Q&A: TOWER Parallel Portfolios

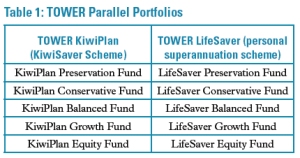

TOWER Investments has introduced the concept of "TOWER Parallel Portfolios" to describe the ways in which its KiwiSaver scheme - TOWER KiwiPlan - and personal superannuation scheme - TOWER LifeSaver - can be mixed 'n' matched to suit the needs of individual investors.

Friday, November 13th 2009, 10:13AM

TOWER Investments' Regional Development Managers Craig Offwood (Upper North Island), Toni Dodds(Central North Island) and Ken O'Rourke (South Island) explain how Parallel Portfolios work and why financial advisers should be making use of the concept.

Q: So how do TOWER Parallel Portfolios work?

Craig: They rely on the fact that the two retail retirement savings schemes we offer - TOWER KiwiPlan (KiwiSaver) and TOWER LifeSaver (personal superannuation) - share five underlying investment portfolios in common. These five portfolios have been designed to cater for the needs of almost any retirement saver. Accordingly, a financial adviser can perform needs analysis and risk profiling for a client, easily identify from there the correct investment portfolio, and then select which format - KiwiSaver or personal superannuation, or perhaps a combination of the two - for the client to invest into. Thereafter, client reporting and periodic portfolio reviews are made simpler and more efficient to research, prepare and present because the same portfolios are involved in both products.

Q. What is the benefit of having these parallel options for advisers to choose between?

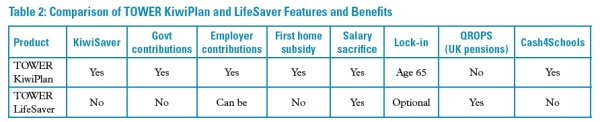

Toni: There are a number of benefits. First, some clients may be better off investing into a KiwiSaver scheme rather than a personal superannuation scheme, whereas for others personal superannuation may be the better

option. So part of the adviser's discussion with clients can involve working out which of those two alternatives represents the optimal choice. Second, there could be cases where it is best for clients to split their retirement savings contributions into two streams and invest part into a KiwiSaver scheme and the balance into a personal superannuation scheme. Accordingly a textured range of options is opened up for selecting the most suitable retirement savings vehicles to use in clients' best interests.

Q: Can you give some examples of where it may be better to choose LifeSaver investment portfolios over parallel TOWER KiwiPlan portfolios?

Q: Can you give some examples of where it may be better to choose LifeSaver investment portfolios over parallel TOWER KiwiPlan portfolios?

Ken: One example would be where the client does not want the KiwiSaver lock-in, currently until age 65. KiwiSaver has been incentivised with government and employer contributions, yet some people plan to retire

earlier and may want more flexibility about when they can access their retirement nest egg. With LifeSaver, the client can choose to lock in all or part of their savings until they reach 50 years of age, or older if they want, at the time they sign up. Another example is that LifeSaver is a Qualifying Recognised Overseas

Pension Scheme (‘QROPS') and thus permitted to accept UK pension scheme transfers. A client could transfer their UK pension lump sum into a LifeSaver portfolio with the lock-in set to match that of their UK pension scheme, and contribute theirongoing retirement savings either to the same LifeSaver portfolio or to the parallel TOWER KiwiPlan portfolio, depending on what suits them best.

Q. How does Salary Sacrifice come into the picture with Parallel Portfolios?

Craig: Both TOWER KiwiPlan and LifeSaver can be used for Salary Sacrifice purposes. With the agreement of the employer, employees can "sacrifice" part of their annual salary by investing it into a KiwiSaver or personal superannuation scheme. The sacrificed part becomes an employer superannuation contribution subject to employer superannuation contribution tax (ESCT) of up to 33%. For employees in the 38% marginal tax bracket - earning above $70,000 per year - this is a saving worth considering. Moreover, if it is a KiwiSaver scheme like TOWER KiwiPlan, then the first 2% of the employer's contribution is taxexempt. Entering into a salary sacrifice arrangement can affect matters including, though not limited to, holiday pay entitlements

and future ACC or income protection insurance claims. As with any decision regarding investing or taxation, clients should seek professional advice before making a decision.

Q. What are the fees like with respect to TOWER KiwiPlan and LifeSaver?

Q. What are the fees like with respect to TOWER KiwiPlan and LifeSaver?

Toni: The annual management fees of the paired Parallel Portfolios of TOWER KiwiPlan and LifeSaver are the same for each pair, with the administration and trustee fees being of a similar nature. Moreover, there are no entry fees charged oneither product, although the LifeSaver scheme has an optional adviser fee. Accordingly it is pretty straightforward for the adviser to explain the fees, and that leaves more time to explore with the client which of the flexible range of options provided under the Parallel Portfolios concept can best answer their personal needs and objectives as retirement savers.

Q. Are there any major differences between TOWER KiwiPlan and LifeSaver?

Ken: TOWER KiwiPlan is a KiwiSaver scheme and so comes with certain features that pertain to KiwiSaver offerings such as legislated rates of contribution, government contributions including the $1,000 kick-start and member tax credits, and first home purchase subsidies for members who meet the criteria.

Additionally, TOWER KiwiPlan members can nominate a school of their choice to receive donation streams from TOWER under our Cash4Schools initiative, a benefit we don't currently offer with LifeSaver. By contrast, LifeSaver is a QROPS-compliant offering and has an optional lock-in period (though not for QROPs transfers) and greater flexibility in regard to contribution rates.

Further information:

For further information on TOWER Parallel Portfolios, contact:

Upper North Island (including Auckland): Craig Offwood at (09) 984 8123 or craig.offwood@tower.co.nz

Central North Island (including Wellington): Toni Dodds at (04) 439 4314 or toni. dodds@tower.co.nz

South Island: Ken O'Rourke at (03) 353 1106 or ken.orourke@tower.co.nz

For a copy of the TOWER KiwiPlan or TOWER LifeSaver investment statement and further information, please contact your investment adviser, call TOWER on 0800 808 808 or visit www.tower.co.nz.

| « EMERGE Series 2: New capital protected emerging markets fund | Having Super Choice » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |