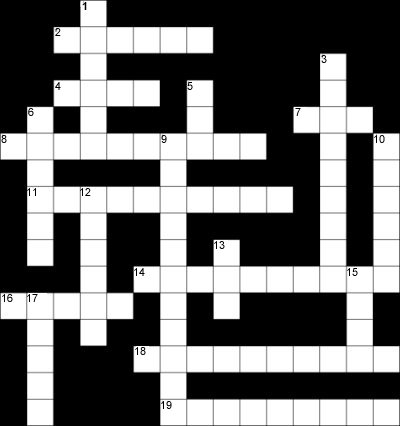

Crossword #2

Test your knowledge of the financial services industry (or just fill in time at your desk) with the Good Returns crossword.

Thursday, December 27th 2001, 2:12PM

Across

2.

4. See 7 across

7 across, 12 down & 4 across A super thing for my retirement

8. Something is rotten in the state of Fonterra

11. Get loony chap at start, now he's a wreck

12. Mega city or mega disaster?

16. See 10 down

18. (6,4) I charm hag... really, it's in the stars

19. They just wanted to say 'thanks a million'

Down

1. A website - keep away from electricity, no way - it depends on it's amps

3. Leader of the school, we'd love to get a BTing

5. Sounds like a chopper, acts like a shopper - do we know what it is yet?

6. Stored for retirement - it's a website

9. Stun ogre with rod - it's where this crossword is

10.down & 16 across (6,5) A former financial planning firm with biblical connections

12. See 7 across

13. A good way to invest

15. I part company to form fund source

17. They help to clear the throat, and tax effective to boot

| « Succession planning: Selling to managers | King builds an empire » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |