One out of three

Three things are necessary for a successful savings regime, Michael Cullen said last year. Only one is likely to eventuate. Find out which of the three here.

Tuesday, February 5th 2002, 12:09AM

by Rob Hosking

Nearly a year ago Minister of Finance Michael Cullen outlined three key elements necessary for New Zealanders to save more – education, opportunity and incentive.

"Education is the responsibility of the government and the industry," he said in a speech to the Association of Superannuation Funds (Asfonz). "Opportunity is the responsibility of the industry; the product they offer has to be relevant. Incentive is the responsibility of the government."

His announcement last week that there would be no changes to the savings regime before the election means that the government’s part of the deal has been postponed.

The significance of the announcement was twofold: firstly, that officials had won Cullen away from his earlier, stated preference for a tax regime which exempts the income from retirement savings (dubbed the TET or taxed, exempt, taxed model) towards a tax concessions, taxed and exempt regime (tTE).

The advice from Treasury makes it clear that Cullen’s officials would really rather leave the tax regime where it is: the current TTE set-up.

The tone of the papers is along the lines of "well, if you really MUST change the tax on savings, tTE would be the better option."

The Treasury’s position remains that tax incentives of any sort do not help savings. As Asfonz executive director David Stevens observed last week, the industry needs to consult more with ministers and officials on ways to encourage savings. "There certainly seems to be quite a sound barrier to go through to get the officials to concede that there may be a case for tax incentives."

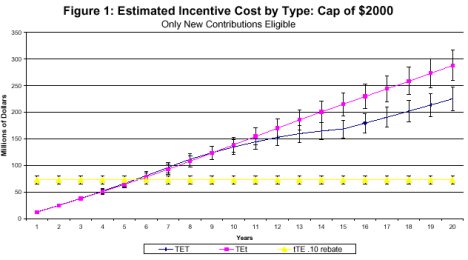

Rather, officials simply see the drain on government revenue – and they appear to have swung Cullen at least some way around to their thinking. The graph below, which covers the three options, shows why officials argued so strongly against TET – and why Cullen bought the argument.

That leads to the other significant reason for last week's decision: short term fiscal pressures. The money simply isn’t there for any tax exemptions in this year’s budget. There are too many politically squeaky wheels elsewhere crying out for a bit of fiscal oil – in sensitive areas such as health and education, which can really swing votes around.

To put it another way: you are a government minister facing re-election. You could offer voters an earlier hip operation for grandma or a TET savings regime? Which are you going to opt for?

That said, the announcement by the government has put the superannuation/savings issue back on the agenda for the year.

The opposition weighed in on the announcement, but have yet to put up much in the way of policy. Act leader Richard Prebble’s ‘State of the Nation’ speech had surprisingly little to say about superannuation.

National’s Bill English, on the other hand, has had much to say, although, again, his party has yet to put up any policy.

Only days before the Cullen announcement, National put out a statement that superannuation, and specifically the Cullen fund, would be a key election issue.

Now, in January of an election year, and with most of us still coming back from the beach, MPs declare all sorts of topics as a "key election issue."

It is not at all unusual for a statement to emerge from an obscure opposition backbench spokesman on ragwort, proclaiming that ragwort eradication will decide the year’s poll. It’s all part of the grandstanding nonsense of political debate.

What was significant about National’s announcement was that it was made by the party’s leader, not the superannuation spokesman Gerry Brownlee. Furthermore, English himself delivered the press release around Parliament’s press gallery. His involvement in the issue led to speculation that he might even take back the superannuation spokesmanship himself in this week’s minor reshuffle.

In the event he did not. But he did make the point that Labour’s bottling out on the encouragement of savings reinforces the dangerous message, implicit in the government’s pre-funded scheme, that the government will now take care of people’s savings for them.

As Reserve Bank governor Don Brash pointed out on Friday in a speech on New Zealanders and debt, it is that message, which, over the years, has led to New Zealanders becoming such poor savers.

Of Cullen’s three criteria - "education, opportunity and incentive" it not only ducks the "incentive" part, it risks undermining all the work that has been done by the Retirement Commissioner, and the government and the industry in other areas, on the "education" aspect. There seems little doubt that the decision to defer – perhaps indefinitely? – any changes to the savings taxation regime is a considerable backward step.

Rob Hosking is a Wellington-based freelance writer specialising in political, economic and IT related issues.

| « Letter: Super ball hoofed downfield | AMP & Good Returns launch superannuation website » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |