Are equity markets due for a strong finish this year?

Good things come to those that wait – after a challenging few months, stock markets have started November brightly. With inflation getting under control, many central banks cooling their jets, and bond yields easing, are equity markets in for a strong end to 2023?

Tuesday, November 7th 2023, 9:37AM

by Devon Funds

If October was meant to be the “Bear Killer” month, it certainly didn’t pan out that way.

The month started brightly enough with the end of the debt ceiling standoff in the US, but the Israel/Hamas conflict came from left field and added another dimension to go with existing market uncertainties.

Bond yields rose, with the US 10-year hitting the highest level in 16 years, despite many central banks pushing pause. The European Central Bank joined other majors in going on hold after 10 consecutive increases.

Inflation prints meanwhile continued to be generally lower than expected, while economic data was broadly positive, as was the earnings season in the US and Europe.

Nonetheless markets continued to soften in October.

The Dow Jones and the S&P500 declined 1.4% and 2.7% respectively during the month, marking the first three-month losing streak for both indices since March 2020. Europe and Asia were similarly weak.

The falls in New Zealand and Australia were more pronounced. The NZX50 fell 4.8% to hit a 16-month low, while the ASX200 dropped 3.8%, back to the levels of a year ago.

November has started off much brighter. As is (usually) the case with October, historically speaking, November is also seen as a strong month for markets, with seasonal tailwinds often featuring in a year-end rally.

Whether this transpires may depend on what the bond market does, and on any messaging that rates may not be higher for longer. There are some hopeful signs at the start of this month, with the Federal Reserve leaving rates at a 22-year high for the second straight meeting, but with the language at Jerome Powell’s post meeting conference being interpreted by many that the central bank is “done” with rate hikes.

While the year has not panned out particularly well for the New Zealand sharemarket to date, there are also some positive tailwinds in the air.

The switch to a right-leaning government appears to have already boosted business sentiment, while a lower-than-expected inflation print and tick up in the unemployment rate could well mean that a rate hike is off the table when the RBNZ meets later this month.

Across the Tasman it is a slightly different story with the CPI and retails sales both coming in hot at the last prints.

While developments in the Middle East were a new factor for investors to consider in October, it was the rise in bond yields which provided the main headwind.

Oil prices initially surged to US$95 following the incursion by Hamas, but have sense settled back to where they were in September. Safe havens such as gold and cryptos rallied on rising geopolitical tension, but the oil market is not suggesting the conflict will broaden within the region.

The view that rate hikes were near an end was not disrupted during the month, but the length of time they would remain elevated was. The “higher for longer” narrative provided a complication to investors buoyed by falling rates of inflation and many central banks hitting the pause button.

The Fed though has perhaps provided some cause for comfort over the past week in holding the Fed Funds Rate in a target range between 5.25-5.5%. While there was no commitment to officials being “done” with further rate hikes, there were some subtle changes to the language used in the accompanying statement, while Jerome Powell suggested at the press conference that monetary policy was “sufficiently restrictive.”

Bond yields dropped away in the aftermath.

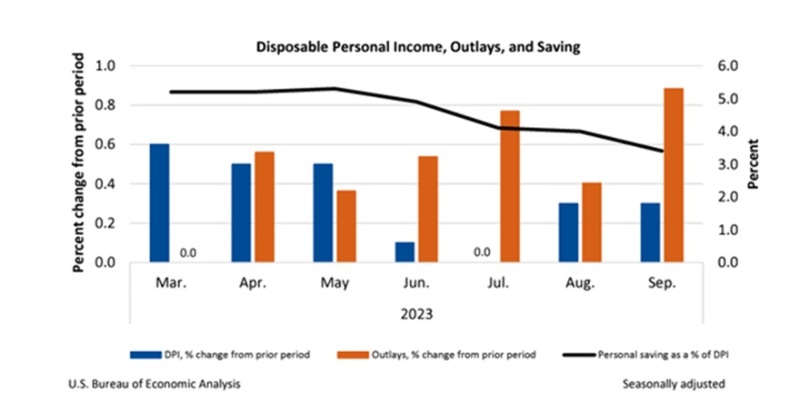

Officials upgraded their assessment of the economy, while noting that inflation (while elevated) was still falling. The Core Personal Consumption Expenditures price index, the Fed’s favoured inflation gauge, increased 3.7%, the first sub-4% reading in nearly two years.

Recent quarterly GDP numbers were robust, and the Fed changed its description of the economy from “solid” to “strong.”

All heading in the right direction. The Fed remains in data dependent mode but also noted the dual sided risks to the economy, with previous rate hikes likely to have a dampening impact.

September and October proved challenging months for markets as bond yields climbed, but sentiment has turned sharply with November underway. Yields have backed away from recent highs, with the US 10-year back at 4.67% in early November after hitting 5% last month.

Data released recently has given further credence to the narrative that inflation is easing and the labour market is slowing (the cost of labour declined in the third quarter and October job additions have come in below expectations), boosting the scenario that the Fed is done with rate hikes.

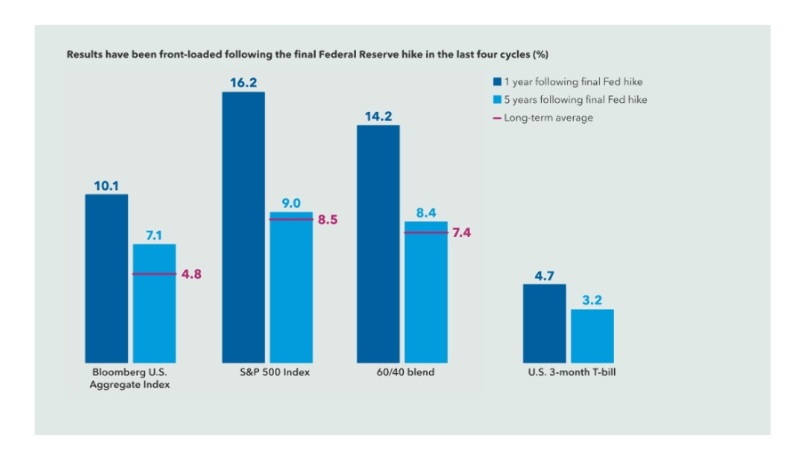

This would be a highly significant milestone, given the strong performance of markets in the year following the final Fed hike over the past four cycles.

The 10-year Treasury yield hit the highest level since 2007 during the month and one area which was impacted significantly were high PE growth stocks. The tech-laden Nasdaq fell nearly 3% and had its third consecutive negative month.

Super-cap tech stocks and particularly the “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) have had a big say in proceedings this year, given they account for around 30% of the S&P500.

It has been a mixed bag in terms of reporting, with strong results but differing outlooks amongst the constituents that have reported to date. Alphabet, Meta and Tesla were somewhat downbeat, while Amazon and Microsoft were in the more positive camp.

In recent days Apple has beat on earnings, but given a weak outlook. Nvidia reports later this month.

Share price performances from the mega-cap group have been contrasting. Tesla fell 20% in October, while Nvidia and Alphabet have also underperformed the benchmark. AI has been one driver behind the blue sky that has been priced into some of the ‘M7’ names, meaning there is a lot to live up to in terms of valuation, and leaving these names prone to any ‘imperfect’ news.

There have been reports that Nvidia may have to cancel billions of dollars in orders from China due to tighter US controls.

Alphabet’s CEO has meanwhile been in court, conceding that agreements making Google’s search engine the default on smartphones and browsers can be “very valuable.”

Google is involved in the most significant monopoly trial in 25 years.

The big super-tech names have a lot to live up to, and time will tell if any become “Maleficent” from a share price perspective. Two of the M7 however put in strong gains in October – Amazon and Microsoft.

Strong results from both were matched by upbeat outlooks. Microsoft, the top holding in the Devon Global Sustainability Fund, rose around 7%. The company’s Azure cloud segment is performing robustly and anticipation is building around the growth potential of Microsoft 365 Co-pilot.

With the earnings season roughly three quarters through, nearly 80% of S&P500 companies that have reported to date have beaten earnings, above the 5-year average, although only around 60% have done so on revenues.

This in part reflects a slowing economy, but also that margins have been resilient amidst cost-cutting. The overall share price reaction though has been heavily weighted towards what management teams have said about the outlook.

Older economy stocks mostly been positive from a reporting perspective.

Results from the banks were well received, although there have been disappointments.

Some companies are also handing an inflationary environment (and other challenges) better than others. Sales at McDonald’s, Coca-Cola and Starbucks have been relatively inelastic as the companies have been putting up prices.

The spotlight on obesity (with new wonder drugs) has also yet to have an impact where you expect it might.

Consumers in the world’s largest economy may be trading down but are still spending on necessities. This was also evident in knockout results from streamers Netflix and Spotify.

There hasn’t been too much in the way of corporate results in New Zealand, but there was an election result.

There has already been some feelgood news from the business sector, with the ANZ Business Outlook showing that business confidence jumped 21 points to +23 in October. The reading is the highest level since mid-2017, when National was the government.

While inflation expectations didn’t fall, reported wage increases versus a year earlier dropped to 4.9% - that’s the lowest read since March 2022. NZ First is now playing a role in the government, but it appears the election result is rubbing off on business optimism. The question now is will there be follow through?

ANZ Business Confidence and Own Activity Index

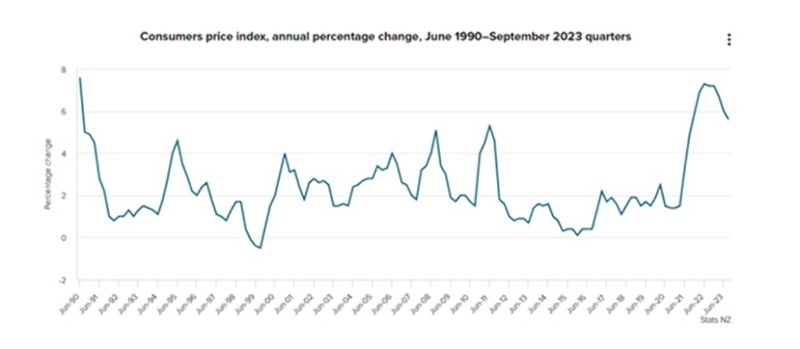

There was some good news on inflation during the month, which came in lower than expected in the September quarter. Annual CPI came in at 5.6% in the 12 months to the end of September, which was down from 6% in the three months to June.

Consensus expectations were around 5.9%-6.0%, while the RBNZ forecast in the August MPS was 6%. On the quarter the CPI rose 1.8% which is below the RBNZ’s forecast for 2.1%. Inflation is cooling with non-tradeable (domestically driven) inflation also coming down.

Inflation is at the lowest level in two years, which has reduced the prospect of another rate rise by the RBNZ (the next meeting is at the end of this month), as has a slight easing of pressures in the employment market.

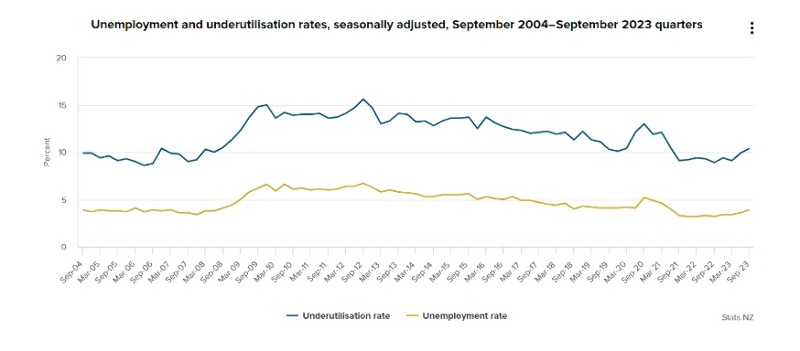

New Zealand’s unemployment rate lifted to 3.9% in the year ending September, from 3.6% previously.

This is materially higher than the 3.2% low in September 2022. The under-utilisation rate lifted to 10.4%, up 0.5% from the previous quarter, and from 8.9% the previous year. Under-utilisation is a broader measure of spare labour market capacity than unemployment alone.

The employment market has been too tight, but things appear to be turning, and arguably heading back towards the “maximum sustainable level” targeted by the RBNZ.

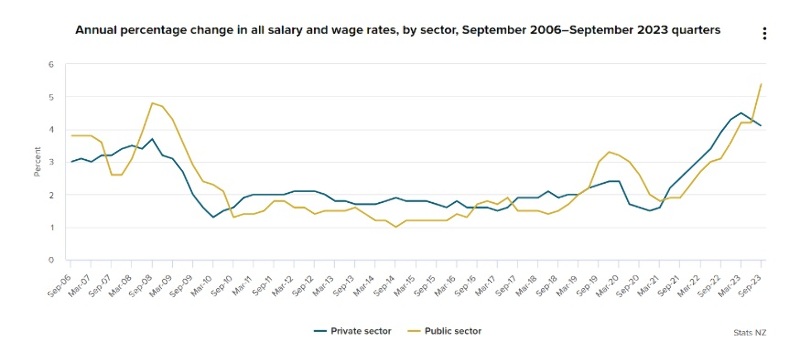

Meanwhile wage growth is easing, at least in the private sector. The Labour Cost Index was 4.3% in the year to the September 2023, unchanged from the previous quarter. Salary and wage rates for the public sector increased 5.4% annually, the highest rate since the series began in the December 1992 quarter. This has been influenced by collective agreements for teachers, nurses, and the NZ Defence Force over the past year. These settlements won’t though be an ongoing feature.

Confirmation that the RBNZ (along with many other major central banks) is also “done” with further rate hikes would be well received across the corporate sector, and the market generally. We are starting to see signs of this being acknowledged with markets rising in the early days of November.

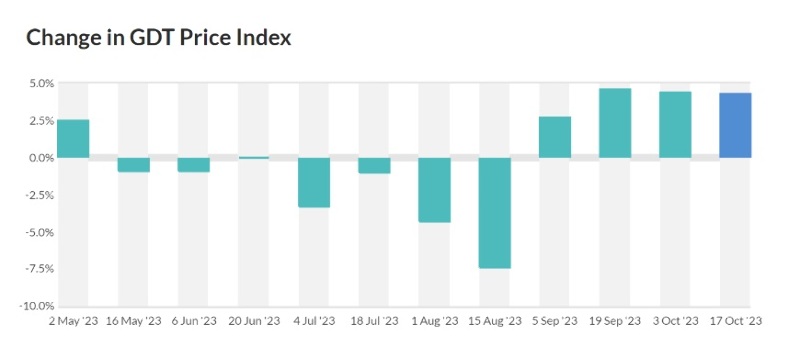

China, NZ’s biggest customer meanwhile remains an unknown, but a key area of the economy – the dairy sector – is already seeing tailwinds. Milk prices have risen at the last four auctions. This could have positive trickle-down impacts for the NZ economy.

Source: Global Dairy Trade

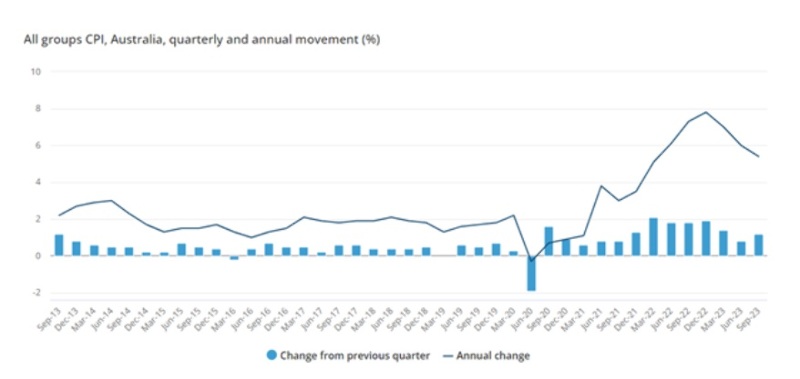

It is a slightly different story in Australia. The RBA noted at its last meeting that keeping rates on hold was a close call. Since then, two key pieces of data have boosted the case for a rate hike on Melbourne Cup day.

Third quarter inflation was stronger than expected with the CPI rising 5.4% year on year, above expectations for around 5.3%, but down from 6% in the second quarter. Core annualised inflation was up 5.2% against a forecast of 5%.

This is while new Governor Michele Bullock has reiterated that officials have a “low tolerance” for a slower return of inflation to the RBA’s target range.

Source: ABS

The Aussie retail sales print for September was also hotter-than-expected. Retail turnover rose 0.9% month on month, around triple consensus forecasts. August and July numbers were revised upwards.

Department stores and household goods were key drivers, which flies in the face of downbeat consumer confidence. We have also seen similar upbeat comments at AGM updates from several big Aussie retail names.

Perhaps a resurgence in the housing market has helped liven spirits. CoreLogic data showed Aussie house prices increased further in October, underpinned by strong demand from migrants and foreign investors, amid a tight rental market. Sydney house prices are up 9.1% on a year ago, while those in Perth have jumped 11%.

The broader fortunes of Australia, like NZ, remain closely tied to those of China.

A rising in iron ore prices (which were already elevated from a historical perspective) in recent weeks suggests that the outlook has improved here.

Once again the past month delivered a major surprise for investors to contend with. The promise of the final two months of the year being much better is however gaining credence.

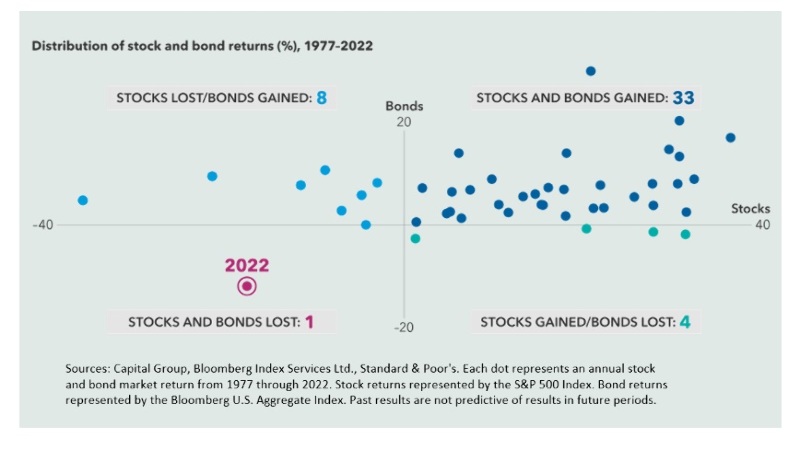

The soft-landing scenario remains alive and well, particularly with many central banks coming to the end of their rate tightening programs. After a tough 2022, history is on the side of 2023 finishing positively.

Uncertainty though still abounds in a number of areas, making for a productive environment for astute, active investors.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Case Study: Comvita – Climate action leaders to watch | Harbour Outlook: Economic Crosscurrents » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |