Ryman shareholders pay a hefty penalty

Where the money went from Ryman’s recent capital raise has raised a few eyebrows.

Thursday, March 16th 2023, 12:35PM

by Castle Point Funds Management

By Stephen Bennie

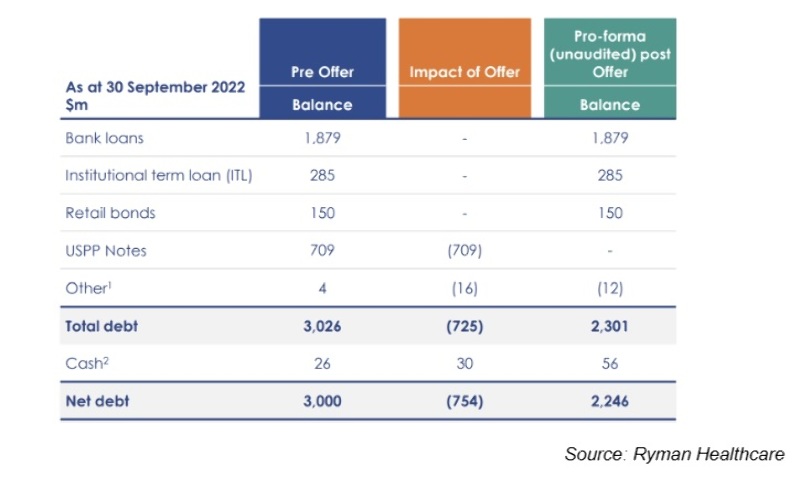

The entitlement offer that they announced on 15 February raised $902 million, and it’s not the extra $2m that caused the raised eyebrows. Nor was it the $30 million that went to the investment bankers that pulled the deal together and organised the underwriting, that cost is ballpark for this type of deal. That left Ryman with $870 million with which to reduce outstanding debt. The matter that raised eyebrows is nicely summed up by this extract from their capital raise presentation.

Extract from the Ryman capital raise presentation

The above extract is a good illustration of the mismatch between the $870 million net amount raised and the $754 million reduction in Net Debt. The bulk of the discrepancy is the $134 million penalty incurred for the early repayment of the US Private Placement Notes (USPP Notes). $134 million isn’t small change in anyone’s book. Especially when you consider that the USPP Notes were issued in February 2021 and April 2022 only to be paid back in full in March 2023, with the extra $134 million of course.

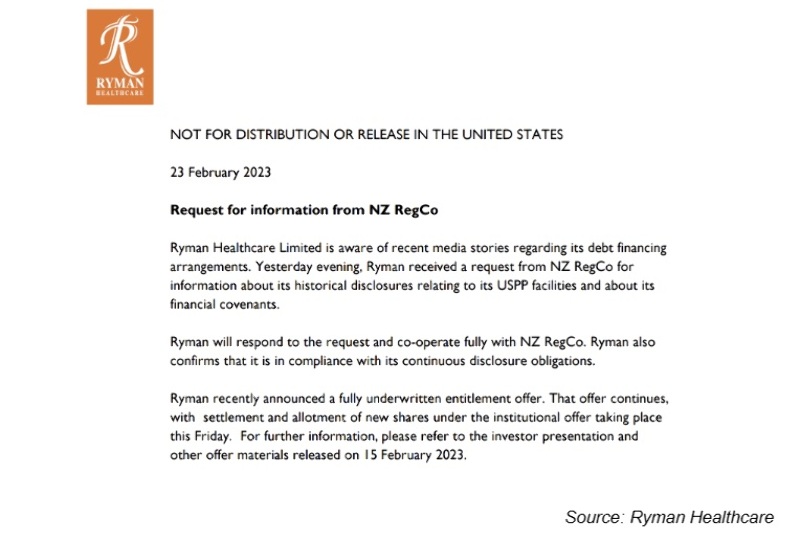

So, why did they stump up $134 million in penalty payments to the USPP Noteholders? The strong implication was that they were convinced they were going to breach its covenants and frankly there is no other credible reason for paying that substantial penalty. It’s also likely that this move was encouraged by Ryman’s local lenders that did not want the USPP Noteholders effectively becoming the senior debt holders upon the occurrence of a breach. None of this was disclosed to shareholders. Hence this announcement on 23rd February.

Announcement of NZX investigation

This announcement has an element of irony as it’s not for distribution in the United States, the home of the USPP Noteholders who just received a stellar return from their short-term loan to Ryman.

Another interesting feature of this capital raise has been the deteriorating investor response to the deal. The structure of the raise was that institutional investors were the first to take up their rights of the new shares at $5 a share. This compares to the previous closing price of $6.40, which when diluted by the discounted capital raise equates to a theoretical ex-rights price of $6.03. Most institutional investors decided not to be diluted at $5 so took up their rights to buy shares at that level.

However, a small number of institutional investors did not take up their rights and that shortfall was offered back to institutional investors that wanted more Ryman shares. The price of these shares was determined by a competitive book build which ended up at $6 a share.

When Ryman resumed trading on 20 February it dropped to $5.75, below that book build price. Meanwhile the second phase of the capital raise, the retail offer, was underway. Just like the institutional investors, retail investors had rights to buy Ryman shares at $5, however they had a longer timeframe, that process gave them until 6th March to take up their rights. Again, most retail investors decided not to be diluted at $5 a share so took up their rights. But there was a shortfall which again was offered to institutional investors in a competitive book build. Scarcely two weeks on from clearing the shortfall at $6, institutional sentiment had clearly soured. On this occasion the clearing price in the book build was a much lower $5.25. It does tend to suggest that on reflection institutional investors have decided that this capital raise and subsequent USPP penalty payment has raised some concerns. It certainly has for the NZX.

Link to Ryman NZX announcements NZX, New Zealand’s Exchange

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

Stock photos can be found here:

https://castlepoint.sharepoint.com/:f:/s/Consultant/EsyXv-TcMlpDn8nDLVXk8tsBWBOMAeERgXPKwmjt8aVzeA?e=BJbuYg

More information can be found at:

www.castlepointfunds.com

| « Invest like a woman | Results galore – so how exactly did the earnings season play out? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |