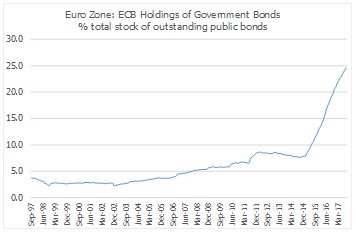

It is of course widely accepted that, since the immediate Post GFC period, central banks have, in general, been either attempting to prevent ‘balance sheet recessions’, or generate wealth effects by pursuing strategies that were explicitly designed to inflate asset values. We firmly believe that these policies, by non-profit-maximizing public-sector institutions, have resulted in the “suspension” or even “subversion” of conventional financial market valuation metrics, such as Price Earnings Ratios and the like. These traditional yardsticks were of course closely watched and influential when the markets were dominated by private sector entities, but more recently, central banks have contaminated the markets and introduced immense moral hazard issues in their efforts to suppress or, in effect, ration volatility. Since these public entities pay little heed to valuations or yields, the markets have been able to follow suit. Nowhere is this situation more obvious than within the bond markets, in which the central banks have not only targeted yields, but contaminated the valuation benchmarks for those markets that ‘price’ off bonds (i.e. which use risk free rates or discount rates…)

However, it is our fear that if the public-sector entities were for some reason to decide to leave the markets, perhaps as the central banks switched back to attempting to suppress prices within the real world (i.e. the CPI), then we believe that the financial systems would quickly revert to their former forms – i.e. those in which private sector investors will have to once again become conscious and mindful of valuations.

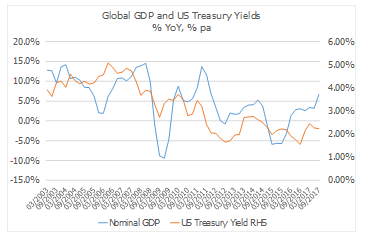

Consequently, we believe that it is not only the forecast for real growth within the global economy in 2018 that matters, it is also – and, arguably, more importantly - the outlook for nominal growth (which includes an inflation component). If global nominal GDP were to break out of its recent multiyear subdued range, and in so doing cause central banks to shift their modus operandi, we may well find that valuations will be under pressure to contract, even as earnings estimates are revised higher in the faster growth environment. This logic, of course, then begs the ‘trillion-dollar-question’ as to whether global nominal GDP growth is indeed set to rise.

Over the eight or so years that have elapsed since the GFC, the US has quite regularly contributed 0.6% p.a. of growth to global GDP on a direct arithmetic basis. The Eurozone has been rather less helpful, only adding 0.1-0.2% per annum, only fractionally more than the perceived perpetually weak economy of Japan.

Consequently, we can suggest that on average since the GFC, the “old world” has only managed to generate 1% of nominal GDP growth for the global economy per annum, at a time during which growth rates in the Emerging Markets have only been fractionally better. This situation has represented a remarkably tame performance for global GDP growth by historical standards and, if we take the old ’rule of thumb’ notion that nominal bond yields should roughly equate to nominal growth rates over the longer term, then we can see part of the rationale behind the low level of bond yields that have prevailed over recent years (although the central banks have, of course, very much exaggerated this impact via their own actions – although this is something that could also make the debt markets doubly vulnerable to any shift in policy focus by the banks in the future...)

If we were, however, to take consensus forecasts for the major G3 economies in 2018, then we can assume that they will add 2-3% to global nominal GDP in 2018. Moreover, China looks set to add 1.5% to global GDP on its own and, if we add the other EM, then we could easily envisage that on the basis of current forecasts, global nominal GDP growth should be more than 5% in 2018, and possibly as high as 7-8% in aggregate.

If this forecast comes to pass, as indeed it already appears to be doing, then it would not seem to make sense for bond yields to remain ‘anywhere’ close to their current levels. Certainly, if global GDP growth does scale these relative heights, there would, in theory at least, be no reason for central banks to continue to support asset prices directly; instead, their focus should shift towards suppressing (potential) inflation rates.

Of course, if the recent recovery in global GDP growth proves to be (another) false dawn and growth slows again, then the central banks will have no need to shift their focus, but this of course takes us back to the question that we asked earlier: will global nominal GDP growth accelerate in 2018? In practice, we believe that the answer to this question simply lies within China. It is, after all, China’s import boom (that has been in full-swing since the fourth quarter of 2016) that has provided the stimulus and impetus to growth, in not just the commodity-producers, but also much of the EM world, and even the Eurozone. Although it is clear that many continue to underestimate China’s recent impact on the European economies, it is nevertheless a fact that the growth rate of domestic demand in Europe has slowed this year, and that the region’s (probable) above trend growth performance has instead been based primarily on a surge in exports to China.

China is, however, a notoriously difficult economy to cover; the quantity of data available is limited, and its accuracy can be found wanting at times. At present, much of the world is expecting China’s economy to slow, following the slowdown in the headline credit data over recent quarters, but it is our sense that this slowdown in credit growth is largely superficial and that, in any case, there are larger forces at work within the economy.

Specifically, it is our fear that China’s re-implementation of binding foreign currency controls in the latter part of 2016 that has led China’s extremely deposit-rich savers to begin attempting to reduce their high weightings to conventional bank instruments via the simple expedient of saving less. We estimate that China’s household sector may have already reduced its savings rate by 2-3% and, in the process, it will have recessed close to US$1 trillion of ‘nominal spending power’ into the Chinese and global economies. It is this that has led to both the pick-up in domestic nominal GDP and the import boom that we referenced earlier.

Consequently, our primary fear for 2018 is that, now that this process of savings reduction in China has begun, it will accelerate further, thereby causing a very significant nominal shock to the global economy. Certainly, the addition of another $1 trillion or (likely) more of demand from China to the global economy will ensure that global nominal GDP growth does indeed accelerate further – and certainly to the 6% or so rate that we suggested above. If this comes to pass, it will not only be China that finds itself with a perceived inflation problem, it will be the global economy and, at that point, we could potentially experience the type of policy regime change that we believe that markets should fear above everything else.

Andrew Hunt International Economist London

| « Stock picking and the art of motorcycle maintenance | Rethinking retirement assumptions » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |