Market Review: London February 2009 Commentary

As regular readers of our Commentary will no doubt be aware, we have tended to be on the pessimistic side of economic forecasters over the last year or so. However, even we must admit to having been surprised by the speed of arrival and the degree of severity of the current Asian Depression.

Monday, February 16th 2009, 12:41PM

The Myth of Decoupling

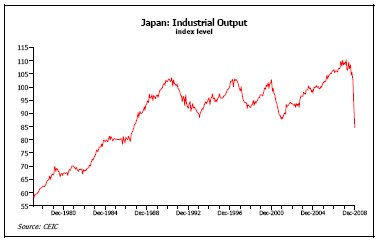

If the Japanese government’s manufacturing industry surveys are to be believed (and they usually should be), Japanese industrial production will have fallen by a third between the end of September 2008 and the end of March this year, a situation that will have resulted in production falling all the way back to levels not seen since 1983, before the bubble economy of the late 1980s was even thought possible. Of course, one can argue that Japan has faced particular headwinds in dealing with the current global downturn: the collapse in global investment in plant and equipment has clearly hit Japan’s heavy industries badly and the decline in consumer investment in durable goods, coupled with the strength in the Japanese currency, has also badly affected Japanese export prospects. However, at the same time we must note that Japan is not alone in Asia in terms of being badly affected by the global downturn.

Despite its weak currency, Korea’s GDP declined by 5% in the fourth quarter of 2008 alone. Elsewhere, Singapore fared only marginally better in the fourth quarter and Taiwan’s economic data is now so bad that to ‘annualise’ the rate of decline appears nonsensical! Overall, Asian GDP and production trends are now even weaker than those encountered during the worst moments of the Asian Crisis in 1997-8 with the result that even Asia’s reputedly much-improved corporate financial health is now under significant stress once again.

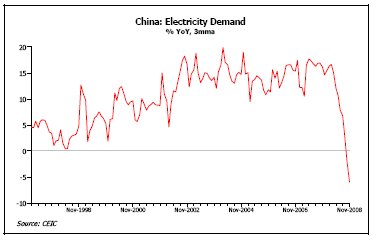

Unlike the 1990s’ Asian Crisis, and contrary to many forecasters’ expectations, China’s economy has also been forced to endure a recession as part of the current global slowdown. Although China is officially expected to grow by 6% or more this year (which suggests that the published GDP data will be somewhere close to this), it is clear from the industrial production, energy demand, cement and corporate data that China’s economy is either in or very close to a recession at present, despite the government’s introduction of what was described as a ‘massive stimulus plan’. Despite Beijing’s hefty fiscal intervention, a probable implosion in private sector investment trends - caused not only by weak markets but also China’s increasingly suspect competitiveness position – and a significant weakening in consumption activity has pushed China into what is probably its first recession in the modern era. It remains to be seen how this slowdown will interact with the country’s still problematic food supply situation and its political regime; the country is clearly facing challenges on many levels at present.

More promisingly, India’s economy has fared rather better than China’s in the current slowdown, in part because domestic demand has proven surprisingly resilient but the other members of the ‘BRIC Club’ are clearly faring as badly as China. Russia’s economy is beset by balance of payments problems, a weakened credit system and a recession that appears as severe as those in Asia. Brazil’s economy is also making heavy weather of the current crisis, hamstrung as it is with the ‘hangover’ from its own recent credit bubble and the effects of falling commodity prices. Far from providing a ‘diversification bet’ for investors, the BRICs have proved to be as vulnerable as any to the global credit crisis.

In fact, none of the ‘regional economic independence’ stories have proved robust during the current crisis. Only 18 months ago, many expected the Euro area to sail through a US slowdown relatively unscathed but collapsing exports, weakened credit systems and deteriorating labour markets are all driving the region into its worst recession for generations. Clearly, Germany faces its worst recession for sixty years and although France’s economy is expected to perform slightly better than its neighbour, the ‘PIIGS’ economies of Portugal, Italy, Ireland, Greece and Spain are now facing their worst economic crisis since the Great Depression. Indeed, Ireland’s government already expects GDP to fall by 10% and the Spanish unemployment rate seems set to top 20%. Separately, Austria, by virtue of its large economic and financial exposure to the now crisis ridden former Eastern Bloc countries, is also facing severe difficulties of its own at present.

In fact, so severe is the level of economic weakness in some of these Euro Zone countries that the markets are now beginning to discount the fact that these countries may be forced to leave the Euro project entirely, a thought that even six months ago when we raised it in these pages, we wondered if it might be too extreme a view to even write about! Once again, we find that the pace and severity of the current crisis is surprising even us.

Naturally, parts of the UK press have begun to enjoy speculating over the possible demise of the Euro, although their comments are necessarily tempered by the fact that the UK is also facing a recession that will also be its worst for 60 years and which may also prove to be particularly protracted. Indeed, we suspect that it may be more than five years before UK growth can return to trend given the need for balance sheet convalescence in the private sector and – soon – the public sector as well.

Given these highly correlated and negative global trends, which we expect to remain relatively protracted – we think that a genuine global recovery is unlikely before 2012 – small open economies such as New Zealand will continue to face a very difficult period.

Admittedly, the RBNZ has acted appropriately by cutting interest rates and by allowing the currency to decline. But the bottom line remains that international trade and tourism receipts will remain under pressure and the home-grown version of the credit crisis will continue to subdue the domestic housing, corporate and household sectors. Certainly, Australasia cannot expect to buck the global trend and we would expect that the NZD and indeed the AUD will remain absolutely weak but, in the current global deflationary environment in which any threat from inflation can only be short lived (a situation that should prove beneficial to bond rather than equity market investors in the medium term). The acceptance of a weaker currency should soften the pain associated with the slowdown and perhaps allow a prompt reaction to the global recovery when it finally arrives.

The weakening Kiwi dollar may re-ignite comments over the ‘Pacific peso’ but we must remember that the first countries to leave the Gold Standard, and to adopt soft exchange rates, were the first countries to escape the depression in the 1930s. Consequently, we believe that a weak NZD should be welcomed since it will soften the pain of the global recession / depression for New Zealand companies and individuals alike.

Andrew Hunt, London

Andrew Hunt will be visiting New Zealand in March:

16 March, Tyndall presentation in Christchurch

9:15am for a 9:30am start at the George Hotel

16 March Tyndall Wellington

Presentation at the Wellington Club, 3:30pm for a 3:45pm start

17 March Tyndall Breakfast in Auckland

at the Northern Club from 7:15am for a 7.30am start

19 March at Philanthropy New Zealand Conference

at Te Papa in Wellington - 2:30pm Keynote address

Please contact Helen McKenzie for further details: 09 377 7220 or helen_mckenzie@tyndall.co.nz

| « Market Review: January 2009 Commentary | Market Review: February 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |