Retail investor bubble; What's happening?

Pathfinder portfolio manager Hamish Sharma has seen a massive retail investor boom since lockdown. He investigates what's driving this new interest in markets.

Friday, July 31st 2020, 6:37AM

by Hamesh Sharma

Over the last few months, I have personally never had as many friends ask me if stocks such as Air New Zealand “are good shares to buy right now”. Many of them have never bought shares before.

This “on the ground” experience has highlighted to me just how real the current retail euphoria in stock markets is, and prompted me to investigate how big an impact retail investors are having on markets and the subsequent implications for investors.

So, what has driven this meteoric rise of the retail investor?

There are a few factors at play. Pre-covid, share trading by small investors had already been showing good growth. The rise of discount broking platforms and introduction of commission-free trading in the 4th quarter of last year led to an increase in overall volume trading, with a number of slicker platforms that facilitate easier trading. Fractional share ownership allows retail players to gain equity exposure without overly committing capital, reducing barriers to entry involved with share investing.

Then, Covid-19 hit, and the world went into co-ordinated lockdown. A sharp drawdown in equities, combined with quarantine boredom “I can’t go to the casino or get involved in a sports book with seasons on hold, so I’ll have some fun trading the stock market” saw a massive surge in small retail investor buying. The four major US retail brokers reportedly picked up a million new customers over March and April.

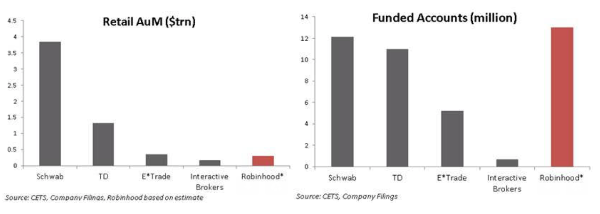

Outstripping them all though was Robinhood, the app-based pioneer of zero fee trading. The demographic of Robinhood’s customer base is similar to that of a sports better. Men aged 25-34 are the segment most likely to bet on sports on a regular basis, and with a lack of sporting events to bet on, it appears a meaningful proportion of them have moved to betting on stocks.

This segment of the investment community has become very active over the past few months, and as retail participation has exploded they have become a big, opaque, driving force of risk, especially over the short time horizons – with retail investment flow account for approximately 20% of US flow of late. The charts below from Citi show how retail investors have been a major player in US equities.

Schwab and TD added a combined $170 billion of new client assets in the second quarter, which is essentially the entire shortfall of corporate share buybacks that we haven’t seen so far in 2020.

This is not just a US-centric story. Closer to home, research from corporate advisory firm Vesparum Capital highlights Australian retail investors were net buyers of $9 billion in equities between late February and mid-May, while institutional investors have fled the market to the tune of $11 billion.

In China, the local market is surging, and five years after China’s last big equity boom ended in tears, there are renewed signs of euphoria among the nation’s investing base.

Turnover has soared, margin debt is rising at the fastest pace since 2015 and online trading platforms are struggling to keep up. A recent Bloomberg article contained some great quotes, such as: “Like millions of amateur investors across China, Min Hang has become infatuated with the country’s surging stock market -there’s no way I can lose, I’m confident that I’ll be able to exit just before the market slump, said the 36-year-old, who works at a technology startup”.

Unlike most major markets, China’s individual investors account for the lion’s share of local stock trading. At Pathfinder, we are watching Chinese market developments closely but have no direct stock holdings across our funds in China at the current juncture.

Back to the US, based on estimates from Citi, in the US retail flow now account for around 20% of all daily trading, and higher in many single-stock cases.

Is this the dot-com bubble round two?

Which leads well into the next question, is this the “dot-com bubble round two”? Led by mass exuberance among retail traders?

Due to the rise of social media platforms, retail participation has grown and become more co-ordinated. The retail investor ‘day-trading’ community is now mobilised and organised, courtesy of Reddit/Twitter, reminiscent of the cryptocurrency markets in 2017.

Retail looks to have a strong tendency towards momentum as a strategy oriented towards hearsay/word of mouth as to what to buy, and a large hub of small investors has found a way to mass communicate momentum strategies to millions of individuals simultaneously.

This has seen some ridiculous moves in the small cap arena, where things look completely irrational.

Some notable examples include car rental business Hertz, which filed for Chapter 11 on May 22; Carl Icahn sold his 39% stake for $0.72 on May 26 to realise a loss of $1.8 billion. By June 8, Robinhood punters had driven it up to $5.53 on enormous volume, Hertz is currently trading at $1.58.

As at April 14, the US shale exploration pioneer, Chesapeake had 216,915 Robinhood shareholders. It filed for Chapter 11 on June 28.

ETF investors also continue to pile into airline stocks, with the US Global Jets ETF attracting record fund flows. Closer to home, we have seen this dynamic play out through Air New Zealand, and judging by investment flow data we see little doubt that it is the retail investor propping up the stock price at what we see as a material over-valuation.

It is not just the “rubbish” which has attracted retail investors who see the stock price as ”cheap” (ignoring what are usually very bleak fundamentals), but retail traders are also piling into glamour names, exacerbating momentum.

40,000 Robinhood accounts added shares of Tesla in one single four-hour span.

In summary, we are seeing retail frenzy in a mixture of “rubbish” and glamour stocks, and this is having a material market impact in certain segments of the market. That said, not all investors in the market are retail and there is real buying, with institutional money still dwarfing retail. However, it is difficult to stand in front of such momentum, just ask short sellers of Tesla about their experience in recent months.

So how could this end, and what are the investment Implications?

We are in a bubble in certain areas of the market, particularly true in the “rubbish” end of the investment spectrum, and at Pathfinder we are avoiding such sectors and focussing on quality. We are far less concerned about “over-valuation” in glamour stocks such as the major technology companies and remain bullish the sector on a medium-term view.

There are open questions as to whether this surge in retail activity will subside as lockdowns ease further, or if this is a longer-term change in the dynamics of the market. But one thing for sure is that the bubble areas of the market by their nature are reliant on ever more money coming in to keep them going.

For a true correction of the bubble, there needs to be a catalyst - whether that is geopolitical uncertainty and/or a trade war, higher interest rates, or the re-introduction of significant lockdown measures causing another sharp drop in economic growth.

While we would not bet against retail trends, we are certainly not following them, and continue to invest in sectors in stocks where we see a solid medium-term investment outlook and themes.

Portfolio Manager, Pathfinder Asset Management

| « A story of value v growth | Mint strengthens SRI rating with UNPRI » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |