Animal spirits - global stock markets have closed out their best month in several years, but can the rally continue?

The early promise of November (that was a feature of last month’s article) played out in earnest as stock markets had their best month in a long time, and in some cases years.

Monday, December 11th 2023, 12:04PM

by Devon Funds

by Greg Smith, Head of Retail at Devon Funds

The US led from the front with the S&P500 and Nasdaq enjoying the best month since July 2022, gaining 8.7% and 10.7% respectively. The Dow (which hit a record high) jumped 8.8%, the biggest monthly gain since October last year. The MSCI World index rose 9%, a feat not matched since news emerged of a Covid vaccine in late 2020. The New Zealand and Australian markets joined in the rally as well. The NZX50 surged 5.3% in November while the ASX200 gained 5%.

After a testing period through September and October, ‘animal spirits’ are back and markets have rallied hard, driven by the notion that falling rates of inflation mean that central banks can not only pause rate hikes, but talk about cutting them at some juncture. Bond yields have declined, in stark contrast to what occurred during September and October. The US 10-year Treasury yield peaked at 5% in October and was back under 4.3% by the end of the month. Risk appetite has also increased with the world economy set to emerge from a sustained rate-tightening phase in relatively resilient shape.

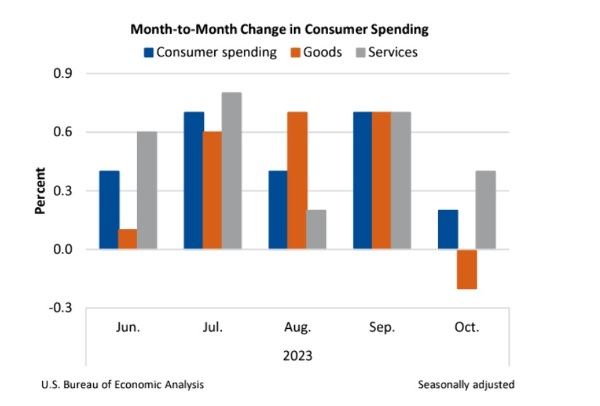

Falling rates of inflation have boosted investor sentiment. The Fed’s preferred inflation gauge chilled in October. The Core Personal Consumption Expenditures (PCE) Price Index rose 3.5% on a year-over-year basis, slowing from a 3.7% annual gain in the prior month. This is the lowest level in more than two years. Falling energy prices saw headline PCE fall to 3% from 3.4%. On a monthly basis, the PCE index was up just 0.1%, as prices for goods declined 0.3% while those for services gained 0.2%. Parts of the US economy are now deflating as opposed to inflating.

The jobs market in the world’s largest economy is also cooling, but not excessively so. US job openings were 8.7m last month, which was the lowest level since March 2021. The housing market has also cooled. Central bank forecasts are also meanwhile signalling a soft landing - the Atlanta Fed has Q4 GDP on pace to grow an at annualised 1.8%, down from previous estimates of 2.1%, and well below the 5.2% in the third quarter. Had this continued, it would have been a somewhat unsustainable rate that might have required further intervention by officials.

Most central bankers seem comfortable however that rates are at the summit, as long as inflation plays the game. Christoper Waller, one of the more hawkish Fed officials, recently suggested that he was “increasingly confident” that no more hikes were needed. Jerome Powell has suggested that policymakers will hold rates steady when they meet next week. Central bankers globally though are on the same page in not wanting to telegraph easing ahead of time. Investors aren’t buying this narrative but are buying equities on the view that inflation is firmly under control, and a soft economic landing is now a baseline scenario. Markets are pricing in a Fed rate cut by May 2024.

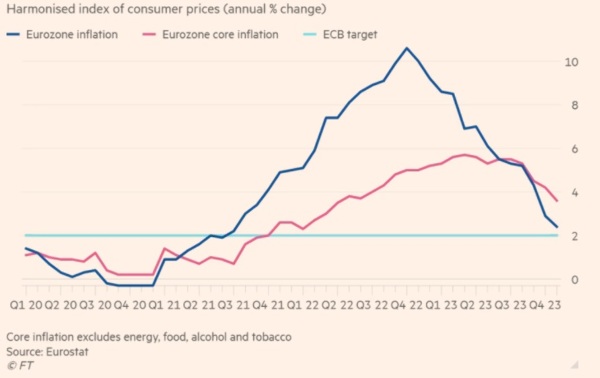

Inflation is also falling in the Eurozone, where it is the lowest since July 2021. Annualised inflation fell to 2.4% in November, well down from 10.1% a year ago. Falling energy prices have been a key driver as OPEC scrambles to try and support prices. The issue for the cartel is that oil production in the US has reached a new record (13.2m barrels a day), with the country now producing more oil than any other in history. Core EU inflation is also falling. This sets up for another hold by the ECB next week, even as President Christine Lagarde has warned it is “not the time to start declaring victory” over inflation. Investors are though now starting to anticipate EU rate cuts in the first quarter of next year.

Many parts of the global economy will welcome the end of the tightening program, including the manufacturing sector which has weakened following the transition from spending on goods to services. The contraction in the US manufacturing sector (which accounts for 11% of the economy, and was also impacted by the auto industry strikes) has been persistent, but is slowing. Construction spending is also picking up as the housing market improves. It is a similar story elsewhere, with UK and European manufacturing activity picking up at the latest print.

A resilient US (and global) economy was also evident through the US earnings season. Around 80% of S&P500 constituents delivered quarterly earnings ahead of expectations. Outlook statements were often conservative, particularly from consumer-facing companies. If the start of the holiday shopping season is anything to go by (), the US consumer is “trading down,” but also holding up better than feared, and is happy to spend, particularly when a bargain is on offer. Online sales during the recent “Cyber week” were $US38 billion, up 8% on a year ago.

Many old economy names are holding up well (Boeing shares rose 25% during the month), but the tech sector was prominent again in November. There was a lot of focus on numbers from AI darling Nvidia, but given the high bar of expectations the news that export restrictions on China (which accounts for a quarter of data-centre revenues) would weigh on its fiscal fourth quarter did not sit well. Microsoft was also in focus, but not just because of the shock dismissal (and then hiring at Microsoft) of the CEO at ChatGPT. ChatGPT is owned by OpenAI, in which Microsoft has invested US$10 billion.

Microsoft shares hit a record high during the month and are up over 50% this year. The stock is the biggest holding in the Devon Global Sustainability Fund. Microsoft has been one of the big winners of the earnings season, with the company’s cloud division going well while investors are getting excited about the growth potential around AI.

Microsoft is not in this camp, but a slowing economy is seeing employment intentions fall, particularly for companies that flourished during Covid. Those “recalibrating” their workforce include super-tech names Google, Amazon, Microsoft, Yahoo, Meta, Zoom, and most recently Spotify (cutting ~17% of its payroll).

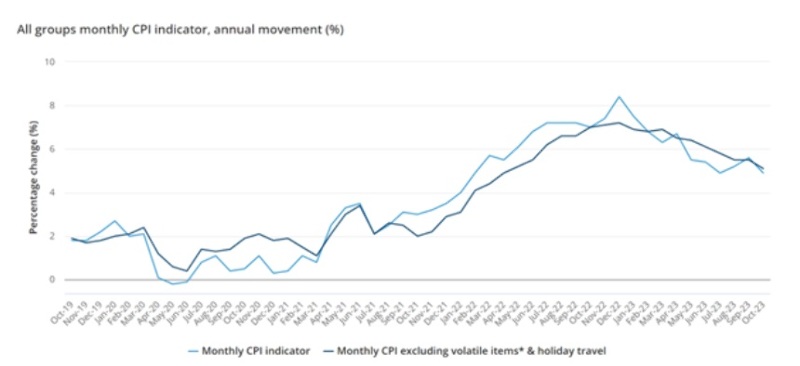

The NZ economy meanwhile is also slowing down, but arguably has also held up better than feared in many respects. Inflation is also coming down. Easing bond yields, and the notion that central banks are nearing the end of their tightening plans, helped the local market during November.

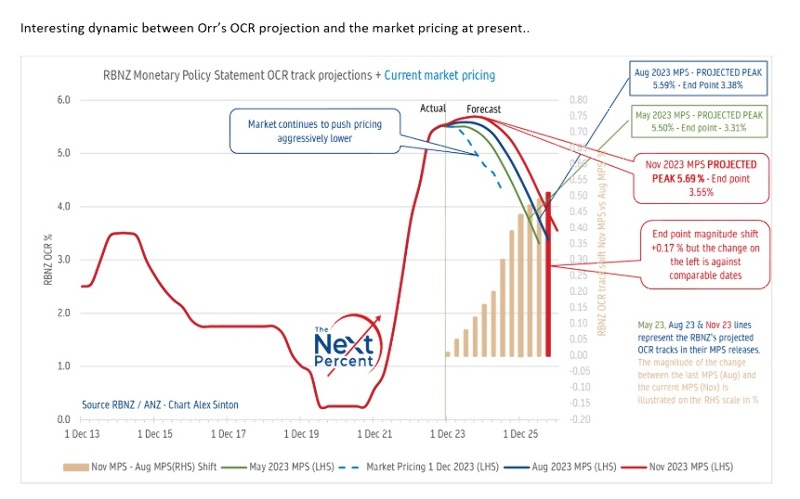

The RBNZ predictably kept rates on hold for the fourth straight meeting and delivered a somewhat hawkish tone. Officials perhaps do not want to signal to the public and investors that cuts are on the horizon for fear of re-stoking inflationary pressures. The bank also does not meet again until February, making for a long time between drinks. The RBNZ also appears mindful about the stimulus impact of strong migration.

The kiwi market though appears to have moved on from the RBNZ’s “hawkish hold” last week. Adrian Orr has continued to push out the timeline for rate cuts and where the terminal OCR will end up. The market (dotted line in the chart below) has taken a different view.

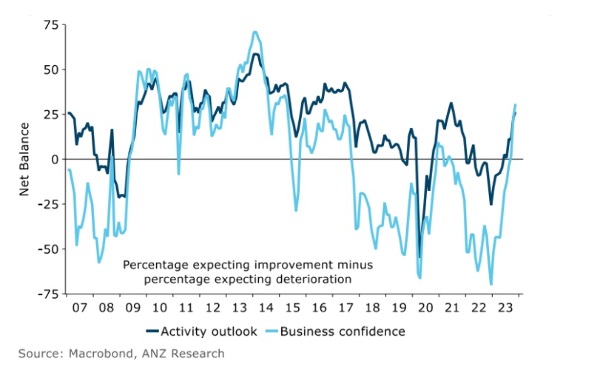

Meanwhile the overall business outlook also appears to be brightening further. The ANZ Business Outlook report showed that business confidence lifted another eight points to plus 31 in November, and expected own activity increased three points to +26. For most of the respondents it was the first survey response since the election. Business confidence is now the highest since March 2015. Business confidence tends to be higher under a centre-right government, but the litmus test will be the level of follow-through investment. Employment intentions are weak, but the survey corroborates the soft economic landing theory.

There are clearly some challenges to the NZ economy, not least of which being further headwinds for cost-of-living challenged consumers. Over a quarter of mortgage holders are yet to refix to higher rates. Some parts of the economy though appear to be turning. New dwelling consents jumped in October, and dairy prices are rising again.

The earnings season in New Zealand could meanwhile be described as somewhat ‘middling’ but there were a couple of clear highlights in Mainfreight and Fisher & Paykel Healthcare. Both names were big Covid beneficiaries and are adjusting to life on the other side of the pandemic somewhat better than anticipated.

Mainfreight’s shares soared despite half-year revenues falling 21.6% while profit before tax fell 42.1%. The declines were not unexpected given that the supernormal pandemic tailwinds (high shipping rates/demand) have dissipated. Trading is now normalising, which is seeing spending re-prioritised. Margins however improved from the first quarter, while there are signs that domestic freight networks in NZ and Australia are getting better.

Fisher & Paykel announced a 16% increase in full year operating revenue to $803.7 million, which was above the $790m guidance provided in August. Net profit after tax rose 12% to $107.3 million. There has been a lot of talk about the impact of weight loss drugs on the business, but FPH is not seeing this yet. The Homecare product group (which includes products used in the treatment of obstructive sleep apnea and respiratory support in the home) saw revenues increase some 26% to $314.4 million. The company’s Evora Full mask continues to see strong demand and positive customer feedback in the US. A new F&P Solo mask is being rolled out beyond New Zealand and Australia this year. FPH gave an upbeat outlook, and with easing shipping rates and improved manufacturing efficiencies, the company also expressed confidence in returning margins to a long-term target of 65% within 3-4 years.

It was also annual meeting season for many companies. Outlook statements were in focus, and there were unsurprisingly several “cautionary tales” emerging from the retail sector. The Warehouse (which has seen a slowdown in sales of big-ticket items at Noel Leeming) remained “cautious” about the outlook as it approached the busiest time of year. The fragility of the consumer was also evidenced by a 3.4% fall in September quarter retail sales on a year prior.

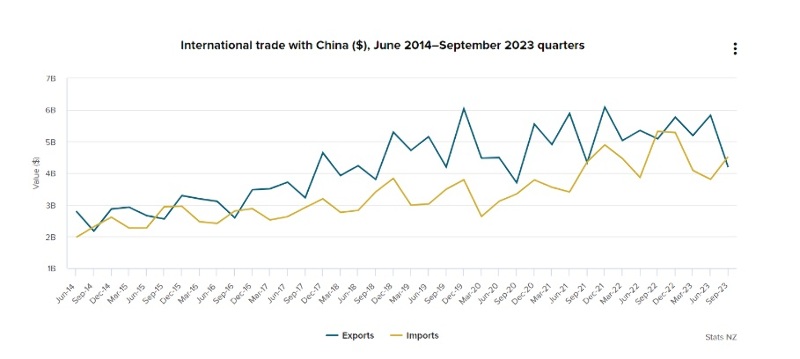

For our exporters, China remains a big part of the equation as it does for the broader economy. Third-quarter trade numbers showed a boost from tourism, but goods and services exports to China fell by $893 million on a year ago to $4.19 billion. This was driven by falls in dairy, meat, and processed foods including infant formula.

There remains something of question mark over China, which has to date displayed a relatively uneven recovery post Covid. Stimulus initiatives have been forthcoming from officials in the country, but there have been calls for more. There was however some positive news at the end of the month as China’s manufacturing sector recorded the fastest expansion in three months. However, the private survey contrasted with official manufacturing PMI figures which showed contraction. New order growth was the best seen since June. Good news for New Zealand’s (and Australia’s) largest customer.

That said iron ore prices are back over US$130 a tonne, which is an earnings tailwind for Australia’s big producers of the steel-making ingredient. The Australian market had a strong November as well.

Inflation also cooled in Australia, with annualised CPI growth down to 4.9% in October from 5.6% in September. This was well below expectations for a 5.2% rise and came as a sign of relief after September quarter inflation overshot on the upside. The only qualification here is that the monthly report doesn’t include all categories, and notably services, which has been a source of persistent inflation.

Source: ABS

Nonetheless, the print effectively ensured that the RBA stayed on hold in early December. Since the previous meeting, employment and retail sales had also softened. Similar to other central banks, the RBA did signal that further tightening would remain on the table should inflationary pressures bubble to the surface.

The Aussie property market is certainly bubbling higher. Building activity is picking up again, which is good news for the likes of James Hardie. Shares in the building product supplier surged on its half-year results. James Hardie is having success in passing on cost rises to customers (prices in Australia rose by 12%). In North America (two-thirds of earnings) the company expects just a short-term downturn in the housing market (7%-14%), but sees renovation work rebounding given people have “more wealth in their homes than they’ve ever had.” James Hardie shares are up over 80% this year. The stock is held in the Devon Alpha and Trans-Tasman funds.

Another highlight of the earnings season across the Tasman came from Goodman Group. The real estate company said that there was A$12.7 billion of development work in progress across 80 projects. Occupancy levels are meanwhile running at 99% and Goodman is forecasting FY24 operating earnings per share growth of 9%. The shares, which are held across a number of the Devon funds, are up over 30% year to date.

Results that were forthcoming from the banking sector also displayed some fairly consistent themes, not least of which being strong bottom-line profitability. Margins have lifted with rising interest rates. ANZ posted a record full year profit. Westpac increased its full year dividend and delivered a A$1.5 billion share buyback as strength in business and institutional banking was offset by weakness in the mortgage unit amidst a competitive market. National Australia Bank’s result highlighted the importance of the BNZ which recorded a record annual profit. It seems that borrowers are coping on both sides of the Tasman, despite a number of headwinds. Credit impairment levels are rising, but are low from a historical perspective.

All in all a very strong month for markets, with conditions for investors becoming more conducive on a number of counts. Can the rally continue through to the end of the year? December is going well thus far and is typically strong from a historical perspective.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « ChatGPT, the Magnificent Seven, Ozempic, and Higher-for-longer | Three risks we are thinking about for 2024 » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |