Where will the OCR go next?

It's pretty clear the official cash rate won't move this week, but when it next moves and in what direction is becoming a fascinating question.

Monday, December 8th 2014, 9:45AM  1 Comment

1 Comment

The mortgagerates.co.nz survey of economists shows that none are expecting the Reserve Bank to move the official cash rate on Thursday, however there are conflicting views on when it will next move.

The key premise is that an increase won't happen until the end of 2015 or maybe in early 2016.

ASB has tweaked its view and pushed out its forecast hike from September 2015 to December.

"The RBNZ has plenty of time on its side to wait for more tangible signs of inflation before there is any need for a rate hike encore - particularly given how low fixed-term mortgage rates are.

"Further OCR increases are a matter of if as much as when. We can easily conceive of events that would mean inflation remains benign for an extended period. But we are mindful that migration is very strong and that the housing market may be gaining a second wind."

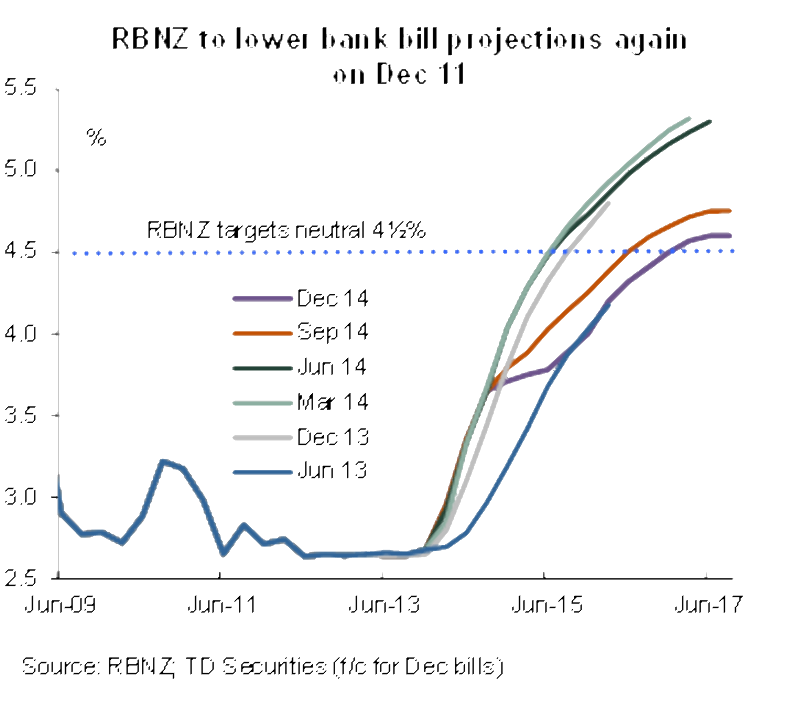

This theme for pushing out the expected increases and lowering the rate the OCR will peak at is illustrated in the graph (below) from TD Securities.

"The RBNZ are unlikely to surprise in its final OCR Review and Monetary Policy Statement of 2014. We expect a fleshing out of recent themes: tighter monetary policy has been more effective on cooling activity than expected; commodity prices remain weak, and that the falling terms of trade means the NZD remains “unsustainable and unjustified”; and the sole upbeat offset record migration places upside pressure on domestic demand," economist Annette Beacher says.

"Flatter for longer is the theme," she says.

The Employers and Manufacturers Association last week called for a cut in the OCR citing a period of deflation next year when the economy is predicted to slow.

"A year ago we said interest rates did not have to be raised this year and that has proved correct," EMA chief executive Kim Campbell said. "We are concerned the Reserve Bank has paid too much attention to domestic house price rises in Auckland and Christchurch and not enough to the rapid changes in global markets..

"Inflation during the year has scarcely tested the bottom end of the bank's one to three per cent inflation target."

Economists mortgagerates.co.nz surveyed put either a zero percent or very small percentage chance the OCR will be cut any time soon. However, if economic conditions deteriorate in the United States and Europe than a cut could be on the cards.

"While it is not our central view that the RBNZ will need to cut the OCR, we do believe that the market may begin pricing a 50% chance of a 25 basis point cut in the OCR sometime in 2015. With inflation at the bottom of the target range, inflation expectations near record lows, and headline inflation likely to remain subdued with falling petrol prices, there is no urgency to lift the OCR. Indeed, if the dairy sector continued to weaken, this could prompt the RBNZ to significantly revise down its outlook for the economy, and make a rate cut a plausible response to any other nasty surprises that hit the New Zealand economy," Harbour Asset Management director Christian Hawkeby says.

Donal Curtin from Economics NZ says the chance of a cut has "risen substantially, to maybe 35%".

He details his views in this post: Did the RBNZ move too quickly?

He says the triggers for a cut are a combination of further lower than expected inflation and the NZ dollar staying high or even rising on a TWI basis.

| « Squirrel applies to become QFE | What the Reserve Bank said - Dec » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |