Market Review: January 2009 Commentary

Bernie’s No Longer Ponzing Around By Peter Lynn

Thursday, January 15th 2009, 4:01PM

One of the most amazing stories of a pretty amazing 2008 came right at the end. It was the revelation that a USD50b Ponzi (or pyramid) scheme had been operating in the US for possibly decades. In addition, it attracted several big names to invest large portions of their net wealth and, even more unbelievably, several major institutions had significant sums invested in it.

Ponzi schemes, for the uninitiated, are simply investment funds that pay out the early investors from the investments of later investors. Hence, it pays to get in early to a Ponzi scheme and then get out. These schemes are required to subscribe to Newtonian physics – eventually they must fall down to Earth, as there will not be enough new investors to keep paying out current investors. They are also illegal, of course.

Their success lies in the ability of a promoter to keep attracting new funds into it. Take a trustworthy former NASDAQ chairman named Bernard Madhoff, who was very well known amongst the US financial community, the Jewish community, as well as at elite golf clubs in New York and Florida, and you have someone that “high net worth individuals” will happily invest their money with. But for a scheme to go for so long and attract the interest of institutions, you need to put up some strong numbers. This, Bernie Madhoff did exceptionally well. His results were so consistently strong that investors felt he almost had some magic attached to him.

I see a lot of fund managers in my job and receive lots of return series from them, for a range of asset classes and hedge funds. One of the most interesting ones I received last year was the following (from an international manager I will not name):

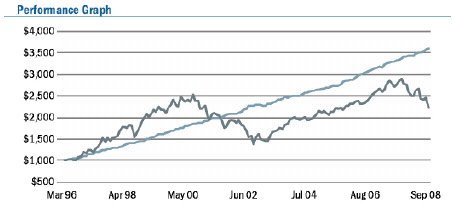

This graph plots the performance of this “single strategy hedge fund” (after fees) against the S&P 500 Index over the past 12 or so years. The performance of the fund is almost a perfect straight line, which would make sense if the investment was in cash.

But it wasn’t. It is invested in what the document refers to as a “split-strike strategy”. And, if you can read the graph legend, the fund climbs from $1000 to over $3,500 over this period. That is a return of around 11% p.a. over the time period. The actual annual returns (after fees) range from around 8% to 16%, including during the bear market years of 2001-2003. Of the more than 150 monthly returns, only seven are negative (in the 0.01% to -0.20% range). If I were making up returns, I think I would put a little bit more volatility into it than this.

I paid little attention to this fund at the time I first came across it (in March) and the later updates, despite its unbelievable return profile. However, in the wake of the Bernie Madoff scandal, I did some investigating and found out that the fund whose performance is represented in the column on the left was invested purely in one Bernard L. Madhoff Investment Securities LLC.

I relate this story to you because it shows the need to do solid due diligence on any investment you get involved with. How was it that so many intelligent people were duped by Madhoff? Even some of his employees had almost all of their net wealth invested in his fabrication, but it wasn’t until he admitted the lie to his sons that the game was up. Anyone viewing that performance record would have to ask how is it that a fund can do so consistently well through all types of market. What is a “split-strike strategy” anyway? Are the funds audited? Do the regulators check them?

Sometimes this due diligence can take a long time and involve a lot of work trying to understand what is involved. Maybe opportunities get missed because the length of time taken to perform the necessary diligence bypasses the time that the window of opportunity is actually open. However, I would rather miss out on an opportunity than rush into a Madhoff special.

The same sort of due diligence would have also prevented a lot of the individual losses some people in New Zealand have suffered over the past couple of years from investing in finance companies that became insolvent. Even a quick read of the offering statements, prospectuses or financial accounts would show that there were not sufficient assets to cover interest payments with any sort of “safety margin”. It makes me angry when people are put into “diversified” investments consisting of a number of failed finance companies. I assume that the ‘advisor’ failed to perform any serious due diligence on any of them.

The Madhoff scandal still has a lot to reveal before we know all its details – indeed, some we may never know. However, a very tragic footnote is that at least one investor has committed suicide as a result of losing a huge amount of money in it. I hope Madhoff gets put away for a very long time.

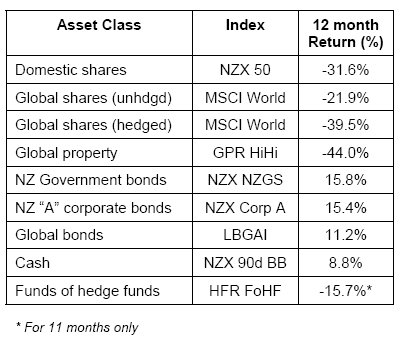

Finally, an update on how markets fared during 2008. We know the answer is “not well” and I highlighted last month how almost all asset classes were heading to some sort of record annual performance. The December month actually turned out all right at the end, with the market seeming to appreciate President-Elect Obama’s fiscal stimulus plan, leading to some consistently strong up days on the US (and hence the world) markets. Here is the table of annual index returns:

| « Market Review: London January 2009 Commentary | Market Review: London February 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |