Harbour Investment Outlook: Higher for longer, but how much longer?

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed income and equity markets.

Friday, October 20th 2023, 6:31AM

by Harbour Asset Management

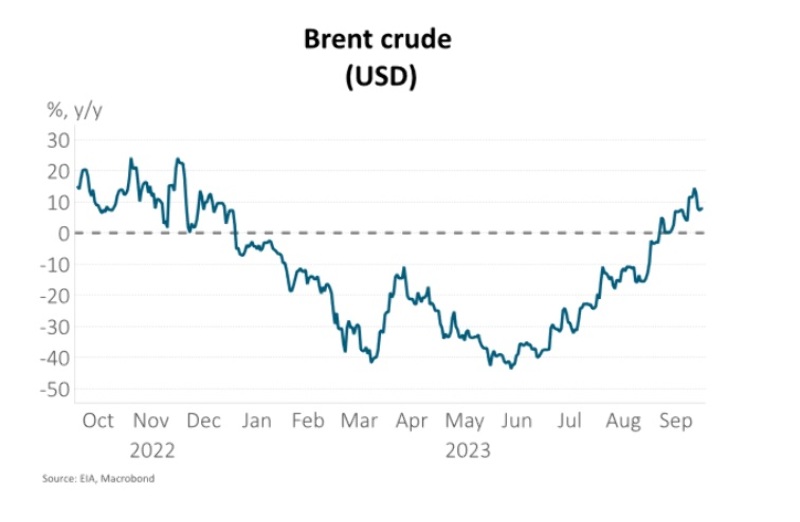

New Zealand and Australian share market returns over the month were dominated by the negative impact of higher long-term government bond yields on valuations. Higher bond yields increase the return required by investors to put their funds into shares. Factors influencing the sharp increase in bond yields included signalling from central banks that official cash rates need to stay higher for longer to offset sticky inflation, the increasing US Government budget deficit requiring increased bond issuance to fund it and oil prices increasing from below US$70/barrel in June to above US$90 by late September.

Central banks have started to diverge over the past month. At one end of the spectrum is the US Federal Reserve that struck a more hawkish tone at its September policy meeting by upgrading its economic forecasts and noting that further rate hikes may be required to meet its objectives. At the other end of the spectrum, the European Central Bank indicated its tightening cycle may be finished with the current level of interest rates seen as making “a substantial contribution to the timely return of inflation to the target.” After recently abandoning yield curve control, the Bank of Japan has returned to its dovish ways by maintaining its ultra-loose monetary policy and noting that it is “yet to foresee inflation stably and sustainably” achieving the 2% target.

The global economy continues to slow in an uneven way. The US economy remains the clear outperformer with Q3 GDP tracking at close to 5% growth on an annualised basis and a recession unlikely any time soon. There are some signs of loosening in the US labour market, however. The unemployment rate increased to 3.8% in August. A large drop in the quit rate also suggests that US wage growth should moderate meaningfully over the coming six months. Elsewhere, Chinese economic activity appears to have stabilised at low levels with the help of some policy support, but a rebound is unlikely. European growth looks to have stalled with both manufacturing and services PMIs remaining in contractionary territory.

A surprisingly strong Q2 GDP print has created some questioning over whether New Zealand monetary policy settings are sufficiently tight. The 0.9% q/q growth represented a 0.4 percentage point upside surprise to the RBNZ August MPS forecasts and, with positive revisions to prior quarters, implies a higher path for the OCR. Other developments since the August MPS, however, augur for a lower path. We don’t think Chinese economic weakness and lower commodity prices were sufficiently captured in the August MPS and nor was the tightening in monetary conditions that has occurred since then.

What to watch – Higher oil prices are providing a challenge to inflation

But central banks are likely to look through the first-round impact. Oil prices have increased by around 30% over the past three months. Robust demand over Northern Hemisphere summer has been met with constrained supply, led by Saudi Arabian production cuts, and resulted in global oil inventories reaching multi-year lows. Central banks, however, are likely to look through the inflation impact unless inflation expectations are influenced. In the US, for example, a 10% increase in oil prices, is estimated to add 35bps to headline CPI over 3 months, but only 3bps to core inflation.

Market outlook and positioning

Developed market central banks are close to finished increasing interest rates, but they may not be there yet. Core inflation indicators are now consistently meeting or coming in below expectations, meaning central banks can continue to take a more measured approach to further tightening of monetary policy. But central banks are likely to retain a hawkish, cautious bias to ensure inflation expectations do not re-accelerate. While bond yields typically peak around the last central bank rate increase, shorter-term interest rates will probably remain rangebound until there is a more meaningful deterioration in labour market conditions.

As in previous cycles, we may need an element of turmoil for the bond bear market (long-term interest rates increasing) to stop and bond yields to fall. These types of large swings have historically either come about due to some exogenous factor (i.e. Lehman Brothers/SVB/Credit Suisse banking type issues) or as a result of big macro-economic data misses (i.e. weak US non-farm payrolls growth, an uptick in unemployment, soft inflation figures, or an Institute of Supply Chain Manager (ISM) miss against expectations).

Capital markets now reflect a higher-for-longer interest rate framework. Given the recent moves in markets, a hawkish pause by central banks in response to slowing inflation and economic data (which allows them to tone down the language associated with monetary policy), may be taken positively by share market investors. Central banks may continue move to a data-dependent watch and wait stance, waiting to see how the lagged impact of interest rate increases flow through to activity and inflation.

Credit markets are now running at levels above post-GFC averages and leading economic indicators are softening. The combination of higher interest rates (both nominal and real) and declining liquidity means financial markets may continue to struggle in the near term - the effects of interest rates staying high for longer are starting to be felt.

Within equity growth portfolios our strategy remains to position for a range of scenarios and to be selective. We continue to favour investments with structural tailwinds that are less dependent on strong economic activity. We continue to see technology dispersion, de-carbonisation, and demographic changes as supporting company earnings. Businesses exposed to the energy transition and the onshoring/nearshoring of manufacturing and storage of goods may face opportunities and threats. We are also favouring companies with productivity and efficiency ‘self-help’ programmes, particularly where business re-engineering introduces technology that improves both revenue and cost structures. We continue to have a bias to quality, well-capitalised businesses that are less vulnerable to a tightening in financial conditions.

Within fixed interest portfolios we retain a long duration position, meaning portfolios will benefit from a fall in interest rates. Our investment strategy is driven by the view that the OCR is likely to shift downwards in 2024. Currently this expectation is not priced in markets, where a further OCR hike is actually anticipated. Our yield curve positioning for this view is within the 1- to 5-year maturity range. With long-dated securities, we are much more cautious. While global bond yields have already lifted considerably over the last month, scope for a rally seems more challenging, especially given the large issuance of bonds coming from governments, such as in the US and New Zealand, that spent aggressively during the COVID-19 years. We retain a notable holding of inflation-indexed bonds, which continue to offer a high effective yield as well as protection in the event that core inflation remains sticky. We have also lifted credit exposure, as new issues have come to market at attractive pricing.

The Active Growth Fund is defensively positioned, being overweight bonds and underweight equities. This is a position which has added value over the past couple of months as equity markets have fallen from their peaks (NZX50 down over 6% and MSCI ACWI down more than 8%). Bond returns have been negative at the same time, but to a lesser degree (global and New Zealand bond indices down over 2% in the past two months). Our thesis to be underweight equities and overweight bonds is predicated on being late in the earnings and economic cycle, which seems at odds with above average equity market valuations and low equity risk premiums. That said, the drawdown in equity markets has left some sectors looking more attractive on a relative basis (for example infrastructure and utilities stocks). We are dedicating our research to identifying attractive entry points to some sectors that have sold off, but still have solid fundamentals. We are overweight fixed interest duration relative to our benchmark and, we further increased this position recently as rates have risen. We think, particularly in New Zealand, there is scope for interest rates to fall more than is priced in to forward curves currently. Further, as the market’s focus moves from inflation concerns to growth concerns, it is likely that equity and bond markets will behave in a less correlated manner. This means that fixed income should provide the portfolio with downside protection during periods of equity market volatility as it did earlier in the year when regional banking troubles surfaced.

The Income Fund’s strategy remains cautious, holding a below-benchmark equity allocation, which has been beneficial through the recent phase of price weakness. Our current concerns reflect a view that the soft landing priced into markets has become less likely while central banks remain committed to a ‘higher for longer’ approach to monetary policy. This may change in New Zealand in 2024, but it seems too early to position for that. We continue to be positioned short New Zealand dollars, not fully hedging offshore assets. Our fixed interest investments reflect strategy views expressed by the broader fixed interest team, being long duration and retaining inflation-indexed bonds.

Article by Lewis Fowler, Investment Analyst, from Harbour Asset Management Limited. This content is not intended as financial advice.

Important disclaimer information

Important disclaimer information

| « Insync uncovers flaws in passive versus active debate | The Bond market gives investors a High Five » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |