Advisers account for increasing amount of ANZ loans

Mortgage advisers now make up an increasing amount of home loans being written by ANZ.

Thursday, November 1st 2018, 1:15PM  1 Comment

1 Comment

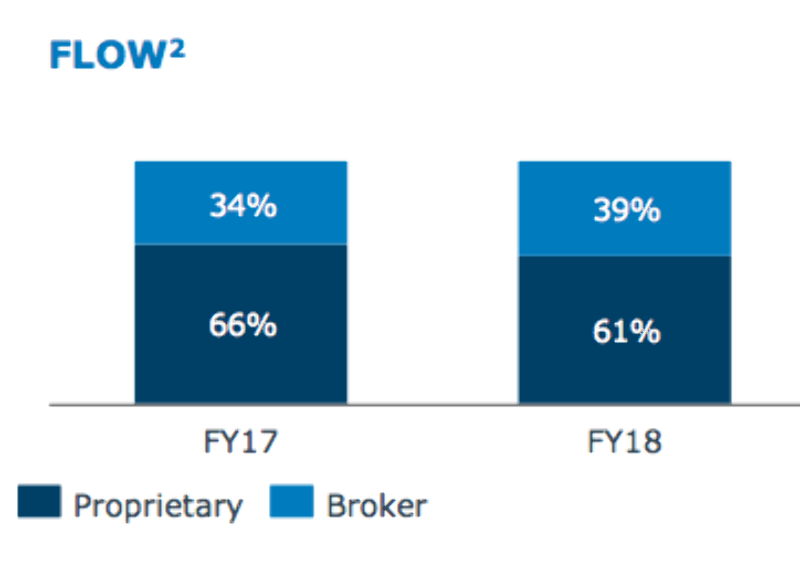

It its full year results ANZ says that 39% of its home loans were originated through mortgage advisers compared to 34% in the previous year.

Previously the bank split out who much came via its mobile mortgage managers, but that number has now been incorporated into its "proprietary" channel numbers which are essentially its branch network.

ANZ chief executive David Hisco acknowledged advisers were an important part of its distribution and that the bank had "a pretty strong proposition" in this channel.

He also thinks that its remuneration model, of upfront rather than using trail commissions is correct.

"I think, reading the news from across the ditch, we have probably been on the money."

He says the key change that the bank has made in the wake of the Royal Commission in Australia is to remove sales incentives for its frontline staff.

It is waiting for the FMA/RBNZ conduct review next week to see if it needs to make any other changes.

"We're actually waiting for FMA review to see what their specific recommendations are in relation to our business."

"If there is anything which comes out of the FMA review we will look at that."

He says ANZ removed sales targets for its front line staff "so that there could be absolutely no insinuation that people are going after sales that aren't appropriate for for customers."

"I don't think they really have been," Hisco says. "I don't think we are seeing any difference to be honest."

He doesn't think that staff come into work looking to flog product.

"You can't image a customer walking in to make a deposit, or do something, and walk out with a home loan they didn't want."

He staff should be doing needs analysis to see what customers need.

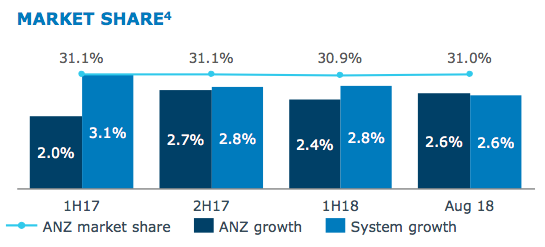

Overall ANZ's home loan market share has been running, on average, slightly below system growth.

Hisco says that ANZ's market share will stay flat around the 31% mark. "If we can grow it a few basis points next year that would be good."

THE NUMBERS

ANZ New Zealand posted a $1.98 billion profit in the year to September, as profits at group level slumped following the Royal Commission.

The lending giant revealed its full year figures to September 30, showing ANZ New Zealand posted a statutory profit of $1.98 billion, an increase of 12% on the previous year.

Cash profit at ANZ New Zealand was $1.90 billion an increase of 3%, the bank said.

Hisco said the strong New Zealand figures reflected the country's robust economy, and wider credit quality improvements.

“The continued strength of the economy – strong exports and tourism sector aided by a lower dollar, continued demand for houses and growth in household incomes – has been good for our business.

“The government’s investment in major infrastructure across the country and trade achievements are providing jobs and fuelling consumer spending and saving. We have also had a significant reduction in provision charges – funds set aside for bad debts – due to credit quality improvements across our Retail, Commercial and Agri businesses,” he added.

Revenue rose by 3% to $4.18 billion over the past year. The bank paid about $760 million in corporate taxes.

While New Zealand figures were strong, wider group profits at ANZ were down on last year. The bank recorded a profit of A$6.49 billion down from A$6.81 billion the prior year. The bank took a $377 million charge over the year for customer refunds and related costs. The bank said legal costs from the Royal Commission topped A$55 million last year.

| « Non-banks plan second “speed dating” event | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |