Is it time to take profits from shares?

With equities looking fully valued at the moment Harbour Asset Management considers what options investors have for growth.

Monday, June 15th 2015, 3:50PM

by Harbour Asset Management

OVERVIEW FOR THE MONTH

- The New Zealand equity market returned 0.97% in May while the Australian market returned 0.40% (+4.08% in NZD terms) over the month.

- The MSCI World equity index fell -0.1% in May. Bond markets reacted cautiously to stronger European and US economic data and Fed comments that it will likely be appropriate to take initial steps to start normalising monetary policy at some point this year. The US dollar strengthened in reaction. The S&P500 index rose 1.1% as soft economic data pushed out expectations of the Fed’s first rate rise to September. European markets were weaker with Greek exit concerns offsetting European economic recovery evidence. Chinese markets rose 2% as investors reacted positively to capital account liberalisation and monetary policy easing.

- The NZ equity market fell as yield investor enthusiasm for Spark, Meridian and Mighty River waned as long term Government bond yields increased. Further new equity issuance (including $152m by Kiwi Property) and expectations of large shareholder block sell downs (including Chevron’s exit of NZ assets, which occurred in early June for $867m) may also have constrained investors. The March period reporting season was generally positive with increases to market earnings forecasts post results, with Mainfreight, F&P Healthcare and Nuplex the standout ‘beats’ versus analyst forecasts.

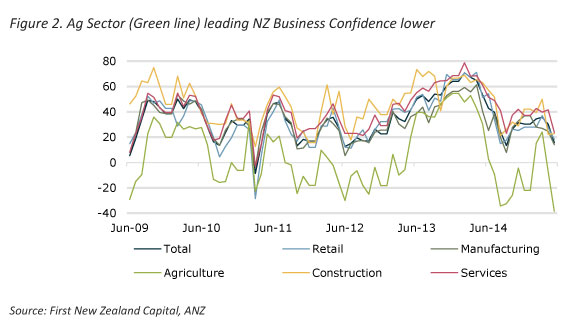

- New Zealand business confidence weakened over May, led by sharp declines in the agricultural sector. This points to a softening in the pace of activity. With inflation risks low, the introduction of macro-prudential policies increases the case for RBNZ rate cuts.

- In Australia, capital raising by the banks to bolster capital ratios, including an A$5.6bn equity raising by NAB and an A$2bn dividend reinvestment equity raising by Westpac, weighed on the market. RBA rate cuts supported domestic cyclical and property stocks. Offshore earners outperformed on AUD weakness. The RBA signalled its reluctance to cut interest rates further due to risks of a housing bubble, indicating the outlook for rates would depend on economic data.

DECOMPRESSION

Yielding assets have been overbought as investors have ‘boot-strapped’ up the risk curve to maintain income streams in an ultra-low interest rate environment. While normalisation of global monetary policy settings may be slow, decompression of yield investments from ‘over compressed’ levels may be painful for some investors.

We don’t expect long term interest rates to increase significantly. However even a ‘low and slow’ unwinding of global easy monetary policy settings (as deflation concerns recede in the US and Europe) will require an adjustment to asset pricing assumptions currently baked into capital markets. Capital markets don’t do ‘low and slow’ very well – they tend to do hard and fast and overshoot. While there may be an increase in volatility and a repricing of assets on change in monetary policy direction, ‘low and slow’ rate rises are still conducive to ‘okay’ equity market returns.

After contracting in recent month’s global industrial production (IP) is expected to increase. ISM manufacturing new orders, a strong global leading indicator, rebounded in April after five consecutive months of decline. The monthly uptick is consistent with global IP momentum accelerating in the second half of the year. In early June, US employment payroll data was more positive than expected.

US economic growth is continuing to accelerate, with some signs of inflation emerging (particularly wage inflation). While a Fed rates increase over the next twelve months is now widely anticipated the Fed is likely to implement a ‘Low & Slow’ strategy so as to not destabilise the recovery in US activity.

NZ ECONOMY SLOWING

Led by sharp declines in the agriculture sector the NZ Business confidence has continued to slide over the last year.

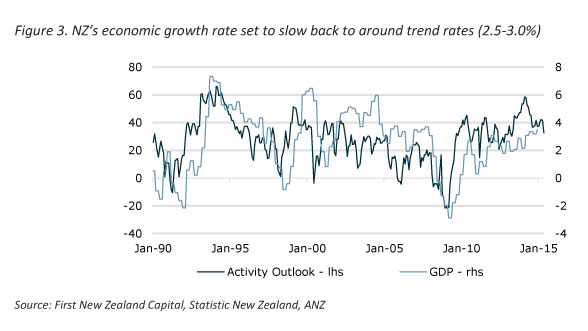

Real GDP levels have historically been correlated with business activity outlooks. Current business activity outlook readings are consistent with New Zealand activity slowing to 2.5-3.0%.

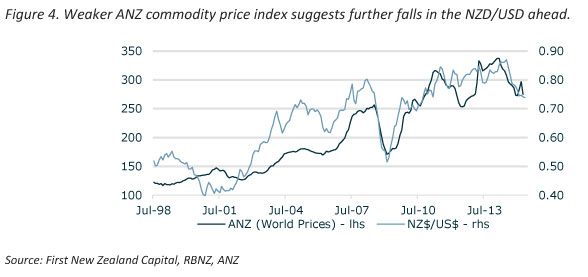

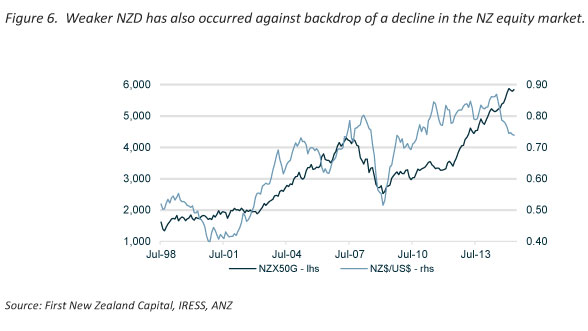

Similarly while the NZD/USD exchange rate has fallen from its decade high of 0.8823 in September 2014 to 0.7133 it may fall further if commodity prices remain weak.

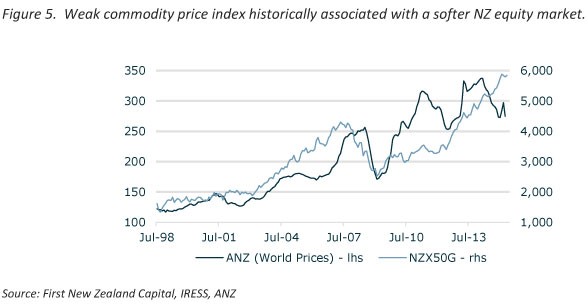

Historically a weaker commodity price index and a weaker NZD has been associated with a softer NZ equity market. The changing composition of the New Zealand equity market, post the raft of new listings over the last year, may have altered this relationship. However, if offshore investors chose to exit New Zealand in favour of other economies and currencies the correlation between the two may increase.

While a slowdown in New Zealand activity may impact on revenue growth for some New Zealand listed companies such a slowdown, if combined with below average inflation, provides room for the RBNZ to ease monetary policy with the NZD and short term interest rates falling.

The portfolio remains tilted in favour of New Zealand companies with global growth platforms such as Mainfreight, F&P Healthcare, Pacific Edge, A2 Milk and EROAD.

OUTLOOK – MODEST RETURNS, INCREASED VOLATILITY

We constantly get asked whether investors should be taking profits. That is an unusual mind-set for long term investors, so we tend to rephrase the question and say, do you mean reduce risk?

We are 30 years into a bull market in bonds (with ample signs that is turning) and some 6 years into a bull market in equities. Rallies of these durations have backdrops of extra-ordinary events. On the one hand Central Banks desire to eliminate inflation since 1984, and more recently Central Banks need to stabilise the banking system and cease deflationary pressures since 2010. But investing isn't all about Central Banks.

When considering whether to reduce risk in portfolios, investors might ponder the alternative return profile. They might also ask about the role of cash, bonds and equities in their portfolios.

We invest in equities to provide real returns, to provide a hedge against inflation and to offer a growing pool of income through rising dividends.

Where is that growth going to come from? Global growth is improving, but for the most part economists think this will continue to be a patchy, muted cycle. Economists could be wrong, but signs are for now that a strong growth cycle isn't something to bake into profits or valuations. Instead we continue to be focused on more structural growth. Growth driven by innovation, technology, demographics and globalisation. We think other investors should follow suit, as valuations of growth are generally less extended relative to more defensive investment opportunities (that is bonds and defensive equity sectors).

Most investors appreciate that higher growth equities have more risk, or more volatility. This is especially so at an individual stock level. To improve investment opportunities investors should therefore diversify their growth options- both locally and globally.

Our persistent view is that while equities are vulnerable to shocks, they are not in a ‘bubble’. They are expensive, they are on many measures overvalued, but a diversified equities exposure should still provide earnings and dividend growth and a longer term hedge on inflation. We tend to think that a hike in rates by the Fed has been very well telegraphed and if we were looking for a shock it may not be from that angle. The equity markets that look most expensive relative to history include the US and New Zealand, and many commentators we follow have made the case for reducing exposure to these markets or at the least rebalancing back to longer term strategic weights.

Andrew Bascand, Shane Solly, Craig Stent

Harbour Asset Management

Important disclaimer information

| « (Under) performance fees | Time right for big banks to list NZ assets » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |