AI: the fourth industrial revolution?

The impact of artificial intelligence (AI) on businesses and the economy has been profound, leading to a notable surge in the value of select information technology companies. Harbour Investment Analyst discusses the AI frenzy and other key market developments for the month.

Friday, June 16th 2023, 6:00AM

by Harbour Asset Management

Key points

- The conflict between observed inflation and soft lead indicators for economic activity continues to influence interest rates and economic forecasts. While some central banks may pause from raising rates, the overall balance of risks tilts towards tighter financial conditions. Investments with robust fundamentals and manageable debt levels are preferred in this environment.

- It was a weak month for Australasian markets, with the S&P/NZX 50 Gross index (with imputation credits) declining -1.7% and the S&P/ASX 200 Index declining -2.5% in AUD terms (and -1.6% in NZD terms). The New Zealand bond market was similarly weak, the Bloomberg NZ Bond Composite 0+ Yr Index declined -0.5%.

- The MSCI All Country World Index (ACWI) returned 2.0% in New Zealand dollar terms, and -0.2% in New Zealand dollar-hedged terms. There continued to be large dispersion within the index, with the information technology sector advancing 8.0% whilst the energy sector dropped -9.6%.

- The technology sector was buoyed by artificial intelligence (AI)-frenzy during the month. Shares in chip-maker NVIDIA surged over 30% in May after revenue forecasts came in over 50% higher than analyst estimates. This was due to high demand for graphics processing units (GPUs) for use in generative AI technology such as ChatGPT (see ‘What to watch’ for more on AI).

Key developments

Global share markets experienced a decline as weakening economic data impacted earnings expectations. The increase in government bond yields, driven by US Budget negotiations and uncertainty surrounding central bank interest rate moves, also influenced valuation multiples. Economic indicators continued to signal potential downside risks to economic growth forecasts. China's economic performance fell short of expectations due to COVID-19 waves affecting activity and a soft residential housing market undermined consumer confidence.

The information technology sector globally outperformed other sectors, benefiting from the opportunities presented by AI. Conversely, sectors with exposure to economic cycles underperformed because of slower economic activity. In New Zealand, the information technology, materials (attributable to Fletcher Building), and utilities sectors performed well. On the other hand, the healthcare sector (impacted by Fisher & Paykel Healthcare and Pacific Edge), consumer discretionary sector and communications sector (primarily Chorus) underperformed. In Australia, the top-performing sectors were information technology, utilities, and energy, while consumer discretionary, consumer staples and materials (including BHP) were the worst performers.

During the New Zealand company profit reporting season for the March 2023 period, there was a recurring pattern of better-than-expected results but cautious outlook statements from company management. This contributed to downward revisions in consensus earnings forecasts following the announcement of results. While a greater number of companies exceeded actual result expectations, there were more instances of misses against dividend expectations, with some aged care and real estate securities reducing earnings pay-out levels. Consensus forecasts for revenue, earnings before interest tax depreciation and amortisation (EBITDA), and earnings per share experienced more downgrades than upgrades, particularly affecting market capitalisation-based index earnings forecasts due to weaker guidance from Fisher & Paykel Healthcare and Mainfreight.

In Australia, various companies provided trading updates and quarterly results during the month, with over 100 companies presenting at the Macquarie conference. However, the market response was generally underwhelming, as downgrades to consensus forward earnings estimates outnumbered upgrades. Consensus earnings forecasts for the Australian equity market were slightly adjusted downward for both the 2023 and 2024 financial years during the month, reflecting the prevailing sentiment and market adjustments.

What to watch – AI: A new dawn

The impact of AI on businesses and the economy has been profound, leading to a notable surge in the value of select information technology companies. Investments in data centres have shown promise, as the increasing demand for computing power and data storage driven by AI applications presents an attractive risk-return balance. Notably, data centres are expected to experience a "third wave of demand" due to the exponential computing requirements of generative AI, as highlighted by Goldman Sachs. This trend bodes well for Australian and New Zealand co-location facilities, which may benefit from hosting early AI deployments and leveraging connectivity with key AI ecosystems. Looking ahead, the medium-term prospects for AI-related investments remain positive as the AI revolution continues to unfold.

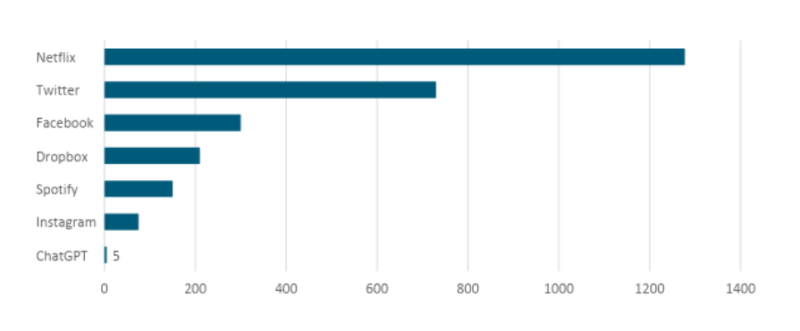

Source: https://www.statista.com/chart/29174/time-to-one-million-users/

Market outlook and positioning

In the capital markets, uncertainty surrounds the future of economic activity. There are concerns about whether we will see a slowdown without a recession, or the unwinding of supportive policies will lead to a recession and higher unemployment. As a result, equity markets are positioning for a hard landing, with underperformance in cyclical stocks. Investors are closely monitoring central banks, hoping for a pause in interest rate hikes to unlock potential returns. However, it is crucial to remain cautious about earnings and valuation risks in the equity market. Investments with unique drivers and low debt levels are preferred over those reliant solely on supportive policies.

In the New Zealand equity market, valuations remain high, exceeding the long-term average price-to-earnings (P/E) ratio (excluding 2020-2022 COVID period). Despite this, the market offers the potential for mid-digit compound earnings growth over the next three years, supported by upward revisions to consensus earnings forecasts after the reporting season. The defensive industry composition of the market may provide better protection in the event of an economic downturn. Whilst the gross dividend yield of the New Zealand market (over 5%) is becoming more appealing to yield-focused investors compared to 10-year government bond yields (4.4%), it may not yet be considered compelling by investors. On the other hand, the Australian equity market presents more attractive valuation metrics, but it carries higher earnings risk. Recently, that market has traded in line with its historical average P/E ratio, with certain sectors experiencing downward revisions in consensus earnings forecasts, notably in information technology, financials (mainly banks), and energy.

Globally, the economic outlook has become less certain due to concerns over US banking stress, debt ceiling issues and mixed economic data. While most global central banks are nearing the end of their tightening cycles, inflation is expected to take time to return to target ranges. The US Federal Reserve does not anticipate rate cuts this year, while the European Central Bank and Bank of England are expected to continue their tightening policies. In New Zealand, the Reserve Bank has signalled a pause in interest rate hikes after multiple increases but remains cautious about inflation and the housing market. Overall, while inflation is unlikely to quickly reach target levels, monetary conditions are considered sufficiently tight to bring inflation down. Rate cuts are projected to occur at the beginning of next year as the labour market eases more meaningfully.

Within equity growth portfolios our strategy continues to position for a range of scenarios and to be selective. We remain wary of the impact of a severe local economic slowdown or recession on the earnings for cyclical businesses. We also remain selective – continuing to favour investments that have their own idiosyncratic return drivers and are less dependent on strong economic activity. We are still focused on appropriately valued investments that benefit from secular tailwinds including technology dispersion, decarbonisation, and demographic changes. And we have a bias to quality, well-capitalised businesses that are less vulnerable to a tightening in financial conditions. This is expressed in the portfolio’s overweight versus its benchmark to the healthcare and technology sectors. The portfolio also favours selected shares in the more cyclical financial and materials sectors, where supported by secular tailwinds. In our view, stock picking – focusing on non-market, company-specific returns - may be a key influence on equity fund returns in the current and near-term expected investment environment.

Within fixed interest portfolios, our core investment view is that the rate hikes imposed by the Reserve Bank of New Zealand will, in time, do enough to slow the economy and bring inflation pressures down. It is difficult to have confidence about when and how quickly this will occur, particularly for the core inflation measures that are proving to be sticky. However, we have a clear skew towards expecting lower market yields and have accordingly shifted duration positioning from short to long relative to benchmarks. Within the corporate bond sector, we have seen some cheapening of bonds in the listed property and retirement village sector, while banks, gentailers and high-grade issuers have not moved nearly as far. While commercial property valuations remain quite high, we assess that gearing within the listed property companies is low enough to be manageable. We had previously reduced exposure into this sector and are now reinvesting. With patience, we believe that we may see better pricing in other sectors. Finally, we are downsizing holdings of inflation-linked bonds. If the economy slows and inflation expectation diminish, then inflation-linked bonds could cheapen relative to nominal government stock. Our inclination is to reduce the size of holdings and be in a position to reinvest if we do see the market become too optimistic that inflation has been beaten.

The Active Growth Fund is defensively positioned. The rally in share markets has seen equities trade at a narrow forward-looking risk premium relative to history, even considering recent falls in bond yields. While this is not a short-term indicator, it does temper our medium-term outlook for equities. That said, we are excited about the prospects for growth equities going forward which were challenged in 2022 battling with yields which were up significantly. With central banks well into their tightening cycle, the headwinds for growth equities may shift from bond yields to more idiosyncratic drivers making the operational performance of companies the key driver of returns. We are overweight fixed interest duration relative to our benchmark.

Within the Income Fund our core view is also to remain defensively positioned. Equities still face enough challenges to continue with an existing underweight position. Similarly, we are somewhat cautious about chasing bonds down at yields that already price a quick reversal in policy from central banks. Our strategy essentially relies on patience. We have reduced our holding in inflation-indexed bonds but do expect to add again if inflation expectations ease further. Perhaps, most importantly, we are also staying cautious with regards to high-yield credit. Pricing of corporate bonds has improved in some sectors, but others are still subject to macroeconomic risks and, as we have seen with US banks lately, the market can be very quick to punish corporate credit valuations at firms with any balance sheet vulnerabilities.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

Important disclaimer information

| « Are Kiwis recession-ready? | Are investors missing out on once in a generation opportunities? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |