Recovery from coronavirus – a buying opportunity?

Hamesh Sharma takes a look at historic market-impacting world events; how they played out and markets recovered; and what this could mean for a recovery from Covid-19's present market grip.

Monday, March 30th 2020, 6:30AM  2 Comments

2 Comments

by Pathfinder Asset Management

By: Hamesh Sharma

Firstly, we hope everyone is staying safe during this difficult and stressful period. It seems insensitive to talk about investing, but we must do our job and do it well through this crisis.

We are in a fast-moving and fluid situation with regards to the impact of coronavirus on financial markets, highlighted by the fact that we have experienced the fastest bear market in record.

On the one hand, there are signs real-money investors like pension funds are ready to step in and buy now that panic liquidations look to have slowed. There are also signs of improvement in some of the world’s regions that were hardest-hit by the virus (China, South Korea) which shows a road map to others. On the other, the number of infections globally continues to accelerate with large-scale containment measures being put in place to “flatten the infection curve”.

In the last few days, we have seen markets recover some lost ground, so the question on everyone’s mind is, what shape could a potential recovery take?

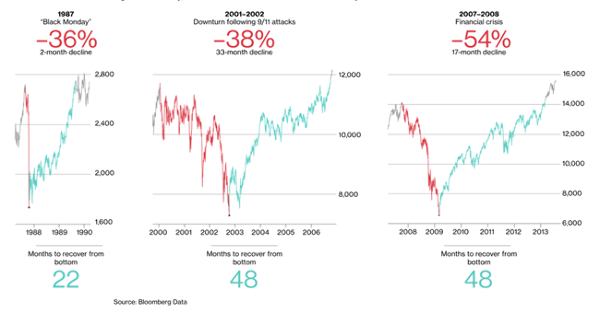

The image below shows that in 1987 when we had a similar short-and-sharp crash, it was followed by a sharp reversal. However, in 2001 and 2008 we had a long drawn out bear market followed by a long recovery. This implies the brutality of the crash may signal the speed of the recovery – although this is obviously a small sample size.

Normally recessions are triggered by large imbalances in the economy such as too much investment in housing supported by questionable bank lending (2008), and crazy tech stock valuations (2001). It takes time for these imbalances to be corrected in a recovery.

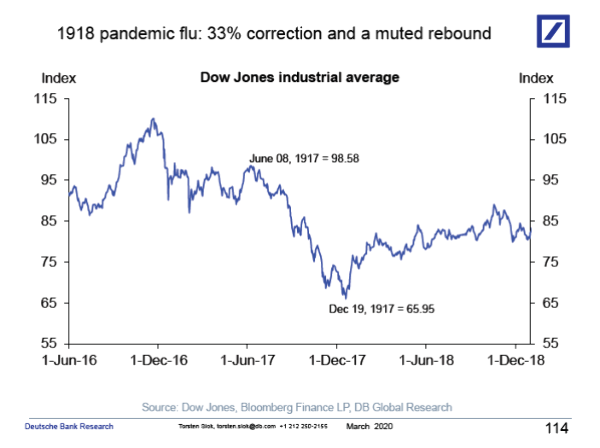

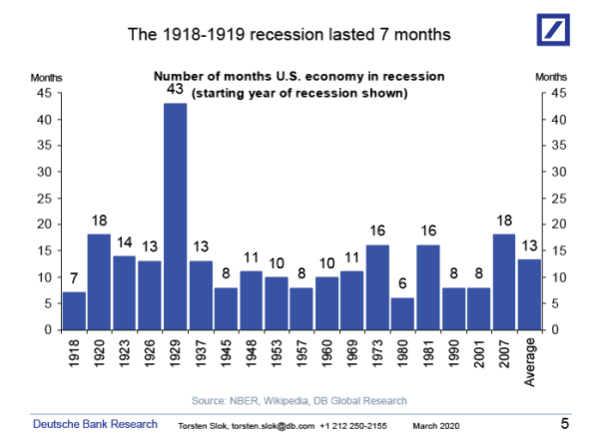

In the current sell-off, it has been caused by an external shock or “black swan” event, which is causing a sharp recession, with several sectors and industries coming to a complete halt. On the basis of this argument, while the recession may be deep, it should be relatively short. As highlighted by Deutsche Bank, this is what happened in the pandemic flu in 1918-1919, where the recession lasted only seven months.

It is a big positive that central banks and governments around the world have learnt from the 2008 global financial crisis. They are being extremely proactive in terms of reducing the economic impact from coronavirus containment measures.

Central banks globally have virtually cut interest rates to zero, and the US Federal Reserve has also announced that they can use their balance sheet to buy corporate bonds for the first time in history. This is a huge development which should bring some calm to corporate bond markets. At the same time, the US is working on a $2 trillion stimulus package, Germany has announced a €750 billion package, and the list goes on as governments synchronise their efforts.

We cannot avoid a global recession in the interim, but the actions provide support in a time of crisis. Unprecedented global monetary and fiscal stimulus also means that a recovery may be faster than in prior economic shocks – see chart of recession lengths below.

In any case, markets will turn higher well before the economy. So, the next question is when will markets potentially start to recover?

If we look at the SARS crisis, it is the second derivative ie the rate of growth in new cases which matters. When the growth rate peaked, markets turned shortly after. The Wuhan lockdown lasted 50 days, which means that the US and Europe should be prepared that we may get to at least early May in containment mode. This would also align with summer in the northern hemisphere, which is important as the coronavirus appears to spread less in warmer temperatures.

In fact, economic activity in China appears to be coming back online, which has been greatly underappreciated by the media given China’s importance to the global economy.

It is early days, but real money investors may start to step into the market at current valuations. A report by JPMorgan estimates balanced or 60:40 mutual funds, a $1.5 trillion universe in the US and $4.5 trillion universe globally, need to buy around $300 billion of equities to fully rebalance to 60% equity allocation. At the same time, the $7.5 trillion universe of US defined benefit plans, would need to buy $400 billion to fully rebalance and revert to pre-virus equity allocations. Finally, there are the “balanced” sovereign pension funds such as Norges Bank and GPIF, which according to JPM would need to buy around $150 billion of equities to fully revert to their target equity allocations of 70% and 50%, respectively.

The above comments are not without risk. The key risk in our view is that the lockdown lasts longer than expected. Based on a two-month lockdown period, most analysts are forecasting a 25%-30% drop in earnings per share for US corporates in 2020, before a rebound in 2021.

Clearly if major economies are closed for longer, such as for six to 12 months there is huge downside risk. We could also see a more muted rebound if consumers and corporates rebuild cash levels, or because of a longer-lasting negative impact on corporate bond markets.

Overall, we see opportunities to selectively buy stocks on a medium-term (one to three year) view which are relatively immune or relative beneficiaries of coronavirus, but have been caught up in the market sell-off and hence are trading at more attractive valuations. Over the last week or so have been averaging into companies such as EBOS and Spark locally.

Warren Buffett says, “Be greedy when others are fearful”, something that is easier said than done. While the near-term economic situation appears bleak, our base case is that we are more likely than not setting up the best buying opportunity since the global financial crisis in 2008. The darkest hour is just before the dawn.

Written by Hamesh Sharma, Portfolio Manager at Pathfinder Asset Management Limited

Pathfinder is an independent boutique fund manager based in Auckland. We value transparency, social responsibility and aligning interests with our investors. We are also advocates of reducing the complexity of investment products for NZ investors. www.pfam.co.nz

| « How this could be different to the GFC | Fund update and future outlook » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

Let us hope for the best . I go with Adrian Orr ...Look after your cash mate !