NZ shares: Upside Down Under?

BT Funds NZ equity manager Andrew South outlines prospects for the NZ share market this year.

Monday, January 28th 2002, 12:59PM

The global slowdown in economic growth dominated world sharemarkets last year. As the US economy first faltered, then fell, it took most of the world with it.

The events of September 11 served to exacerbate the downturn of an already shaky world economy.

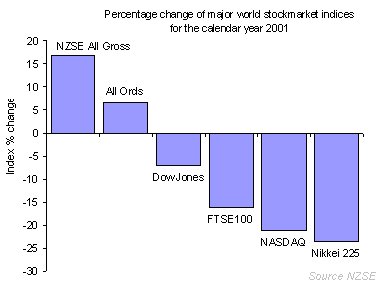

Over the course of the year most sharemarkets suffered negative returns. In the US the S&P 500 fell -5.61% and the Nasdaq tumbled -14.3%. Britain’s FTSE index dropped -11.32% and Germany’s DAX index was down by -17.43%; results reflected all around Europe. Asian economies fared little better, as export orders dried up, tourism numbers declined and business confidence took a battering.

However, amongst the global hand wringing the New Zealand sharemarket returned 13.4% for the calendar year.

Just what the doctor ordered?

In the first few months of 2002 the world economy is delicately poised. On one hand, the US Federal Reserve and central banks worldwide have been very aggressive in easing monetary conditions, making borrowing much cheaper and stimulating investment by businesses to try to precipitate some form of cyclical recovery.

Federal Reserve chairman Alan Greenspan recently said: "There are sound reasons for concluding that the long-run picture remains bright, and even recent signals about the current course of the economy have turned from unremittingly negative to a far more mixed set of signals recently."

On the other hand, Greenspan goes on to say: "I would emphasise that we continue to face significant risks in the near term."

These risks, emanating from the US, come in the shape of poor company earnings, rising unemployment, and unstable household spending.

Domestic Drivers

To a large degree the outlook for the NZ economy hinges on a global economic recovery. There are, however, several domestic drivers of growth that continue to differentiate the NZ economy from international economies.

The current low interest rate environment should continue with ‘tolerable’ inflation levels. Also the local economy, unlike most of its trading partners, is in rude health; the building and construction sector is strong and economic growth for the calendar year is expected to be around 2.5% for 2002.

By comparison, according to Consensus Economics, the US can expect growth in the region of 0.9%.

In addition the current account deficit is improving, the New Zealand dollar looks to be strengthening against a weakening US dollar, and we expect another good agricultural growing season – although prices for agricultural commodities will continue to come off their peak.

These conditions should result in positive earnings growth for companies and result in solid, if unspectacular, NZSE40 earnings per share (EPS) growth of approximately 9% this year.

Offshore interest in the New Zealand sharemarket is unlikely to improve from last year despite the local market outperforming so well.

Foreign investors generally view the New Zealand sharemarket as a niche market with low liquidity.

Takeover and merger activity amongst listed companies is expected to be lower than last year although there is some activity remaining from 2001 still be ironed out including Danone’s offer for Frucor and Edison’s bid for Contact Energy.

Interest rates supportive

New Zealand is currently at the bottom of the interest rate cycle. The official cash rate fell from its high of 6.5% in 2001 to 4.75%; good news for borrowers.

Reserve Bank governor, Don Brash, recently said "there is good reason for businesses in New Zealand to be more optimistic about the future than is the case in many of our trading partners: New Zealand starts from a situation of relatively strong growth, and there is ample scope for monetary policy to stimulate the economy if that should be needed, without jeopardising price stability."

Our expectations are that the Reserve Bank will not take rates any lower and the environment going forward should be relatively supportive for share prices.

Road signs

As usual the direction of the local market will rely on picking the trends in international sharemarkets. However there are several local factors that will influence the market over the course of 2002.

The NZ Stock Exchange still has the potential to demutualise this year. Also, given the dearth of new company listings on the stock exchange last year, and the hunger with which the Briscoe Group listing was snapped up, any quality listings in 2002 would inevitably stimulate the market.

The lack of new capital raisings has meant fund managers have been looking at Australia for diversification and opportunity.

Another positive market influence this coming year may come from further re-weightings of the Morgan Stanley Capital Index (MSCI). This is an index that covers global sharemarkets and is a benchmark for many international fund managers.

As changes are made to the weighting of companies in the index, passive fund managers are forced to re-weight their portfolios in order to maintain their benchmark positions. The weighting of New Zealand firms in the index should increase slightly.

These changes ought to be positive and provide opportunities.

Market outlook

New Zealand is generally perceived as a ‘low beta’ market, being a market that tends to demonstrate lower volatility than most global markets. As such it could underperform other equity markets if world growth shows an early improvement.

However, New Zealand share valuations do look reasonably priced compared to international markets, which are starting to look expensive.

Overall we expect the New Zealand sharemarket to produce a modest capital gain with a gross dividend of around 5% to give a total expected return of around 10% for the 2002 calendar year.

We expect that the ability to pick individual companies to outperform the market will differentiate performance results this year and we will continue to look for stocks that have good franchises and quality management at a reasonable share price.

Andrew South is executive vice president at BT Funds Management. He is also BT's NZ equities and property portfolio manager.

Special Offers

Commenting is closed

| Printable version | Email to a friend |