Economic strength brings RBNZ into play

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed income and equity markets.

Tuesday, August 17th 2021, 6:55AM

Key points

- The MSCI All Country World (global shares) Index rose 0.6% (in USD) in June. The Australian market gained 1.1% (in AUD) while the New Zealand market fell 0.5% over the month.

- The US Earnings season has been strong with, at the time of writing, 443 companies reporting earnings and 377 companies (85%) delivering earnings above consensus expectations.

- Concerns around the COVID-19 delta variant and associated mobility restrictions has contributed to some forecasters reducing global growth expectations.

- In contrast, the strength of the New Zealand economy has seen the Reserve Bank of New Zealand (RBNZ) signal imminent rate hikes, seeing rates out to five years increase over the month.

Key developments

Global markets were mixed as concerns about the delta COVID-19 variant and associated mobility restrictions contributed to forecasters reducing global growth expectations. Global bond yields fell as central banks remained dovish, only marginally moving closer towards tightening monetary policy . A solid profit reporting season supported the US equity market. Chinese stocks were weak following regulatory changes. Commodity prices eased with iron ore and oil lower, but copper prices increased on supply constraints.

The fall in global bond yields over the month saw investors rotate away from the more cyclical parts of the market towards more structural growth. One barometer of this is the MSCI ACWI Growth index, which outperformed the corresponding value index by 1.7% over the month. The New Zealand equity market lagged over the month and is behind broader global indices over the past 12 months. A key driver of this over the past 12 months is the different sectoral composition of the index, being light on cyclical stocks (such as banks and energy companies) which have performed strongly over the past 12 months.

Global economic growth is naturally slowing as the expansion progresses but is likely to remain well-above potential. Much has been made of the small reductions in various PMI measures from historically high levels but most of these remain consistent with slowing but still high rates of economic growth. Growth continues to be driven by ongoing vaccine rollout that is allowing re-opening. Households still have large amounts of savings to deploy in an environment of historically loose financial conditions. The US is estimated to be currently growing at an annualised rate of more than 7%, the euro area at almost 10% on the same basis. With potential GDP growth around 2% for both countries, spare capacity is quickly being removed, paving the way to persistent inflation pressure and higher interest rates.

The New Zealand economy continues to strengthen. June quarter CPI came in at 3.3% (year on year), well above the 2.7% expected. Employment data is also strong with the unemployment rate falling to 4.0% (vs. consensus estimates of 4.4%). Business surveys suggest domestic demand remained strong in Q2. A net 26% of firms experienced increased demand in Q2, consistent with an annual average GDP growth of around 4% vs. current potential GDP growth of about 2%. Purchasing manager surveys suggest momentum is likely to continue, with both the manufacturing and services PMI readings close to 60, consistent with high rates of growth. The RBNZ has recognised this economic strength by signalling less accommodative monetary policy. The market is currently pricing in 65bp of hikes by the end of the year, equivalent to an OCR of 0.9%.

What to watch

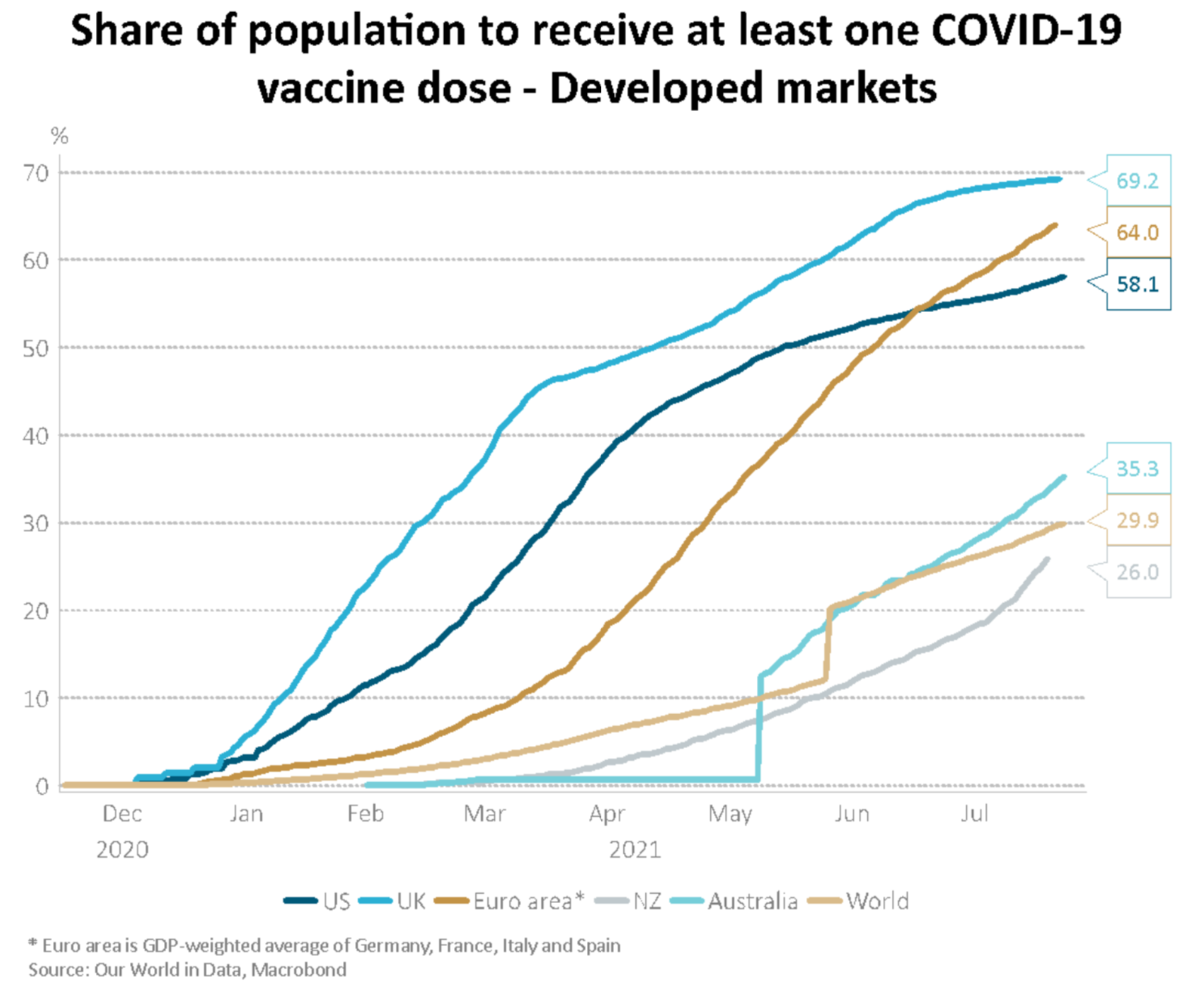

Acceleration of COVID-19 vaccination rollout: The recent lockdowns experienced in Australia are a stark reminder of the vulnerabilities New Zealand has with so little of the population vaccinated. Currently just 26% of the population has received one COVID-19 vaccine dose, making our vaccine rollout one of the slowest in the developed world. After expecting a ramp up to around 50,000 per day in June, the run rate per day was running at less than half of that rate, due to dwindling vaccine stocks. On the encouraging side, the Ministry of Health vaccine stocks have recently been boosted by new deliveries.

Market outlook and positioning

Global economic growth indicators remain positive, but the rate of growth may be slowing as we find a new equilibrium following the big recovery from COVID-19’s economic lows with production constraints limiting activity. While the rate of economic growth may be slowing from peak to decent levels, this does not preclude equity market gains given lead economic indicators remain historically high.

The market is currently digesting the interplay between the rate of economic growth, supply side inflation risks and the potential for gradual monetary policy tightening. This may contribute to equity market fluctuations and sector volatility as investors seek to position in advance of potential changes.

Within equity growth portfolios, we remain overweight relative to their benchmarks in selected quality growth companies in the healthcare and information technology sectors, where the potential rate and sustainability of growth may not be fully reflected in share prices. The portfolios have selected investments in cyclical growth stocks in the financial and materials sectors that may benefit from structural change. Conversely, the portfolios are underweight the New Zealand energy sector where disruption risk remains high, and the utilities, communications and real estate sectors where valuations are high relative to their potential growth.

Within fixed interest portfolios, our investment strategy has centred on the view that the global and domestic economies would shift into a regular, yet strong, expansion phase, with the recovery from last year’s collapse in activity now largely complete. Monetary and fiscal policies remain highly stimulatory. Our judgement is that this should lead to central banks hiking rates, with long-term bond yields rising as well. We expect that the possibility of persistently higher inflation will also continue to be a major theme.

The investment decisions that flow from this are straightforward. We have maintained a short duration position, essentially reducing the extent to which the Fund is locked into long-term securities at low yields. The Core Fixed Interest Fund’s overall duration position has been close to 1 year shorter than the benchmark, reflecting a high conviction in our view.

The Active Growth Fund’s weight to share markets remains above its benchmark index weight. Globally valuation multiples have contracted this year as earnings growth has outpaced strong share market returns. We view current multiples for global markets as supportive of high single digit returns over the medium term, especially when compared to current (and projected) interest rates. This gives us confidence to hold an overall allocation to share markets which is above the benchmark index for this fund.

The Income Fund’s investment strategy has continued to reflect the themes of economic expansion and inflation risks. While the markets have looked to move on from this outlook, seeing some risk that growth will decline, we see this concern as likely to be temporary. In the Fund, we have emphasised equity sectors that capture the positive cyclical outlook and can provide ongoing earnings, which thereby support income-providing dividend streams. Fresh inflows into the Fund during July were channelled into these areas. In the fixed interest sector, we have reduced duration by 0.5 years to 2.3 years, as we see an ongoing risk of rises in yields across all maturities. 0.8 years of the duration exposure is held via inflation-indexed bonds.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer

| « FMA accuses gold mine boss of market manipulation | Why DIY investing and professional advice can see eye-to-eye » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |