Mortage advisers get the ear of Com Com

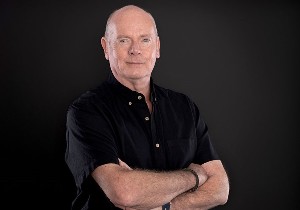

Mortgage adviser Jeff Royle’s sounding-off about the Commerce Commission dropping a “bombshell” on the industry has got its attention.

Tuesday, March 26th 2024, 5:43AM  4 Comments

4 Comments

by Sally Lindsay

After being accused of being out of touch with reality and having a poor understanding of the industry, the commission is arranging a meeting with Royle and industry body Financial Advice New Zealand (FANZ).

Australia’s newly established rival body Finance & Mortgage Advisers Association NZ (FAMNZ) is also seeking a meeting with the commission to air its views, although it does not have any members yet.

The ComCom dropped the “bombshell” by saying mortgage brokers are at risk of being “unduly influenced” by the commissions that the banks pay them for placing mortgages.

This prompted Royle and other advisers to make scathing remarks that the commission and chairman John Small had been asleep for the past five years when major industry changes had been made.

These include that mortgage brokers are now mortgage or financial advisers, banks pay much the same commissions across the board so there is no “incentive”, advisers have to disclose to clients the banks and other lenders they deal with, and all income derived from the transactions has to be disclosed to clients.

Royle was contacted by the commission last Friday for a meeting but he decided the industry as a whole needed to respond, handing over the arrangements to new FANZ chief executive Nick Hakes. He hopes it will cover off the clear lack of understanding the commission has “about what actually goes on in the real world”.

“It’s opening statement was enough. We're not mortgage brokers, we haven't been for years. Although the use of ‘mortgage brokers’ is in the public domain, people at the commission or the Financial Markets Authority (FMA) should at least be aware we are mortgage or financial advisers.”

Royle believes the meeting will have far more impact if FANZ convenes and controls it.

“I feel strongly that somebody needs to fly the flag and actually educate these people because clearly they are clueless as to what goes in our disclosure requirements to clients, how we give people greater choice and the fact that consumers, in droves, are ditching going to banks directly.

“Banks are closing branches. It's quite difficult for people to actually talk to somebody at the bank these days, which is one of the drivers for going to an adviser.”

Adviser penetration into banks, for example the ANZ, is more than 60% and even higher in other countries.

“If that isn’t choice, I don’t know what is,” says Royle.

He believes the ComCom’s remarks will galvanise the entire mortgage advice industry, just as the 2019 Royal Commission on Australia’s banking industry did.

Commissioner Kenneth Hayne recommended five changes to the mortgage broking sector.

The most contentious was that the borrower, not the lender, paid the broker the fee for arranging a loan. Hayne also argued that consumers were in the dark over arrangements between brokers and banks and this led to dishonest conduct.

“The Hayne report was so damning it actually galvanised advisers, lenders, and aggregators to come together and have a meaningful conversation. And it worked,” Royle says. “If the government of the day had hit the go button on the report, there would be no mortgage advisers in Australia. It would have wiped out the industry. So, fortunately, common sense prevailed.”

The ComCom is keen for the meeting to go ahead sooner rather than later.

| « ComCom accused of being out of touch with the reality of mortgage advice | Potential FAMNZ members in waiting game » |

Special Offers

Comments from our readers

Unfortunately this is happening a little too late for many advisers. I believe there have been many good advisers leave the industry over the last few years, as we have become not much more than data collectors and pre-qualifiers for banks. Those words actually came from a BDM and were reiterated from a senior mending manager at another major bank.

Sign In to add your comment

| Printable version | Email to a friend |