Effective vaccine, better earnings spur on markets

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

Tuesday, April 20th 2021, 9:30AM

Key points

• Both New Zealand equity and bond market returns bounced back in March with the S&P/NZX 50 index returning 2.7% and the Bloomberg NZ Bond Composite 0+ year Index returning 0.6%.

• Globally vaccine programs have gained speed, with the US and UK (alongside Israel) leading the way. The European vaccine rollout has been significantly slower, making re-opening difficult for many nations in the area as they battle rising infections.

• Following changes in New Zealand residential property “bright line” tests and tax deductions on investment properties, expectations of New Zealand’s official cash rate (OCR) increasing were pushed out, contributing to lower bond yields, as well as the New Zealand dollar weakening.

The global economic recovery continued in March with successful vaccine rollouts in many developed nations allowing investors to envisage a path to “normalcy”. The strength of the recovery has seen investors price in higher inflation and real interest rate expectations resulting in longer-dated nominal bond yields continuing to rise offshore. This dynamic has led investors towards many of the cyclical and value stocks which had lagged broader equity markets throughout most of last year. As a result, in March, the MSCI All Country World Value index outperformed the equivalent growth index by 4.7%. Over the quarter, the outperformance was even more pronounced at 8.2%. Overall global equity markets were strong with the MSCI All Country World Index up 2.5% in March and 4.2% for the quarter.

Similar themes played out in the New Zealand and Australian share markets. The rotation towards cyclicals and value helped drive the resources and bank-heavy Australian share market (in AUD) up by 1.8% over the month and 3.1% over the quarter. The New Zealand share markets performance was relatively tamer, up 2.7% over the month, but down -4.1% over the quarter. The key feature of the New Zealand market over the quarter was the volatility in the electricity generation stocks that had seen extreme pricing moves in late 2020. Contact (-19.4%) and Meridian (-26.3%) are both large constituents in the global iShares Global Clean Energy Exchange Traded Fund (ETF). These companies saw significant selling in the quarter associated with the performance and funds flow of the ETF. This was compounded by an expected rebalancing of the index in April that will see a down-weighting in both Contact and Meridian.

The global economic recovery is gaining significant momentum, and this is likely to continue this year as vaccines facilitate wider economic re-opening in many countries. The US has administered 49 vaccines per 100 people while the UK has administered 54; the rapid pace of these rollouts means economic re-opening could happen earlier than expected in these places. Re-opening, alongside recent additional fiscal stimulus, could see the US economy grow by 6-7% this year and reach above-trend output in the second half-year as consumers with large amounts of savings are unleashed. The US rebound has already started with the labour market adding almost 1.5 million jobs in February and March, and the unemployment rate dropping from 6.3% to 6%. US manufacturing confidence is the highest since 1983 and services confidence is the highest since records began in 1997. China may also contribute meaningfully to the global recovery, such that the global economy expands almost 6% in 2021. Europe is facing greater challenges in vaccine rollout and is likely to lag the recovery in other developed countries.

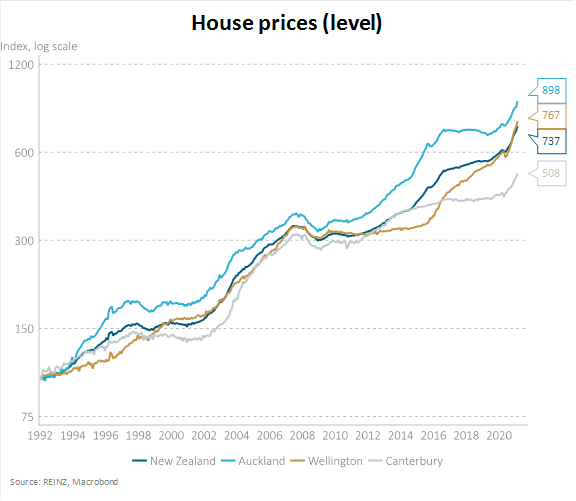

The New Zealand economic recovery has slowed in recent months as the construction sector struggles to find the resources to continue to expand, while retail trade and accommodation activity is challenged by a lack of tourists. We think capacity constraints in the construction sector should ease, however recent government measures to curb investor housing demand are likely to create headwinds for house prices. The absence of international tourists has weighed on activity over summer; however New Zealand has now secured enough vaccines to reduce the probability of a repeat border closure next year. Recent weakness in service sector business surveys, retail sales, electricity grid demand and traffic volumes, is consistent with the absence of international tourists during the normal peak period. Sub-potential economic activity is likely to encourage a patient approach from the Reserve Bank of New Zealand (RBNZ).

What to watch

House prices: New Zealand house prices have been on a tear the past 12 months, with the Core Logic NZ house price index up 16% over the past year. However, changes to the residential property “bright line” tests and tax deductions on investment properties will almost certainly challenge this surge. The potential scale of this is tough to determine, however history can provide some guide, with the following examples having some relevance:

• Australian house prices fell c.5% in H1 2019 after opposition party Labour (well ahead in polls at the time) proposed removing negative gearing (interest deductibility).

• Following the final round of LVR restrictions in 2016, we saw a -7% impact on house prices.

• We estimate the house price drop required for after-tax rental yields to remain unchanged for new investors is 10-15%.

Market outlook and positioning

The world economy is set to grow at its fastest rate in decades, powered by monetary and fiscal stimulus, COVID-19 vaccination progress, re-opening of economies and excess household savings built up over the past year. The key risk is that inflation begins to rise and that, despite central banks anchoring short term interest rates, the market continues to lift longer-dated bond yields. Although excessively strong growth expectations may build higher forecasts of corporate profits, risk assets generally may look forward to the potential for policy to tighten in 2022 and beyond.

We think that the US and China will continue to power the economic recovery. Rapid progress with vaccination programmes is part of the story, flexible labour markets and an ability to invest heavily in infrastructure could provide longer-dated growth expectations. Currently higher growth expectations appear to be the main factor behind the rise in bond yields. Fears of inflation remain contained for now. This may be why equities have performed relatively well compared to previous sharp corrections in the bond market. In New Zealand, economic activity seems likely to breach the previous pre-COVID-19 peak in the next quarter, and with that we expect corporate earnings will also show continued acceleration.

Within equity growth portfolios over the past six months, we have reduced exposure to technology and smaller growth companies, as we saw potential for these companies to fall under pressure as interest rate expectations reset. We increased cyclical weights and quality growth companies, remaining generally constructive on the equity markets. The portfolios’ largest tilt remains into the healthcare sector, including some biotechnology names, in addition to our positions in retirement/aged care companies including Summerset, Ryman, and Oceania.

Within fixed interest portfolios, our investment strategy continues to reflect the medium-term view that global economies will recover, with the possibility that inflation rises persistently above 2.5%. In this regard, we differ from the RBNZ and US Federal Reserve that both see a probable near-term rise in inflation as temporary. While the central banks are providing strong guidance that they are in no hurry whatsoever to hike cash rates, we see their commitment to low rates as adding to inflation risks, ultimately facing the prospect that more assertive rate hikes may follow. We do not have strong conviction that inflation will rise sharply but do see that as a quite feasible outcome and the one that would be most damaging to fixed interest (and broader market) returns.

Within the Active Growth Fund, we have continued add to more cyclical exposures with the ballast of the portfolio remaining in stocks that will benefit from long-term structural trends. Overall, the Fund is modestly overweight equity markets.

The Income Fund strategy continued with its slightly underweight equities position during March, but we have lifted exposure in April. The concern was directed mainly at growth-style firms, such as tech companies, which would come under pressure with higher bond yields. Now, with an economic recovery widely anticipated, and with bond yields stabilising at higher levels, the impetus for the rotation may diminish, enabling growth stocks to perform. We have lifted the dividend-focused equity exposure and are considering lifting growth-focused equities as well.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer

| « Interest in interest rates is rising | TCFD sounds dreary, but it's important. Here's why » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |