Cutting to the chase

The RBNZ has “cut to the chase” with the first rate cut in over 4 years. Is this cause for celebration and what does this mean for the NZ economy and stock market?

Monday, August 19th 2024, 10:56AM

by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

The RBNZ surprised many market participants by coming through with a 25bps rate cut. We have said for several months, including our 2024 predictions at the start of the year, that central bank would need to go earlier that most were expecting, and be driven by economic necessity. This appears to have played out.

It was only a few months ago that at least one commercial bank and many market participants, were calling for more hikes this year. The RBNZ wasn’t forecasting any rate cuts until the second half of 2025. After being one of the most hawkish central banks around for much of the past few years, the RBNZ have even beaten the Fed, the world’s largest central bank, to the punch.

A tip of the hat to Adrian Orr and the RBNZ, who are trying to get ahead of further weakness in the economy, which they acknowledge has become more pronounced, and broad based, since the last Monetary Policy Statement In May. They are perfectly entitled to do that. There are a huge number of moving parts in the economy and things have clearly deteriorated in the last few months – we are looking at going into recession again in the fourth quarter, so better going now to limit the extent of the downturn.

Business and consumer confidence has worsened , consumer spending and housing markets have weakened further, and lots of parts of the economy are under pressure. Unemployment is probably over 5% right now. Growth in China our biggest customer has also been soft. The RBNZ also acknowledged that migration tailwinds are fading. Belts are also tightening in the public sector.

With the economic medicine of higher rates taken, inflation is well down from its peak, and Adrian Orr did not hide his relief that inflation is likely back between the target 1-3% band. The reality is that the elements of inflation that can be controlled are largely under control. The big thing here is the spare capacity that has emerged in the economy which should also help reduce services inflation which has been quite elevated. A weaker currency may push up imported inflation but you have to take the rough with the smooth there, and the benefit to the broader economy as a whole.

Adrian Orr quipped that it is “darkest before dawn” and hopefully he is not too far off in saying that we are in dawn at the moment.

Orr also made a good point monetary easing doesn’t work immediately, and operates with a lag. Meanwhile a lot of the data we get is not that timely - we don’t get June quarter GDP numbers until later next month. Going now makes sense and that we will have more chance of hitting the RBNZ’s forecast growth rates of over 3% for next year and the year after. In the meantime, mortgage holders and borrowers can look forward to a more immediate easing of pressures – most banks have already moved on rates.

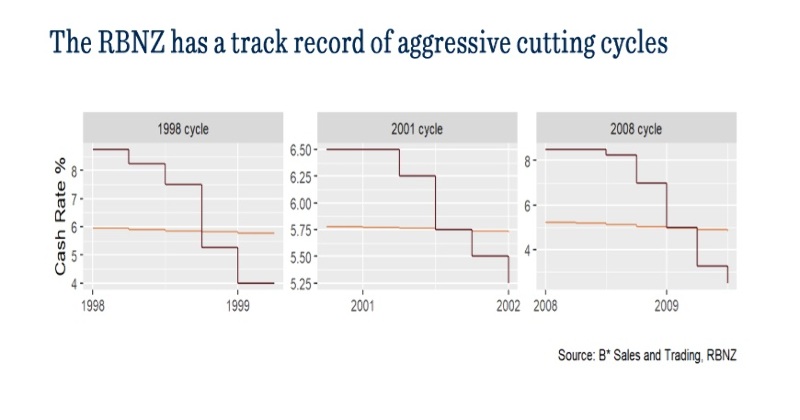

And we can expect more easing before the end of the year. Officials are signalling we may get up to another 50 basis points of cuts before 2024 is over. Also note the central bank also has a history of going quickly when it does cut rates. The OCR is set to be below 4% by the end of next year. Deposit rates are going to head much lower. But perhaps don’t expect an overpriced (by OECD standards) housing market to roar back, but yesterday’s decision is great news for our equity market.

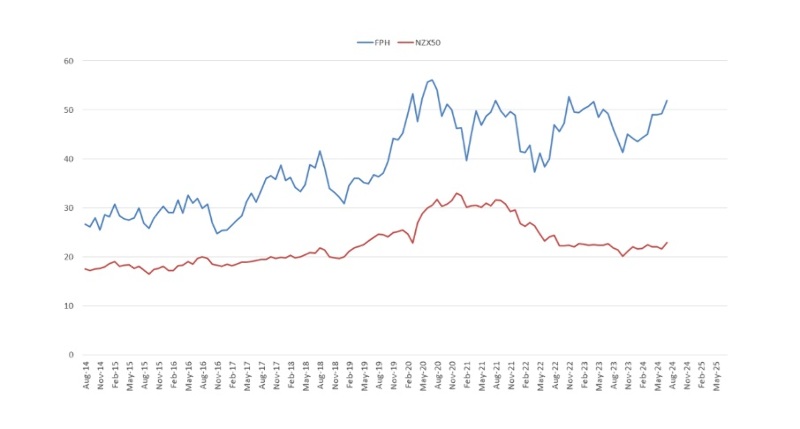

Investors have celebrated the news with vigour. The NZX50 is at a 31-month high. Stocks sensitive to Interest rates and the economy are on the up. Dividend heavy stocks have also been in demand.

Investors were already getting prepared for this scenario though. The NZX50 posted a 5.9% gain in July, which outperformed the 1.8% rise in the MSCI World Index. The month was also notable for another evolving thematic with positive ramifications for the kiwi market which has lagged many other benchmarks this year. Globally, there was a rotation away from super-cap technology, towards older-economy names, and smaller capitalisation companies on the view that they offer better leverage to a soft economic landing.

Recent data firmly crystallised the notion that the RBNZ would be looking at multiple rate cuts this year.

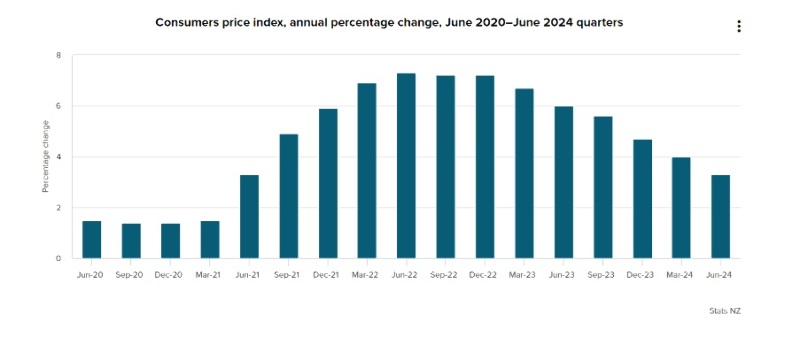

June quarter inflation came in at a three-year low of 3.3%, which was down from 4% in the March quarter, and less than half of the peak of 7.3% in 2022. On a quarterly basis, it fell to 0.4% from 0.6% in March. This was right down at the bottom end of expectations, and materially below the 3.6% that the RBNZ had pencilled in at this stage. This is all good news for people looking for a glimmer of positivity around cost-of-living pressures, and also as local investors seek tailwinds for our market.

At 3.3%, inflation is still above the RBNZ’s 1-3% target range, but only just, and (just like the Fed has made clear) officials didn’t need to see it there before they started easing rates. Officials just wanted to see it heading in the right direction. The September CPI print out later in October should confirm that inflation is indeed under 3%.

That said, there are elements of inflation that remain “sticky.” Non-tradeable (domestic) inflation is still persistent at 5.4%. Rent, rates, and insurance are all still seeing strong levels of inflation. However, these pain points are not ones that the RBNZ can necessarily control through the OCR.

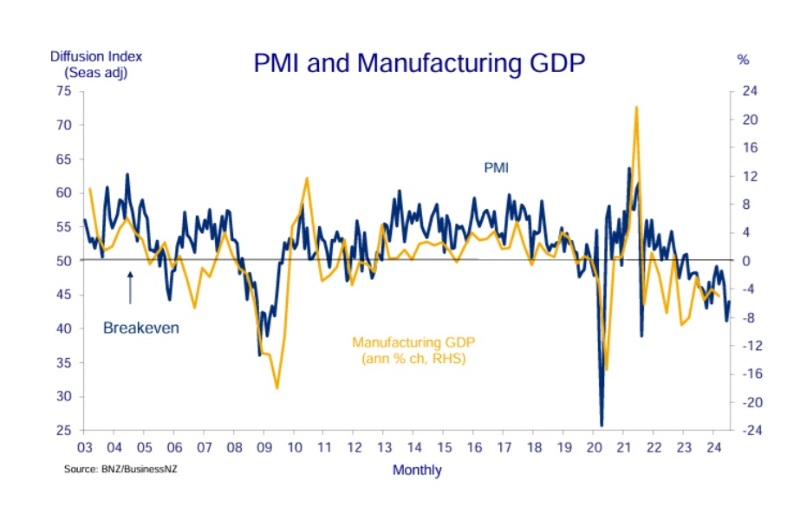

Meanwhile last month there were many weak data prints in the form or a range of business and consumer surveys, and card spending data, all suggested declining activity. The Quarterly Survey of Business Opinion also pointed to a further decline in business confidence in the June quarter. New home consents are back at the levels of 10 years ago. Weakness in retail is also having a knock-on impact to the manufacturing sector which has been in contraction for 17 months. The downturn has not reached the depths of the Global Financial Crisis yet, but the weakness has gone on longer. The services sector is also doing it tough and is also in contraction.

With inflation getting under control, the economy needed a boost. Whilst not a magic bullet overnight, the reality of lower interest rates will do much for consumer as well as business sentiment. After a sustained period of monetary tightening, investors will now need to consider what life may look like as the next stage of the cycle sees interest rates head back down.

Retail investor appetite domestically has been somewhat lukewarm for much of this year with the backdrop of elevated inflation, a hawkish RBNZ, and an economy which was in technical recession. The lack of technology exposure in our market has also been a headwind, with this sector running hot in 2024, propelled by the AI thematic.

High deposit rates have also provided a reason for investors to sit on the sidelines. A fertile environment for savers though is turning – it is now much more difficult to secure a standard 1 or 2-year deposit rate above 5.5%, much less with a “6” out in front of it. The current deposit rates on offer could fall further in relatively rapid fashion now the central bank has pressed the monetary easing button.

Lending rates are also set to fall, which is good news for borrowers, many companies, and many sections of the economy. The question though might be whether this also makes residential property (which has been falling since December 2021) an attractive option again. The reality is though that on OECD standards at least, New Zealand remains one of the most expensive property markets around, even after the shake-out of the past two years.

There are meanwhile some positive indicators that the value inherent in some corners of the kiwi market is being recognised, and that also a re-rating of many others can be sustained, particularly amid a lower rate environment. This is not least because the kiwi market is a high yielding one (which holds more relative appeal as rates fall), but also as a period of catch-up is overdue, helped by a rotation back towards value.

It is also worth pointing out that the broader valuation appeal of our stock market is somewhat masked by the presence of Fisher & Paykel Healthcare which accounts for around 15% of the index. The healthcare name is a great company, but also trades at a higher valuation compared to other locally listed peers.

Recognition of the value on offer has already been seen with acquisitive moves in two fairly beaten-up sectors, which could both turn upwards as the economy improves. There is a $1.2 billion offer for retirement and aged care operator Arvida on the table, but still at a ~15% discount to its net asset value. It will be interesting to see whether this sparks more interest in other retirement names.

Also in the eyes of a suitor was The Warehouse which received a takeover offer from an Australian buyout firm, accompanied by founder and majority shareholder Sir Stephen Tindall. The “opportunistic” offer fell at the first hurdle as it did not secure critical shareholder backing. Shareholders (including those bidding) may have come to the conclusion that it would have been a case of “selling at the bottom.” The board though did appear open to taking an improved offer back to shareholders.

With the RBNZ ringing the bell on rate cuts, it will be also interesting to see whether there are other acquisitive predators considering these or other sectors in New Zealand.

Another broader indicator of the improving sentiment for our local market came with a strong response to the $1.15b capital raise by Infratil. This may in part have been because this was centred around the expansion prospects of one of the real success stories in their portfolio, being the CDC data centres, which have been riding tailwinds from the AI thematic.

Holding many kiwi investors back until now however have been concerns over a hard lending for the economy, a hawkish central bank, and also the relative attraction of high deposit rates. These considerations are now all fading into the rear-view mirror. The scene has been set and we will see how investors react in the near term as the earnings season ramps up.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Are NZ equities a buy? | A bit of volatility » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |