How Kiwis can invest in the world’s best companies

Stephen Arnold, Founder and Chief Investment Officer at Aoris Investment Management, explains the quality approach that sets its global equity investment strategy apart.

Friday, September 13th 2024, 6:02AM

Could you tell me about your investment strategy at Aoris?

We define our approach as Quality First, Value Investing. We see ourselves as business owners. We aim to generate an 8% to 12% p.a. return over a 5- to 7-year market cycle by owning businesses that become progressively more valuable over time, and where the risk of a disappointing outcome is low. Thinking about the attributes we’re looking for:

Firstly, we like businesses that have been around for a long time. That provides a lot of proof-points as to their growth, durability, resilience, profitability, and how competitive they are.

Secondly, we want businesses that grow their earnings. They can’t become more valuable if they don’t grow profitably. We’re looking for businesses that are not only leaders in their markets, but they continue to grow faster than their markets. From a leadership position, they are consistently gaining share every year.

We don’t know what economic challenges are around the corner, so we want companies with balance sheets that are robust and resilient. It also provides them with optionality – they can deploy that capital intelligently when there’s good opportunities to do so.

Lastly, we place a lot of emphasis on management culture and values. This informs our view of how the business can grow, win more customers, do more business with those customers, and keep good people for a long time. That culture and those values are very important to the long-term trajectory of high-quality businesses.

Is there a stock you like that many people haven’t heard of?

Compass Group (CPG:LON) is listed in the UK and is the world’s largest contract catering business. It feeds millions of people every week in places of work, hospitals, universities, remote mining sites, and sporting stadiums.

This is an interesting business because about half the total market it addresses is currently insourced, but there’s a steady progression of all those organisations to outsource the catering.

You can imagine if you’re a large organisation in New York, or a hospital in the UK, your primary business is something else, and feeding people in the cafeterias is something many organisations are concluding is best done by a specialist. This trend towards outsourcing has become more pronounced in tight labour markets.

Compass is by far the largest in this market and that brings many advantages. It’s the largest purchaser of food in the United States. It has sophisticated practices to manage its business more effectively and efficiently than smaller operators can.

In a growing market, Compass is a consistent market share gainer. It keeps its customers, on average, for more than 20 years. It has a good record of winning new customers every year; most often those who are outsourcing catering services for the first time.

Management are disciplined, work hard to improve Compass at what it does every year, and run the business with a conservative balance sheet.

We think Compass Group can continue to grow profitably at an attractive rate, and we believe we own it today at an attractive share price.

I see you only own 15 stocks; that’s quite unusual?

It is unusual. Firstly, by owning just 15 businesses, it allows us to set those quality criteria very high. If we had 50 businesses, they wouldn’t all be as good as our 15.

Secondly, it allows us to make considered decisions. We expect to replace, say, four of those companies each year. There’s a lot of discipline and consideration given to those changes, which we make on average every three months. We know our businesses very well, which is helpful when we’re dealing with difficult economic periods, as we have through much of the last few years.

Lastly, owning just 15 businesses allows us to be disciplined when it comes to valuations. It’s one thing to own a great business, but it’s important to own them at a sensible price in order to achieve a good investment outcome.

You have had very strong investment outcomes the last few years…?

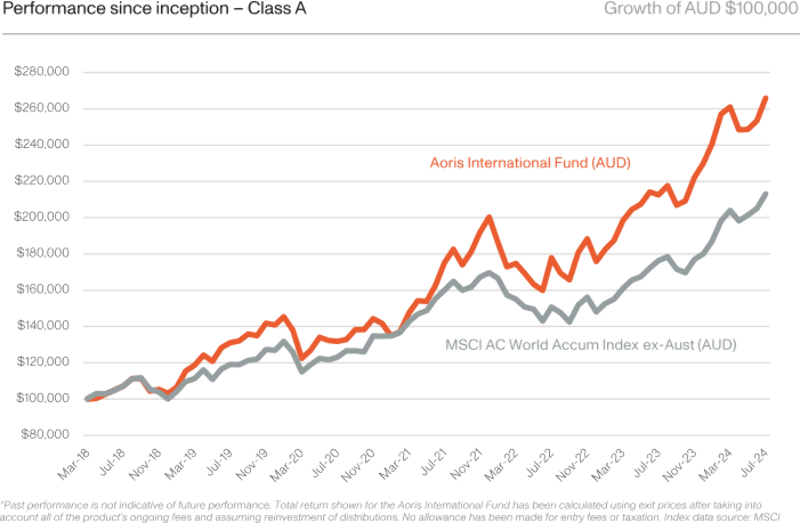

We are always focused on delivering long-term outcomes for our clients. Since inception in March 2018 through to July 2024, we have delivered 16.7% p.a. for our class A unit trust – comfortably above our 8% to 12% target. That’s been pleasing. I think a lot of that has come from our success in avoiding the problem areas of the market, as well as owning good businesses that grow profitably in line with our expectations, and paying sensible prices for them.

But you only own one of the ‘magnificent seven’?

Indeed. In fact, of the 100 largest tech businesses in the world, we don’t own 99 of them. We do own Microsoft. There’s a lot about Microsoft that speaks to those quality attributes we look for. It’s been around a long time, it has a conservative balance sheet, it keeps its customers for a long time, and it charges modest prices relative to the value it delivers. Customers have a high appetite to take more products from Microsoft, as we are seeing with AI.

It’s also a very broad business. Some of the big tech businesses do predominantly one thing, like cyber security, and that creates an inherently fragile business.

Some large tech businesses operate in sectors where market share moves around in a very fluid fashion, which makes it hard to assess whether they’ll be a market leader in five years’ time.

Lastly, some of the big tech businesses face rising risks, as their business practices are subject to increasing government oversight. It might be regulation regarding anticompetitive business practices, or it might be trade regulations where the government is playing a more active role.

Can you tell me more about what quality means to you, and why it’s a focal point of your research?

On all attributes we set our quality criteria very high. We want to own businesses that are leaders in the market they operate in. Being the largest is not a particular advantage in every industry. Being the largest car company in the world, the largest bank or the largest airline is not a particular advantage. We like businesses where size and scale is a real advantage, and one that becomes more powerful every year as the leader progressively grows faster than their peer group.

We like businesses that keep their customers for a long time, whose customers want to do more business with them, and who’d happily pay more for a product than they are currently charged. That’s a sign of quality, a sign their customers are happy, and it gives us confidence in the ability of the business to grow profitably at a good rate for a very long time.

We pay a lot of attention to avoiding businesses where we know we’re more likely to trip up as investors. We avoid businesses with a lot of debt on their balance sheets, and those that are competitively weak. And we avoid those where the share price looks very expensive relative to fair value, or companies that are subject to changing regulation – that all goes into our conservative investment approach.

We work very hard to avoid those problematic sorts of businesses and we’ve done a good job since our inception of doing so. That’s made a big contribution to our investment success.

Tell us about your own investing experience.

I’ve been investing internationally for 32 years, having started at Platinum Asset Management in Sydney in 1994. I spent 10 years in London and I think working overseas was a helpful experience for someone in this part of the world who’s investing in global equities.

I was a banks analyst in an investment at Goldman Sachs in London during the GFC, and seeing the problems banks experienced in stressed financial conditions has informed our decision not to own banks.

Other areas we consider out of bounds include energy or mining companies, because externalities like commodity prices or geopolitical events play a big role in the earnings of those businesses. Similarly, we actively avoid businesses where government regulation plays a big role, such as utilities. Regulations can be fluid and can change unexpectedly. We want to own businesses that are much more in control of their own destiny.

Is there anything else you think New Zealand investors should know?

A couple of things are distinctive about how we’re set up at Aoris: First and foremost, we want to do one thing well, so we’re a single-strategy business. Number two, we’re aware that the amount of funds can sometimes become an impediment to a manager’s performance. Based on market liquidity today, A$5 billion is the most we’ll manage. Third, we’re unusually transparent and disclose all our holdings every month, which allows our clients to see what we own and what we’re doing. We welcome that. Number four, we’re an independent, staff-owned business. We think this ownership structure is important to allow us to do our best job for our clients.

For those interested, there’s a lot of information available on our website (www.aoris.com.au). One document I’d direct readers to is our Owner’s Manual.

Our approach is common sense, and executed with uncommon discipline. We think a portfolio of high-quality global businesses can help diversify a lot of New Zealand investors’ portfolios, while also adding some comfort around the underlying durability of their portfolios.

This is general information only and is not intended to provide you with financial advice and has been prepared without taking into account your objectives, financial situation or needs. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 is the Responsible Entity and issuer of units in the Fund. Prior to making a decision about whether to acquire, hold or dispose of units in the Fund you should consider the Product Disclosure Statement (PDS) and target market determination (TMD) for the Fund to see if it is right for you. The Fund’s PDS and TMD is available at www.aoris.com.au

| « New Zealand Equity Monthly August 2024 | New Zealand Equity Monthly September 2024 » |

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |