Canterbury economic activity still robust

For the last five years, the rebuilding of Christchurch has contributed strongly to NZ’s economic activity. Canterbury’s economy is currently undergoing a significant transition.

Tuesday, May 30th 2017, 9:01AM

by Andrew Bascand

While a moderation in residential and commercial construction activity is occurring, significant Government anchor projects remain in the pipeline. A recovery from local drought conditions and the re-opening of transport routes should also be supportive. Our assessment is that, overall, Canterbury economic activity is still robust.

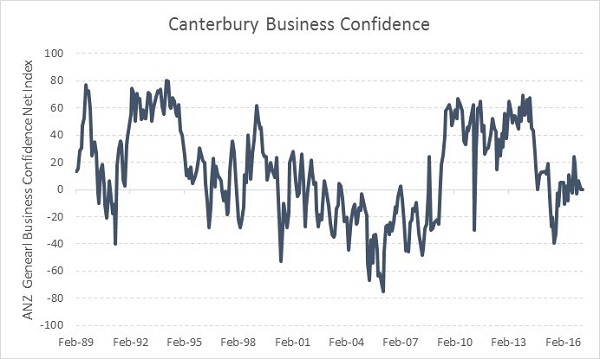

To some extent, the current data supports the conclusion that activity growth is moderating in Canterbury. For instance, the ANZ General Business sentiment index for Canterbury has fallen slightly to a net 0, compared to a peak level of over 60 in 2013-2014 and long term average of +14. Nationally, the same survey is showing a slowing in business sentiment. However, it is difficult in sentiment surveys to disentangle broader effects from factors that might be influencing Canterbury.

Business sentiment in Canterbury has fallen slightly

Source: ANZ

More specific Christchurch data on building activity is clearly showing a reversion in activity back toward long run trends. Canterbury housing approvals peaked at over 7,000 pa and have now slipped back to under 6,000, with most analysts expecting the data to moderate further to under 4,000 in the next year. Christchurch housing rental levels have also fallen from a peak of $414 a week, down to $383 a week, suggesting an oversupply in parts of the residential market.

Non-residential construction has been well above the long-term trend, with more than $9.1bn spent since the September 2010 earthquake, an estimated $4.4bn above long-term trends. However, this total is well below the government estimate of $16bn. With the addition of significant new office buildings, some property consultants say rising vacancies in both the CBD and suburbs suggest that further significant commercial building development is less likely in the near future. Consents for new commercial buildings are down 33% in Canterbury in the last year. It is likely, however, that the current shortage of hotel and motel beds will encourage more activity in that sector.

Importantly, the transition from residential and private commercial activity to Government core projects is underway. The rebuild of Christchurch Hospital has been progressing for well over a year, as has the University of Canterbury, secondary schools, the Central Library and the Justice Precinct. Moving forward, Otakaro, the entity that took over a year ago from the Canterbury Earthquake Rebuild Authority, has announced building work is underway on the Metro Sports Facility and the Convention Centre. These anchor projects are expected to attract further investment in the CBD. A smaller start on the East Frame project - a new housing community in the CBD - has commenced. The East Frame housing project has a target of 20 terraced houses by May 2018, and a further 200 homes over the next two years.

With this background, and the resilience of Canterbury people, it is hard to paint a picture of a real underlying slowdown. Clearly, activity levels are “normalising”, but there is still a lot of work - underway or yet to commence - on larger projects. Additionally, consultation on the Residential Red Zone, New Brighton and a number of other areas may see further investment over the next five years or more.

The broader Canterbury region has also seen significant disruption from the long-term North Canterbury drought, which has finally broken in the past month. The Kaikoura earthquake and the impact of the closure of State Highway 1 has also most likely reduced productivity and had an impact on business sentiment and tourism in the region. The re-opening of that key route and the production pick-up from better growing conditions may see business confidence lift in the next year.

If the Crusaders wrench the Super Rugby title from the Hurricanes anything is possible!

This column does not constitute advice to any person.

www.harbourasset.co.nz/disclaimer/

Andrew Bascand is the Managing Director of Harbour Asset Management

| « Socially responsible investing (Part 4): Growing pineapples in Alaska | Match racing: NZ PIE funds vs US ETFs » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |