Prospa increases loan size

Prospa has today announced product enhancements and new partner tools to support the New Zealand adviser community and their small business customers.

Thursday, August 29th 2019, 11:25AM

Prospa has increased its maximum loan size from $150,000 to $300,000 in New Zealand, following adviser feedback and growing demand from small businesses looking to access larger funding amounts. The increased loan size will enable advisers to support even more small business owners across a wider range of funding needs.

Prospa provides a suite of marketing tools and educational resources designed to help advisers grow their small business customer base. To complement this, Prospa has today launched a Dynamic Landing Page solution for advisers that:

- Integrates with insights-driven eDMs to engage and win new customers

- Creates a seamless, hassle-free referral process and customer experience

- Can be customised with adviser branding, including logos and colour palettes

“Advisers are a vital part of our business – and have been from day one," Prospa New Zealand general manager, Adrienne Church, said. When our partners offer up feedback - we listen and act on it. Use of alternative lenders like Prospa is on the rise and we’re seeing larger loan size requests coming through from advisers and a lot of excitement around the opportunities in small business lending. This increased loan amount will enable our partners to support even more of the 500,000 small businesses in New Zealand.

“Diversification is more important than ever for advisers looking to build sustainable businesses and we’re here to make this easier. Our suite of marketing solutions and education resources has been helping advisers build their customer base for years, and we’re thrilled to now launch the Dynamic Landing Page to our New Zealand partners.”

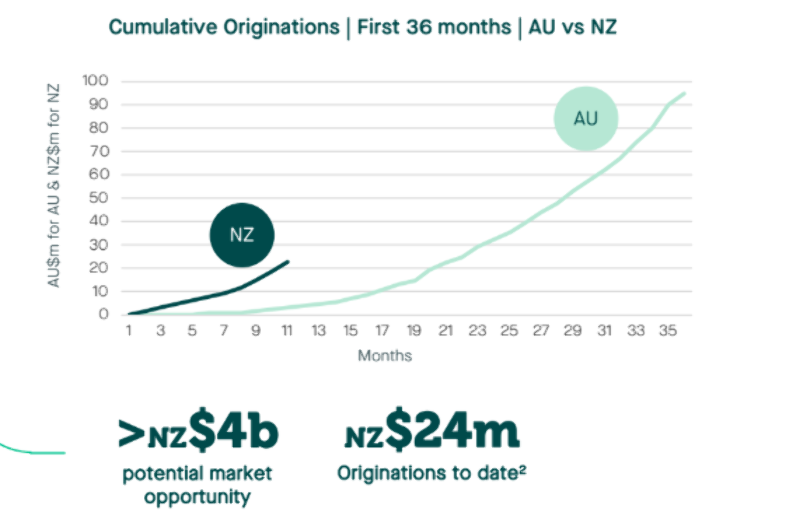

Prospa estimates that the potential opportunity in the New Zealand market to be in excess of $4 billion annually. During the pilot phase in August 2018, Prospa reached $1 million in originations in the first full month of operation (vs. 14 months for the Australian business). Since then Prospa has originated $24 million of loans to New Zealand small businesses to 30 June 2019.

As at 30 June 2019, the New Zealand business had over 700 customers, with an average loan size of approximately $27,000 and average loan term of 13 months. Prospa’s customer base is diversified across a range of industry sectors including hospitality, retail, professional services and building and trade. The product has a TrustPilot rating in New Zealand of 9.8 out of 10 as at 30 June 2019 and ranks first in the non-bank finance category.

Earlier this month, Prospa announced a dedicated New Zealand funding facility – with an initial capacity of NZD$45 million – designed to further increase access to finance for small businesses across the country.

| « [OPINION] We are not alone with Monetary Policy: Orr | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |