Inflation about to hit Main Street

Markets will have one and half eyes on inflation prints over the rest of 2021 as investors try to ascertain how substantial and sticky inflation pressures are.

Wednesday, May 12th 2021, 12:56PM

by William Curtayne

There is good reason for this intense focus. Inflation pressures ultimately drive the level of interest rates which in turn have a major influence of the prices of stocks, bonds and real estate.

What is driving inflation up?

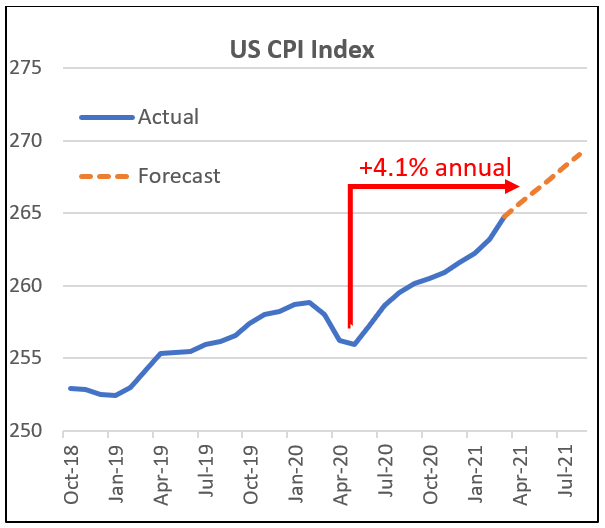

Reported inflation will rise over the coming months as year-on-year price measures compare to the depressed levels in March to May last year. This “base effect” should see the headline US CPI inflation measure reach a strong +4% year-on-year in May before potentially declining again.

But there is more to the inflation story than just base effects. Several COVID-19 effects, and policy reactions are creating inflation pressures. These include:

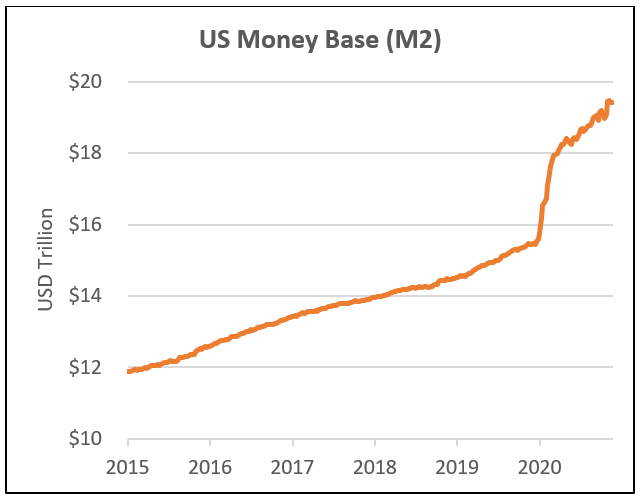

1. Too much money – Central Bank monetary policy has led to an enormous increase in the monetary base of nearly all fiat currencies. The number of US Dollars in the world has increased by 27% since the beginning of 2020. Said another way...nearly a third of the US dollars in the world, were created in the last year! If more money ends up chasing the same quantity of goods, inflation should rise.

2. Government spending – The Great Financial Crisis of 2008 (GFC) saw the bare minimum in fiscal policy which prevented an economic depression but did not encourage a fast recovery. This time Governments have spent freely trying to protect their populations from the negative economic effects of Government forced lockdowns. The average developed world stimulus package reached 10% of GDP in 2020 compared to 2.6% of GDP in the GFC. The US alone has spent US$6 trillion in fiscal stimulus.

3. Supply chain squeeze – COVID-19 lockdowns and disruptions have constrained various factories and supply chains causing shortages of various products. But this is only half the story. Thanks to the money creation and Government stimulus, consumers are sitting on record cash savings levels which is creating excess demand for various products. As the Northern Hemisphere lockdowns come off, we expect consumer spending to accelerate and shift into different areas such as dining, travel, and entertainment. This will represent money shifting from the financial economy of investments and bank accounts to the real economy of goods and services.

From Wall Street to Main Street

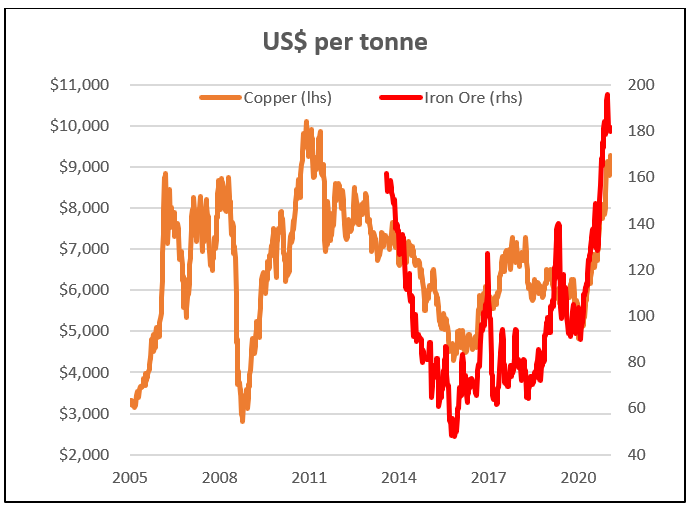

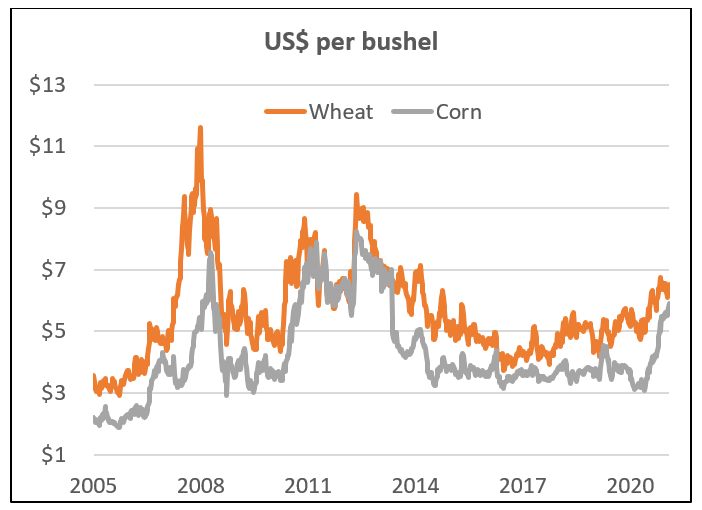

These pressures are showing up in commodity prices and various finished products. Iron Ore and Copper prices are up 70% and 50% respectively since the beginning of 2020. And perhaps more concerning for lower income countries is the increase in food prices as shown by corn and wheat prices up 50% and 15% over the same period.

How high will inflation go this year and how long will it last?

Market participants all know inflation is going to accelerate temporarily. The important question is how aggressive it will be and how long it will last. Milford believes that inflationary pressures may be worse than expected over the next six months. Central Banks are pushing ahead with money creation and the Government fiscal injections have

been larger than the economic hole in most countries. This combined with an upcoming spending splurge from Northern Hemisphere consumers as they exit lockdown creates a perfect cocktail for higher prices. Upside inflation surprises are not a sure thing, but it is a likely outcome given where expectations are today.

The good news is that most of these inflationary pressures should prove temporary. Pent up demand will wash through and supply chains will catch up as production normalises.

We should also see the level of money creation and Government stimulus decline to more sustainable levels as the year progresses.

The major uncertainty is to what extent Governments continue fiscal expenditure and whether price increases become ingrained in consumer expectations. There is a tail risk that this causes the “transitory inflation” situation to last into 2022 or even longer which would be a negative surprise for markets. Longer-term some factors such as ageing demographics and globalisation will become a more inflationary force that may require higher interest rates to keep inflation at a reasonable level. However, the timing of these impacts is very difficult to determine and will, at least in the near term, be overwhelmed by the more immediate drivers discussed above.

How Milford is managing the inflation risk and opportunity

Milford has been preparing for the transitory inflationary effects since the second half of last year. The main actions taken are:

1. Reducing our exposure to longer dated bonds by either selling them or taking derivative protection.

2. Investing more in companies that outperform in inflationary environments. These include increasing our holdings in banks, commodity producers, agriculture companies, fixed cost manufacturers, building materials and gold miners. The inflation dynamic is just one of the many factors we consider and manage. We have also

retained exposure to structurally growing business and continue to focus on bottom-up stock picking opportunities. But if inflation surprises in magnitude or duration, the actions we have taken will help our portfolios navigate through any volatility.

Milford is an active manger with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.

| « TCFD sounds dreary, but it's important. Here's why | Investors and traders both want good returns but are polar opposites » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |