Expect more economic carnage

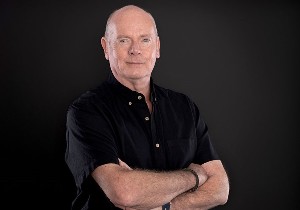

iLender business owner Jeff Royle says mortgage stress, defined as mortgage payments more than three months in arrears, is rising.

Tuesday, January 9th 2024, 2:18PM

by Sally Lindsay

At the peak of the GFC, mortgage stress was at 1.2% of the country’s total mortgage book. Today it is tracking at 0.4%.

However, in the past or two to three months, Royle has seen people coming to the end of their tether. “Interest rates are not going to come down anytime soon and it is going to be hard for a lot of people. I am expecting another wave of mortgagee sales in the next few months, unfortunately.

He says, while iLender has some great products to restructure mortgage lending, all they do is buy time when it would be better to sell up in the normal way.

The common theme so far in mortgagee sales has been predominantly self-employed people who have been the victim of another company collapse, Royle says.

He had a recent case of an architect who came unstuck when two building companies went under owing him $180,000 and he couldn’t pay his bills.

Royle says he has never seen a bank move so quickly and put the architect’s home under mortgagee sale, even though his house was worth about $4 million and he had a $1m loan.

Even though the architect buried his head in the sand for some time, Royle was able to get him an emergency loan, costing the best part of $100,000, and saved his house. “The architect has new work contracts, which means he can go back to a bank in about six months for a new mortgage.

Royle says his business has been doing quite a bit of work like this recently.

More money to be made

Mortgage adviser Kris Pedersen believes there will be economic carnage in the first six months of this year – job losses and business failures.

However, for his own business, he is more optimistic because 90% of his clients are property investors who thrive in a market that is on the way up after sinking into the doldrums over the past 18 months when prices dropped an average of nearly 15%.

More deals speed up in an in-between market, Pedersen says.

Even though the economy will take a hit, property prices have bottomed out and when that happens property traders return because there's more money to be made, he says.

“Since the election, the change of government has given investors a lot more confidence.”

While there will definitely be a lot of clients going through pain because of interest rate increases, banks are being far more reasonable about walking back changes under the CCCFA.

However, Pedersen says it’s still hard to get money for a lot of people because the test rates are so high.

Analysis he did over mortgage applications made 10 and five years ago shows borrowers can’t get anywhere near the money they did then.

“Even if interest rates dropped back to 5.5%, what people can borrow now compared to then is a lot less because of the way criteria has changed.

“One client, in particular, who a bank had given $16 million of debt 10 years ago would struggle to be able to borrow $6 million from the same bank now, even though his actual income is probably the same or a little bit higher than it was when he took out the original loan.”

Pedersen says banks’ test rates have a big influence on borrowing. The Reserve Bank has had a look at regulating test rates as they are in Australia, but Pedersen says debt-to-income restrictions appear to be more favoured and will probably be introduced this year.

In Australia the serviceability buffer is a regulator-enforced standard requiring lenders to review the ability of borrowers to repay their home loan at interest rates three percentage points over the market rate. For instance, National Australia Bank’s basic variable home loan rate is 6.24%, so it would assess if potential borrowers can repay at 9.24%.

Pedersen says a DTI restriction won’t have the same effect as high test rates while interest rates are high. He believes they should be regulated as they are in Australia and the focus should be taken off DTI restrictions.

| « Uncertainty over DTI effects | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |