South of Neutral OCR?

Thursday, August 13th 2015, 1:56PM

by Harbour Asset Management

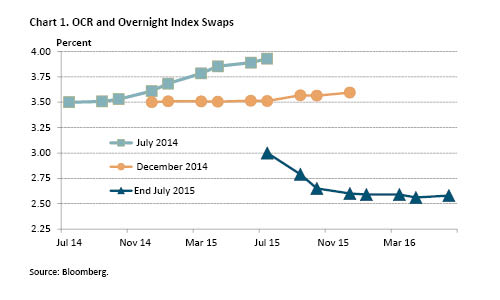

After starting with a 25 basis point cut in June, the RBNZ continued the easing cycle with another 25 basis point cut at its July OCR Review, but cautioned the market pricing too much more easing.

At the time of the June Monetary Policy Statement, the RBNZ had hinted that “further easing may be appropriate”, leaving another 25 basis points or so of further cuts in their forecasts for the next 12 months. Economic data over the course of the month reinforced the idea that growth in the NZ economy was moderating further, and that the easing cycle would continue. Business confidence surveys softened noticeably, and non-tradeable inflation at its lows underlined the absence of domestic inflationary pressures.

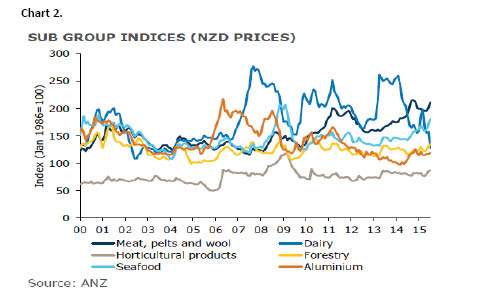

However, the key news came from dairy prices which continued to fall sharply in July, prompting the market to bring forward its expectations, and price more action from the RBNZ, more quickly than previous forecasts. While the current level of dairy prices will be hurting the cash flow of farmers, the greater risk is prolonged period of low dairy prices, hurting the economy and financial sector.

While the RBNZ did deliver a 25 basis point cut to 3.00% in July and signal that “some further easing seems likely”, it was quick to water down expectations that the OCR would eventually fall below its record low level of 2.50%. In a speech soon after the decision, the Governor highlighted that to forecast aggressive OCR cuts the RBNZ would need to be forecasting a recession, which it is not seeing at the moment. In fact, the RBNZ isn’t really even forecasting a slowdown at all – more a case of the economy continuing to grow at 2% to 3%.

While some of New Zealand’s previous drivers of growth are abating (the Canterbury rebuild and dairy sector), there are alternatives in their place (looser monetary conditions, record net migration, growth in labour market participation, and construction in Auckland). The fortunes of the dairy industry have rightly captured the attention of the media and markets. However, it is also important to remember that other parts of the agricultural sector are experiencing more resilience in their commodity prices, and a more stimulatory NZ dollar (Chart 2).

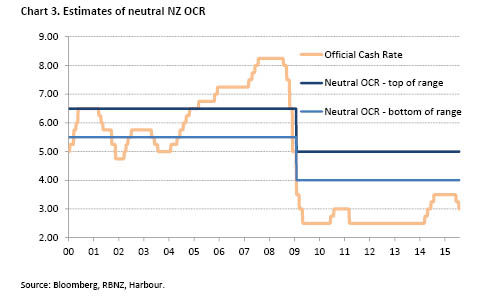

A key judgement for the RBNZ is its assumption for the neutral OCR – a theoretical concept of where it expects the OCR to settle once inflation is at target, the exchange rate is at fair value, and the economy has neither spare nor excess capacity. Before the GFC, the RBNZ saw the neutral OCR at around 6%. It now estimates it to be in the range of 4% to 5%; if not, a touch below.

The implication is that it sees the current OCR at 3% as stimulatory, even before the “some further easing” it is expecting to do. This helps explain why the RBNZ is hesitant to cut the OCR aggressively from here, especially given that the RBNZ expect that annual CPI inflation will revert back close to 2% once the previous negative quarters fall out of the annual measure in Q1 2016. In other words, they are seeking to avoid the volatility that would occur in interest rate and exchange rate markets if they were to cut the OCR below 2.50% in 2015 only to turn around quickly and lift the OCR towards 4% in 2016.

US FED PREPARING FOR LIFT OFF

While the market debates how far the RBNZ easing cycle with take the OCR, US economists continue to debate when the US Federal Reserve will begin to remove stimulus and lift the US Fed Funds rate off its lower bound.

For some time now, the US Fed has made clear that it expects to increase the Fed Funds rate during 2015, if the US economy evolves as anticipated. The market has interpreted this as implying a September or December start date. However, over the course of July the US economic data haven’t been weak enough to rule out September, or strong enough to make a September a done deal. This ambiguity was reinforced by the July FOMC meeting, which continued to keep the options open, leaving future decisions dependent on the strength of US economic data. A full 25 basis point hike from the US Fed is not priced until its December meeting.

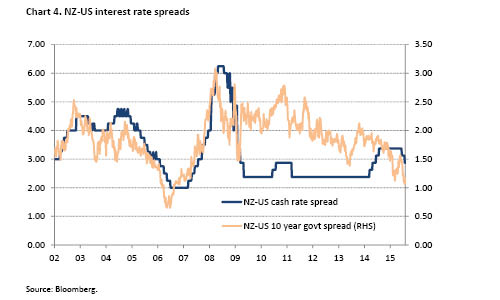

The prospect of a tightening cycle has left investors nervous about the US Treasuries market. By contrast, dealers report strong demand for New Zealand government bonds, which benefit from a higher running yield and a more supportive central bank cutting interest rates. Indeed, this demand for New Zealand government bonds has narrowed the NZ-US 10 year government bond spread to less than 100 basis points, which is very narrow considering the difference between the NZ and US cash rates is nearly 300 basis points.

The implication is that, with NZ government bonds relatively expensive, there is little cushion for the NZ market to weather a rise in global long-term yields. So even if this is prompted by the US Fed lifting interest rates sooner than expected, it is likely the NZ government bonds yields rise at least in tandem.

Christian Hawkesby

Important disclaimer information

| « Questions to ask fund managers - Investment management | Vertical fund businesses – a broken model? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |