The bird in the hand or two in the bush?

August 2021 marked the start of an almost four-month lockdown for Auckland – none of us would wish to return to that challenging period. Except, that is, if you were a domestic investor. From the end of August 2021 to the lows in October 2023, the NZX50 Index fell almost 20%[1].

Saturday, January 20th 2024, 6:09PM

by Mint Asset Management

by Kirsten Boldarin

If you’re a diversified investor you’re probably thinking: at least I had fixed income as a back-up, bonds move contrary to equities in periods of stress? Sadly not this time. The New Zealand Government Bond index lost 14%[2] over that period.

And yet, these declines did not come on the back of a material slowdown in growth. In fact, global growth remained remarkably resilient in the face of rising interest rates, a war in Ukraine (and now the Israel Hamas war), and a cost-of-living crisis. The much-forecasted US recession has remained elusive. With cash finally paying an attractive rate, many investors opted not to take on market risk. A bird in the hand is worth two in the bush, right?

This is a very appealing argument – why take a risk when you don’t need to? We empathise with it. But, for investors with a long time horizon, it negates decades of investing wisdom.

Over the last twenty years, the New Zealand stock market has generated an annualised return of 8.3%[3] - a better outcome than global markets which have averaged 6.9%[4] (in US Dollars). What is often lost when presenting these long term averages however, is how these returns are generated.

The long-term average masks the ‘lumpiness’ of the return profile of equity markets. When they move (both up and down), they move fast and hard. The rally over the last two months is evidence of just how sharp these reversals can be when they materialise. Importantly, that 8% annualised market outcome assumes you have been fully invested over that entire time period, taking both the good and the bad.

But, some financial professionals and non-financial professionals like to believe that they can time the market and sidestep those downdrafts and catch the updrafts. Unfortunately, there is scant evidence that this is a repeatable skill any investor possesses – a handful of good calls does not a maestro make. And, as it turns out, perfect market timing may also be less important than you might think.

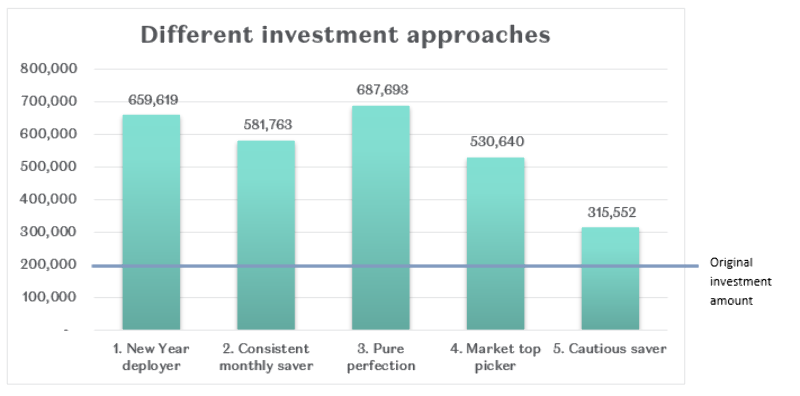

We reviewed data on the New Zealand stock market and contrasted a few different investment approaches. We looked at data from the start of 2002 to the end of 2022. If, back in 2002 you were in the fortunate position of having $10,000 to invest into the markets at the start of each year for 20 years, what would have been an appropriate contribution method?

Here are a few types of investors for you to consider.

1. The New Year contributor

You contribute your $10k of capital into equity markets on the first trading day of the year, each year.

2. Consistent monthly saver

You spread your $10k over the year, investing $833 at the start of each month, also known as dollar-cost averaging.

3. Pure perfection

You were a market timing genius, you waited for the market to hit the lowest level[5] and then pounced with your $10k.

4. Market top picker

You were a market timing disaster and managed to every year pick the top[6] of the market for the year and drop your $10k in then.

5. Cautious saver

You decided the equity market wasn’t for you and you sat in cash earning the 3 month NZ bank bill rate.

The results are below and may be a little surprising.

Unsurprisingly, our perfect deployer of capital came out on top, but perhaps not by the wide margin you might have anticipated. In fact, even the investor who chose the highest month-end closing level to deploy their capital didn’t fare too badly. The only one who came out the worst was our Cautious saver, who ended up well behind those invested in equities over the 20 years.

The reason why there are not vast differences in these approaches is because they all share a common trait – once invested, they remained invested. Even badly timed investments were better than none at all.

Ultimately, time in the market has far more bearing on long-term outcomes than ‘timing’ the market.

[1] S&P/NZX50 Gross Index 31 August 2021 to 30 Oct 2023

[2] S&P/NZX Government Bond Total Return Index August 2021 market peak to 31 October 2023

[3] S&P/NZX 50 Gross Index Oct 2003 to Oct 2023 annualised returns

[4] MSCI All Country World Total Return Index in USD Oct 2003 to Oct 2023 annualised returns

[5] We took the lowest month end closing level for that year

[6] We took the highest month end closing level for that year

Disclaimer: Kirsten Boldarin is Head of Distribution at Mint Asset Management Limited. The above article is intended to provide information and does not purport to give investment advice.

Mint Asset Management is the issuer of the Mint Asset Management Funds. Download a copy of the product disclosure statement at mintasset.co.nz

Mint Asset Management is an independent investment management business based in Auckland, New Zealand. Mint Asset Management is the issuer of the Mint Asset Management Funds. Download a copy of the product disclosure statement at mintasset.co.nz

| « Coming into land in 2024 | Gaming still bigger than Ben Hur » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |