Insync: Market concentration a myth

Evidence does not support a new and perilous belief that global markets are becoming increasingly more concentrated, according to Insync Funds Management (Insync).

Tuesday, October 29th 2024, 9:23AM  1 Comment

1 Comment

‘The CIO of one of Australia’s biggest super funds recently said there is stock concentration in markets, being driven by an increase in tech stocks,’ says Insync Head of Strategy and Distribution, Grant Pearson. ‘And she is not alone. Bloomberg has also recently made this statement, adding to a popular chorus across the media over the past year.’

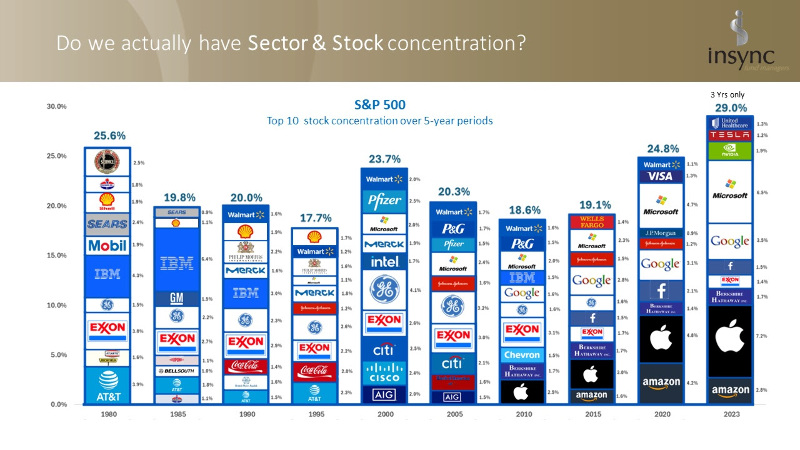

Insync looked across reasonable 5-year period blocks since 1980 to test the belief with today’s big six tech stocks. The Top 10 over these five-year periods held between 18%-29% of market cap for the S&P 500. The S&P 500 best represents all industry sectors where most of the market capitalisation exists.

‘It’s worth reminding ourselves that stocks such as Meta and Google are not classified as tech stocks but communication stocks, and for good reason,’ Mr Pearson says. ‘Apple, Microsoft and Cisco are ‘technology’ stocks, and Amazon is a ‘consumer discretionary’ stock.’

Nvidia burst onto the Top-10 only last year at 1.9%, while Tesla only briefly made the big group at 1.2% by 2023, but has since dramatically lost this position.

‘It is true that for the first half of 2024 Nvidia shot up to eye-watering levels,’ Mr Pearson says, ‘but this is a common occurrence over relatively shorter time periods for many companies.’

In 1980, seven of the Top 10 stocks were in oil, the biggest sector concentration to date. By 1985, this had broadened across no less than seven industries but still at around 20% of market cap in total. IBM fell off the list by the early 90s with the first big new tech stock, Microsoft, appearing with 1.1% share in the preceding period.

‘While the Top 10 percentage of the market remained in the 20%+ range from the turn of the century, it wasn’t until after 2020 that tech stocks increased, and then to just three of the 10 positions,’ Mr Pearson says. ‘By 2023, there were six sectors represented in the Top10. With a year or so to go for the latest five-year period, it’s not a forgone conclusion that tech stocks will occupy the top slots.’

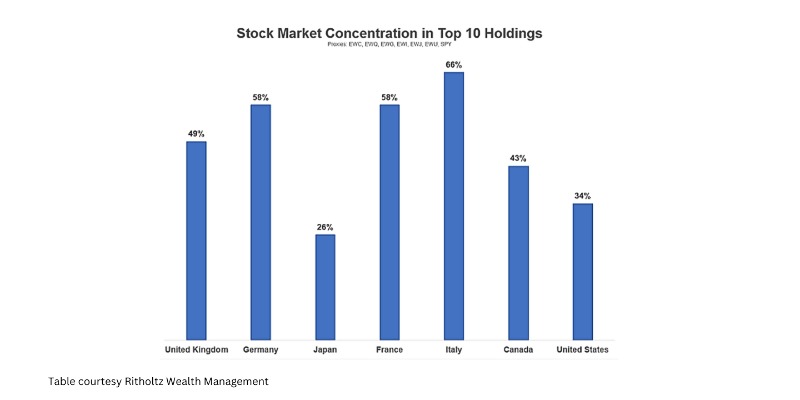

Insync then considered whether there is US market concentration. However, looking across global major bourses, it became clear that the US, at least in recent history, actually holds one of the lowest stock concentration profiles.

‘It is clear that stock concentration is not a US thing,’ Mr Pearson says. ‘If you’re really worried about concentration, avoid China and our own back yard.’

China’s top five stocks occupy 38% of its market, the Top 10 a whopping 57%. South Korea has 49% in its Top 10 (22% alone in this industrial behemoth – Samsung), but Australia is the worst of all with around 60% in its line-up.

‘The facts simply don’t support several beliefs doing the rounds,’ Mr Pearson said. Those beliefs include:

1. That Top 10 concentrations are a new or a rare occurrence – they’re not.

2. That it’s a US thing – it’s not.

3. That it’s mostly in one industry sector – not since oil in the 1980’s.

4. That tech stocks are dominating well above historical norms – they’re not.

‘It always pays to check the facts and how the markets evolve over time,’ Mr Pearson said, ‘and these mistaken beliefs are the perfect example as to why.’

| « Active or Passive? How about the best of both worlds | New Zealand Equity Monthly October 2024 » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |